Ethereum News Today: Tether Chooses Compromise Over Closure in Blockchain Shift

- Tether reversed its plan to freeze USDT on five legacy blockchains amid user pressure and evolving regulatory demands. - The company will retain transfer functionality but halt new issuance on these chains, prioritizing Ethereum and Tron for 85% of USDT activity. - This strategic shift aligns with MiCA and GENIUS Act compliance goals while maintaining liquidity and avoiding forced token repatriation risks. - Tether's focus on high-traffic chains reflects market trends toward scalability and cost-efficien

Tether, the largest stablecoin issuer by market capitalization, has reversed its earlier decision to halt USDT operations on five historic blockchains, including Omni Layer, Bitcoin Cash SLP, Kusama, EOS, and Algorand . This backtrack, announced in mid-August 2025, follows mounting user and community pressure and reflects a strategic recalibration amid evolving regulatory and market conditions [1].

Initially, Tether had announced that it would freeze USDT smart contracts on these blockchains starting September 1, 2025, citing a shift in commercial strategy to focus on more scalable and widely used networks. However, in response to feedback from these blockchain communities, the company has now opted to retain the functionality of token transfers while halting new issuance and redemption of USDT on these chains [2]. This decision avoids blocking users from accessing their tokens, mitigating reputational risk, and preserving a more balanced relationship with legacy blockchain ecosystems.

The move underscores Tether’s broader strategy to concentrate its resources on high-demand blockchains such as Ethereum and Tron , which together account for the majority of USDT activity. By Q2 2025, Tron held over $80 billion in USDT, representing 51% of the total supply, while Ethereum maintained $72.4 billion, reinforcing their dominance in the stablecoin market [3]. BNB Chain, the third-largest, held $6.8 billion. Tether’s decision to focus on these high-traffic chains aligns with the need to streamline operations and enhance efficiency in a market projected to grow significantly.

Tether’s strategic pivot also coincides with a period of regulatory evolution. The implementation of the EU’s Markets in Crypto-Assets (MiCA) regulation, which enforces reserve backing and transparency for stablecoin issuers, and the U.S. GENIUS Act, which strengthens oversight of dollar-pegged tokens, have added pressure on stablecoin operators to comply with stringent standards. These frameworks aim to reinforce financial stability and consumer protection while encouraging innovation. Tether’s reduced exposure to underutilized blockchains is a pragmatic step to align with these regulatory expectations and limit potential legal risks [4].

The reversal highlights the ongoing tension between legacy blockchain ecosystems and emerging high-capacity networks. While blockchains like Kusama and EOS have seen limited USDT activity—less than $5 million in circulation—the broader market has shifted toward faster, more cost-efficient solutions. Tron’s low transaction fees and rapid settlement times have made it an attractive option for remittances and payments, particularly in regions such as Latin America, the Middle East, and Asia-Pacific [5]. The dominance of these blockchains reflects a broader industry trend where scalability and cost-effectiveness are increasingly prioritized over historical prestige.

Analysts suggest that Tether’s decision is also influenced by the need to remain competitive in a rapidly evolving stablecoin market. USDC , Tether’s primary rival, has been expanding its regulatory footprint, particularly in the United States and Europe. Tether’s strategic realignment to focus on Ethereum and Tron positions it to better compete in regulated and institutional markets while maintaining its role in decentralized finance (DeFi) and cross-border transactions.

Despite the reprieve for legacy chains, Tether’s long-term direction is clear. The company continues to explore innovations in areas like AI-driven operations and Bitcoin mining, signaling a broader ambition to diversify its influence beyond stablecoins. This pivot aligns with the broader maturation of the cryptocurrency market, where competition is intensifying, and user expectations for performance and compliance are rising.

The decision also has implications for the broader crypto ecosystem. By maintaining transferability on these chains, Tether avoids a scenario where users are forced to repatriate their tokens, which could strain liquidity and cause disruptions. Instead, the company has opted for a more measured approach that balances user needs with long-term strategic goals. This flexibility reflects Tether’s role as a key infrastructure provider in the crypto space, where maintaining trust and usability is paramount [1].

