Growing institutional interest in Ethereum (ETH) has led to speculation about a potential price uptrend, especially as the strategic reserve expands.

-

ETH has seen growing interest from corporate treasuries.

-

Is the institutional interest enough to push ETH to the $3K psychological level?

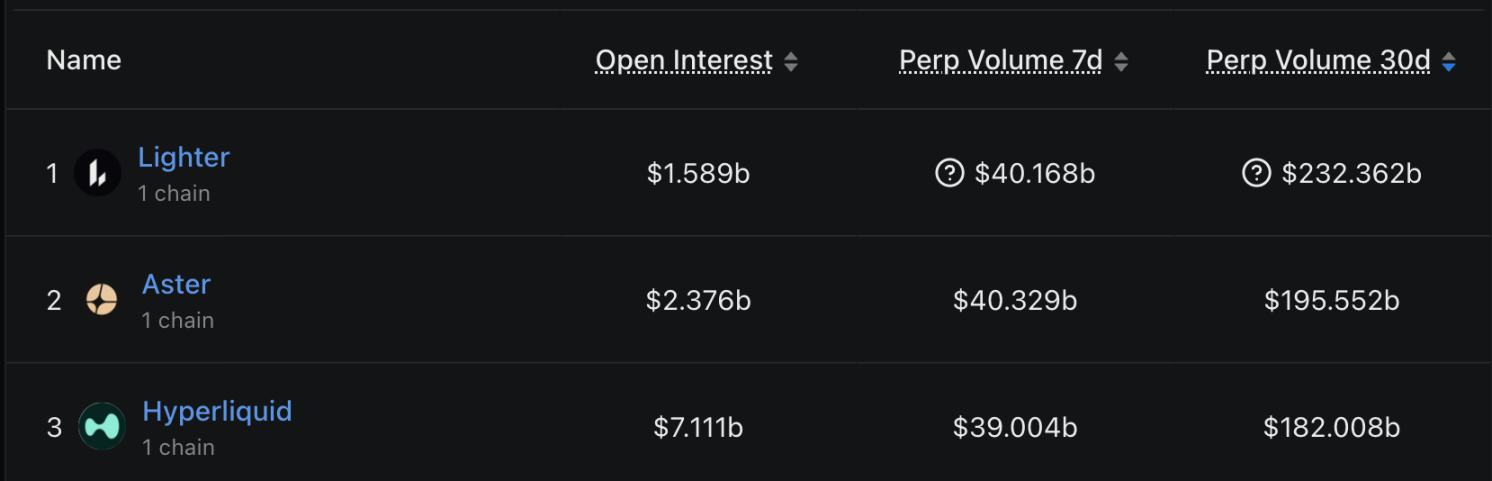

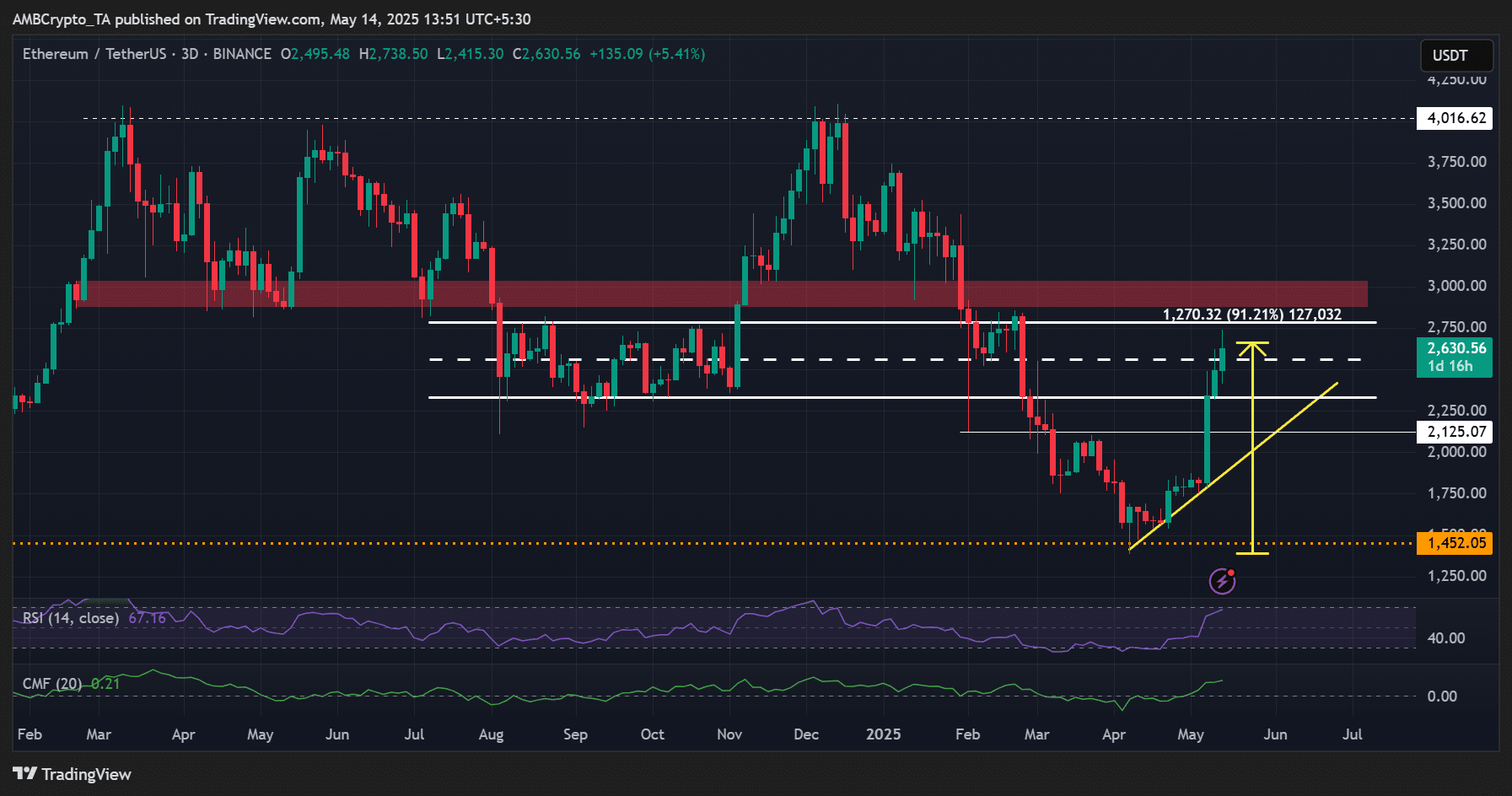

Strategic Ethereum [ETH] Reserve (SER) has picked up momentum to rival booming Bitcoin and Solana [SOL] corporate treasuries.

Institutions and even the state of Michigan collectively own $2.1 billion of ETH (789,905 coins).

Ethereum Foundation, Coinbase, and Golem Foundation top the charts on the leaderboard.

Source: SER

The U.S. government holds 59,965 ETH while the state of Michigan possesses 4,000 ETH. Notably, the Royal government of Bhutan, a prominent BTC miner, has accumulated 495 ETH.

Will institutional demand fuel ETH?

A rising demand for corporate treasury in the BTC ecosystem, from firms like Strategy, has accelerated BTC prices. Will ETH record similar growth?

