US Government Shutdown Might Cause a Crypto Sell-Off: Here’s Why

A looming U.S. government shutdown could shake crypto markets with risk-off pressure, delayed ETF approvals, and stalled regulatory progress.

The US government is headed toward a shutdown if Republicans and Democrats in Congress don’t agree on a spending bill before the end of the day. Should that happen, government services will be temporarily halted.

Such an event would spark greater economic uncertainty, creating a risk-off environment toward more speculative markets like crypto. The sector may also experience delays in regulatory decisions at the hands of federal regulators like the SEC.

A Political Impasse

Congress is working against the clock to avoid the first government shutdown in six years. Republicans and Democrats are gridlocked over legislation to fund the government for the 2026 fiscal year.

Though Republicans have a majority in both chambers of Congress, they do not currently have sufficient votes in the Senate to pass their spending bill.

Democrats are refusing to approve the legislation, arguing that millions of Americans will see their healthcare costs rise if Congress does not extend temporary tax breaks that expire at the end of this year.

“We believe that simply accepting the Republican plan to continue to assault and gut healthcare is unacceptable,” House Democratic Leader Hakeem Jeffries said during a Monday press conference.

Yesterday, Vice President JD Vance said an agreement seemed unlikely.

VP JD Vance: “I think we’re headed toward a government shutdown.”

— Iris Tao

“I think we’re headed into a shutdown because the Democrats won’t do the right thing,” he said.

Should this scenario remain unchanged until midnight tonight, crypto markets can prepare for a downturn.

Why a Shutdown Spells Risk-Off for Crypto

The extent of a government shutdown’s impact on crypto markets depends on its duration.

A prolonged one can slow economic activity and potentially harm the wider economy. This uncertainty directly translates to a “risk-off” environment in global financial markets.

Since cryptocurrencies are still generally considered higher-risk assets, this sentiment can trigger selling pressure. In such a scenario, major cryptocurrencies like Bitcoin and Ethereum can experience price declines and increased volatility.

Crypto products may also be affected.

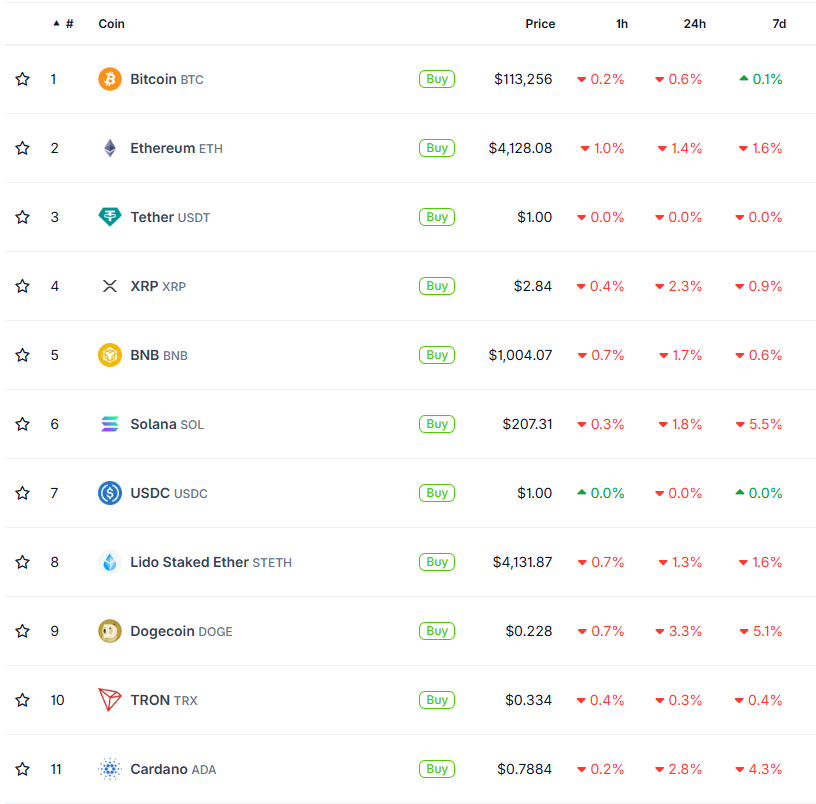

Crypto Market In Red Today In Anticipation Of a US Government Shutdown. Source:

Crypto Market In Red Today In Anticipation Of a US Government Shutdown. Source:

SEC Closure to Halt Crypto Approvals

A government shutdown would severely limit the non-essential operations of the Securities and Exchange Commission (SEC).

The most significant consequence for investors would be the immediate halt of critical regulatory decisions on highly anticipated events.

Specifically, the approval and launch of new crypto exchange-traded products (ETPs) would face postponements, which could dampen market enthusiasm and potential price rallies.

This regulatory gridlock would affect various products, including delays in final or intermediate decisions on spot ETFs for cryptocurrencies like Solana and XRP. The SEC would also be unable to decide whether to permit staking features for the already approved spot Ethereum ETFs.

Even though the regulator recently approved generic listing standards to fast-track new commodity-based ETPs for assets like Dogecoin and XRP, a shutdown would still interrupt the final necessary paperwork, delaying the expected wave of new ETP launches.

Meanwhile, any progress on crypto-related market structure bills or other essential legislation moving through Congress would likely halt.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet launches OmniConnect developer suite, seamlessly connecting 1.1 billion Telegram users to the multi-chain Web3 ecosystem

Web3 wallet Bitget Wallet has announced the launch of OmniConnect, a software development kit aimed at developers. OmniConnect enables seamless integration of Mini-Apps within the Telegram ecosystem to a multi-chain ecosystem, supporting all EVM-compatible public chains, TON, Solana, and more than 500 other chains.

OVERTAKE Market Officially Launched, Introducing the New Seller Store "TakeShop"

Newly added support for "Path of Exile 1," "Last Epoch," and "MapleLand," and the introduction of the seller store TakeShop.

Hong Kong stablecoins see their first batch of players exit the market

At least four Chinese-funded financial institutions and their branches, including Guotai Junan International, have withdrawn from applying for Hong Kong stablecoin licenses or have temporarily suspended related attempts in the RWA sector.