As the stablecoin market continues to grow, regulatory and technological developments will play a decisive role in shaping its trajectory. Tether’s actions highlight the challenges and opportunities inherent in navigating a market where innovation must coexist with compliance. The upcoming implementation of MiCA and the expanding influence of the GENIUS Act will further test the adaptability of stablecoin issuers, making strategic foresight a critical asset in this evolving landscape.

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

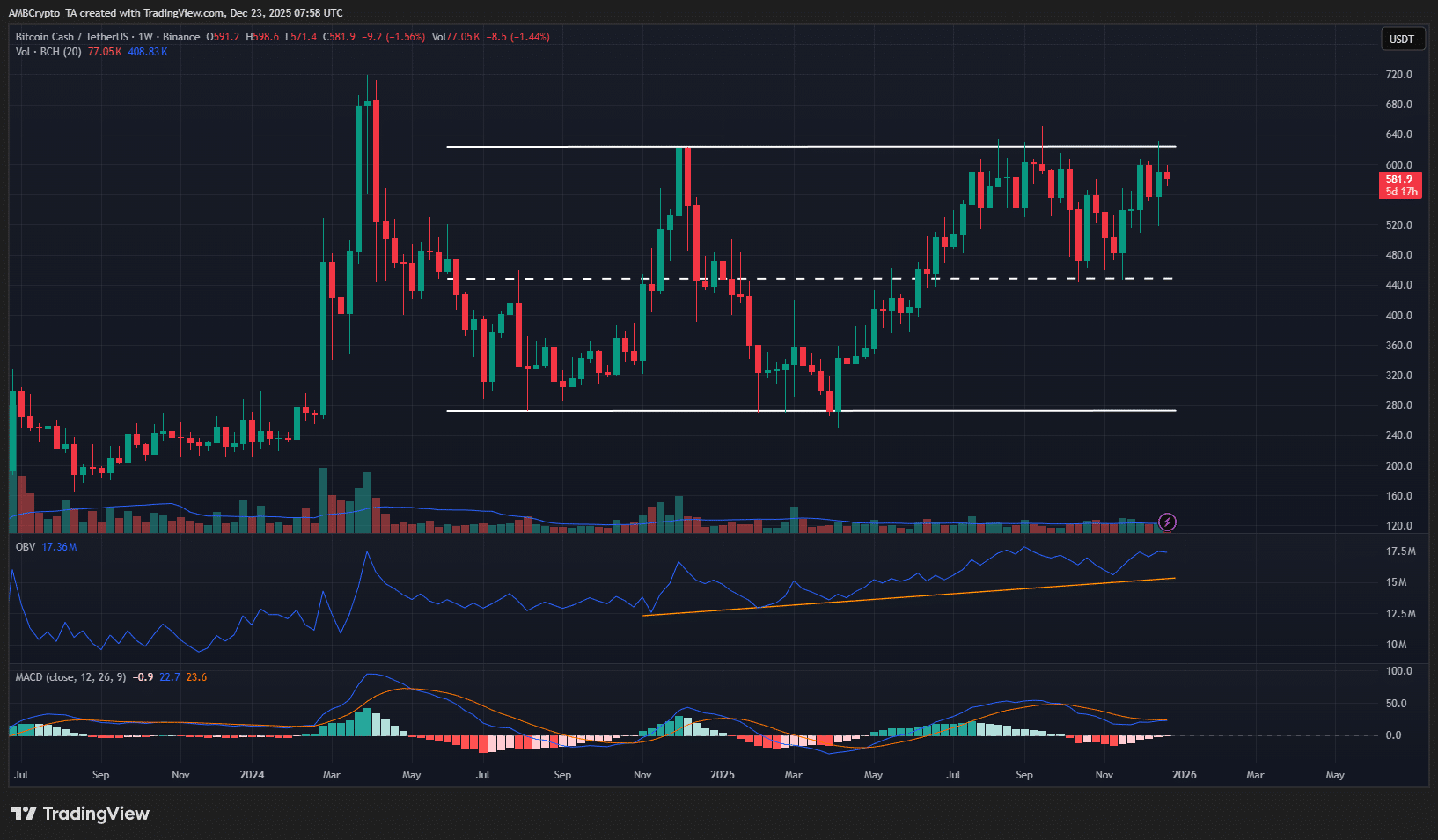

Bitcoin Cash – Why buying BCH before a $624 breakout is risky

Falcon Finance Strengthens USDF Expansion Through Chainlink Price Feeds and CCIP

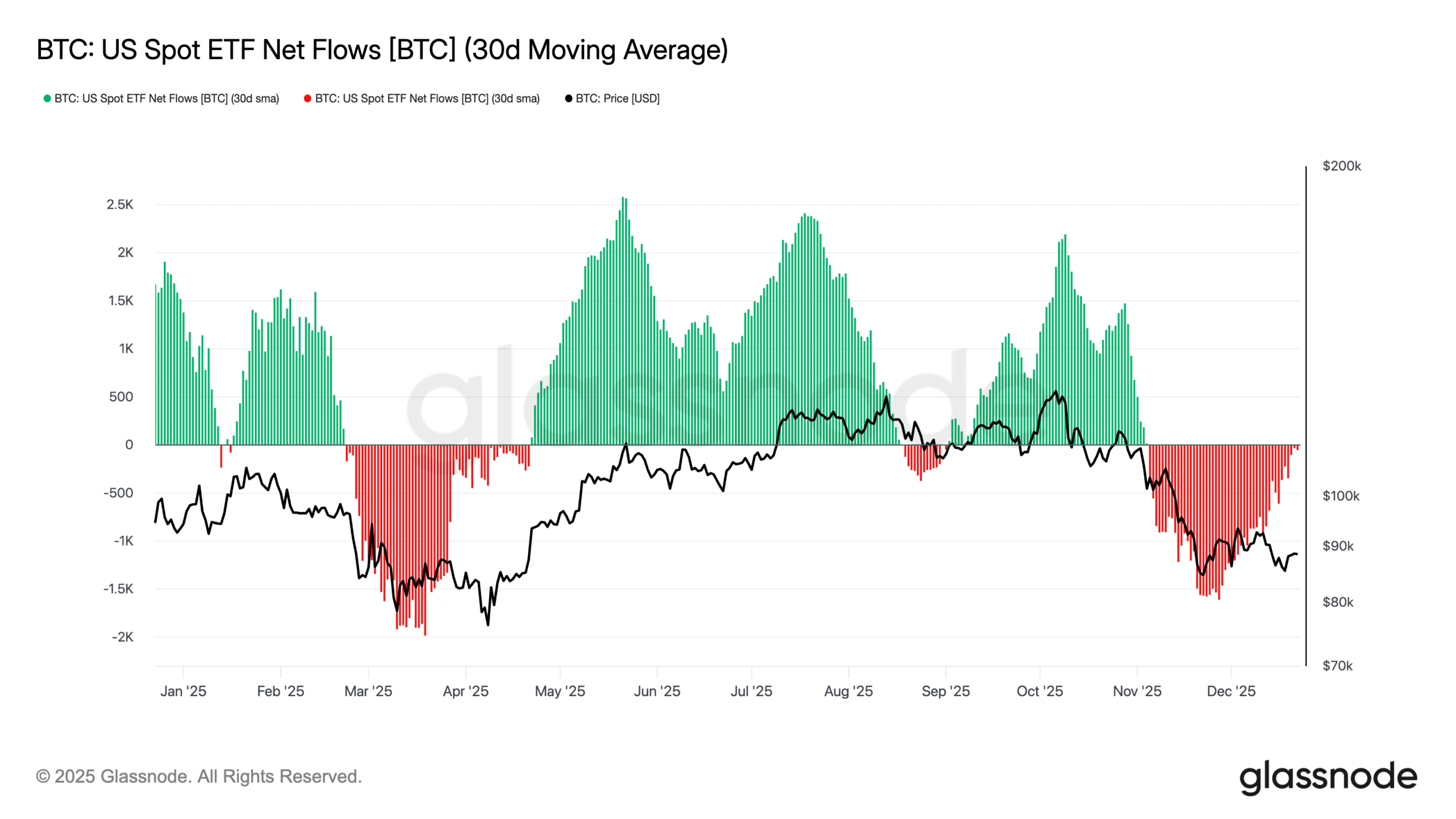

Bitcoin and Ethereum ETFs see persistent outflows as institutional appetite weakens

Zoox issues software recall over lane crossings