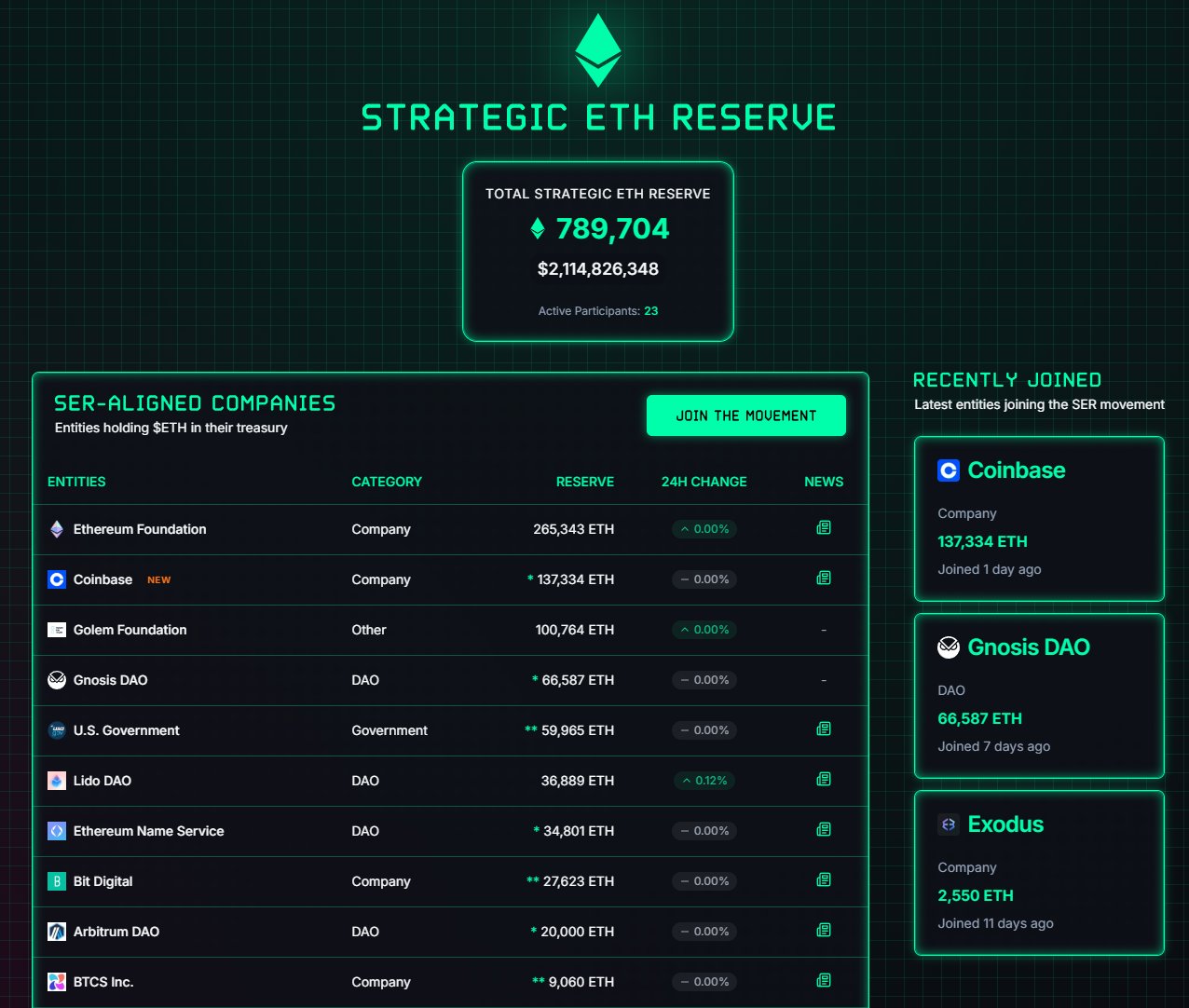

According to CryptoQuant, ETH demand remains primarily concentrated among large players, likely institutions.

Since late 2024, large holders with 10K-100K ETH (blue) and 1K-10K ETH (orange) have increased their holdings significantly since mid-2024.

Source: CryptoQuant

Large holders fall under two categories, with 16.7 million ETH and 12.5 million ETH held, respectively. Meanwhile, those with 100-1K ETH—likely retail—have decreased their holdings from about 14 million ETH to 9 million ETH.

This indicates that institutional players dominate the ETH market, and the growing strategic reserve trend could lead to further accumulation and value appreciation.

