Crypto Bear Market Callers Are Misguided, According to Investor Chris Burniske – Here’s Why

Venture capitalist Chris Burniske says that the current dip in digital assets is typical of any bull market cycle.

In a post on the social media platform X, Burniske, the former head of crypto at Cathie Wood’s ARK Invest and current partner at Placeholder, points out other corrections in the 2021 bull market cycle that ultimately preceded new highs.

“In the middle of 2021:

BTC drew down 56%

ETH drew down 61%

SOL drew down 67%

Many others 70-80%+

You can come up with all the reasons for why this cycle is different, but the mid-bull reset we’re going through isn’t unprecedented. Those calling for a full-blown bear are misguided.”

At time of writing, Bitcoin ( BTC ) is down 20% from its all-time high, Ethereum ( ETH ) is down 50% from its all-time high while Solana ( SOL ) is down 51%.

Earlier this month, Burniske said that BTC’s lackluster price performance looked like a “mid-cycle top” reminiscent of April, May, June of 2021, when “many said it was over, top-callers gloated, and then we ripped in 2H ’21.”

Former Goldman Sachs executive and current Real Vision CEO Raoul Pal echoes Burniske’s sentiments. Pal, who has been vocally bullish on crypto, also believes the current correction is a speed bump on the way to new highs.

“You guys all need to learn patience…

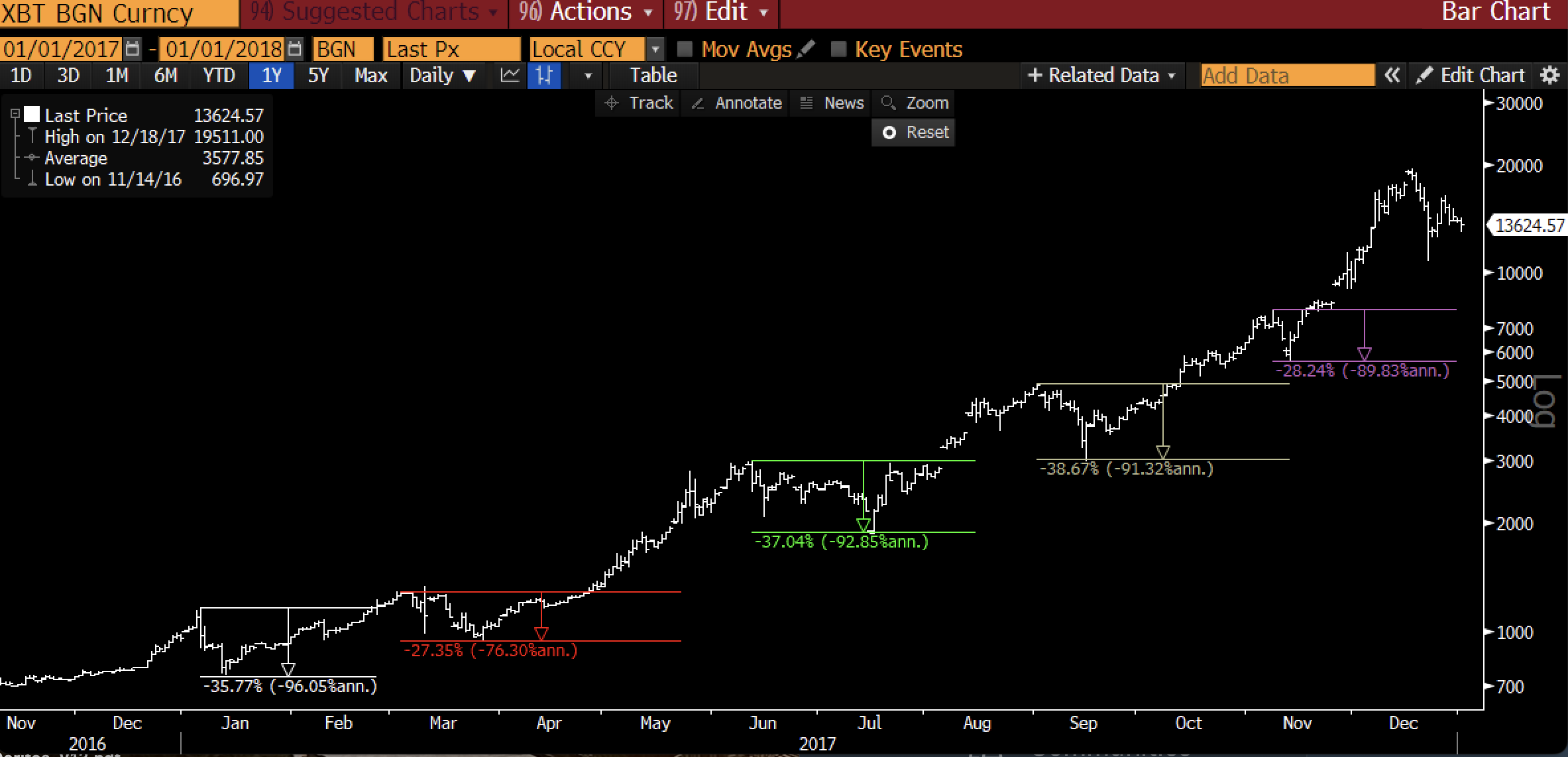

This was 2017. Very similar macro structure:

5 x 28%+ pullbacks in BTC

Most lasted 2 to 3 months before a new high

Alts saw 65% corrections.

All were noise.

Go do something else more constructive than stare at the screen.”

Source: Raoul Pal/X

Source: Raoul Pal/X

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ark of Panda Collaborates with Duck Chain to Boost Network Scalability, Connect RWAs To Cross-Chain Ecosystems

Crypto market’s weekly winners and losers – CC, UNI, HYPE, M

Former BlackRock Vice President Discusses XRP ETF

Bitwise CIO Just Said It Out Loud: XRP Was Better Received Than Ethereum