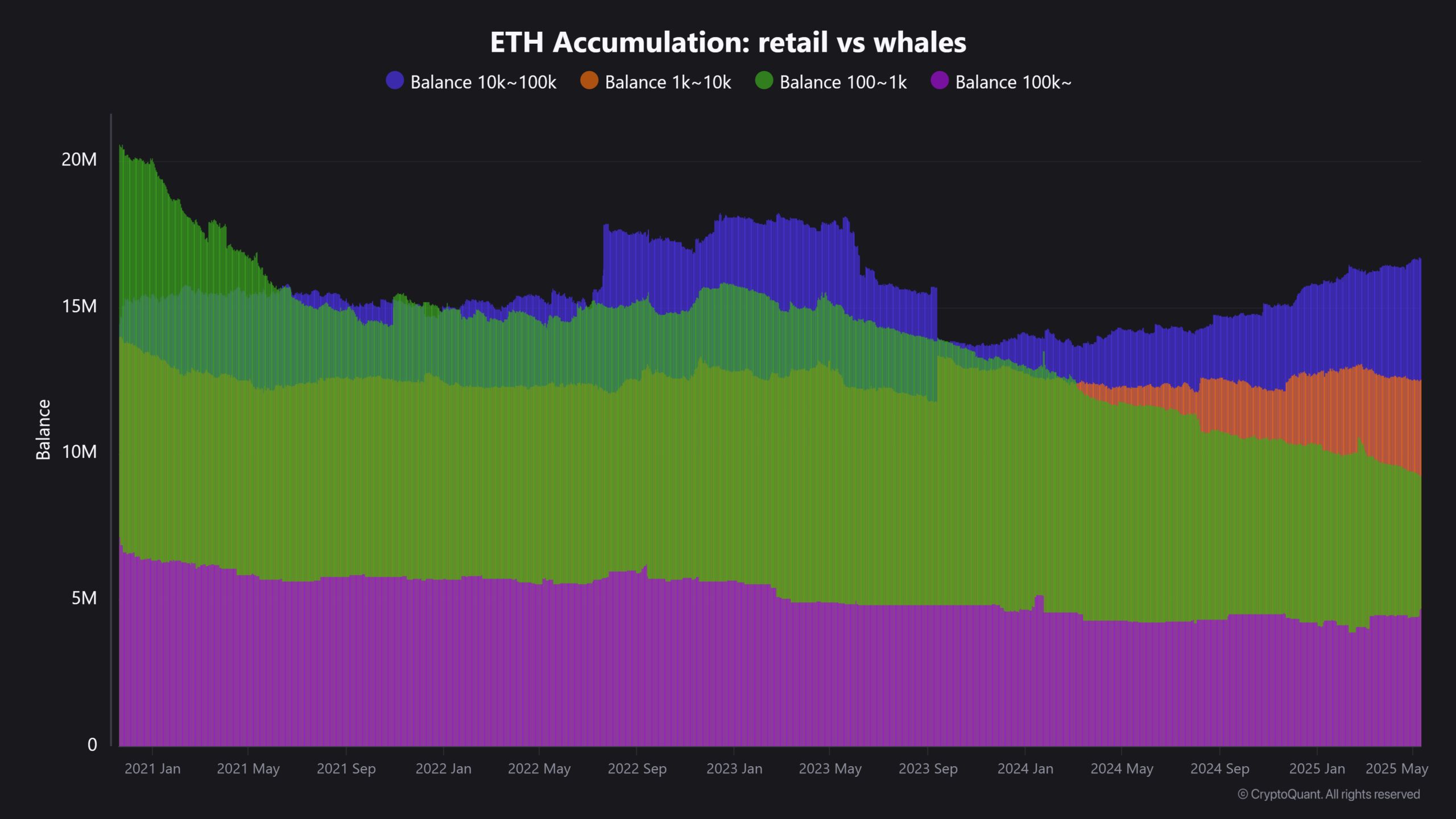

Remarkably, ETH has recovered over 90% from its April low of $1,385 and briefly retested $2.7K for the first time since February. Analysts attribute this rally to the success of the Pectra upgrade and a renewed risk-on sentiment.

Source: ETH/USDT, TradingView

Currently, ETH is positioned within the August-November 2024 price range of $2.3K-$2.8K. To confirm further upward movement, it must escape this range and clear the overhead resistance at $3K (red zone). Otherwise, a brief cool-off may be on the horizon.

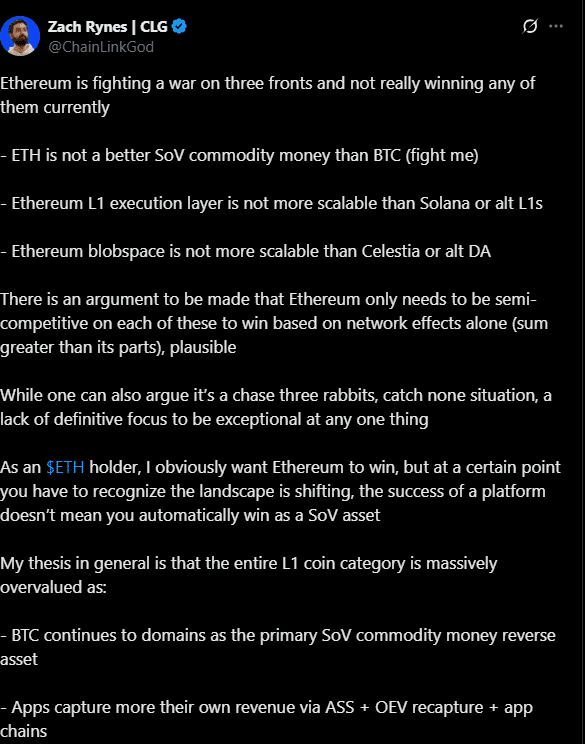

Despite the strong rebound, criticism against ETH persists on Crypto Twitter (CT).

According to Zach Rynes, Chainlink’s community liaison, ETH is entangled in a three-pronged fight and remains far from securing victory.

Source: X

Although other market watchers challenge Rynes’ statements, the ETH market appears strongly positioned for further upside movement. CoinGlass data reveals that Binance’s top traders have elevated their ETH long positions from 63% in early May to 74% over the past four days. In essence, smart money remains bullish on ETH, despite its substantial 90% recovery.

Conclusion

With substantial institutional participation and the ongoing expansion of strategic reserves, ETH is poised for a hopeful trajectory. The institutional interest could be the decisive factor in pushing ETH prices toward the $3K mark, given the current market conditions.