This week, the crypto market tested investor conviction.

The BOJ rate hike, combined with November’s softer-than-expected inflation reading, kept Bitcoin [BTC] volatile. The result? Macro FUD pushed fear levels higher, showing that the risk-off mood is still present.

However, a few coins still managed to grab the spotlight.

Weekly winners

Canton [CC] — Smart-contract reclaimed key levels in one decisive move

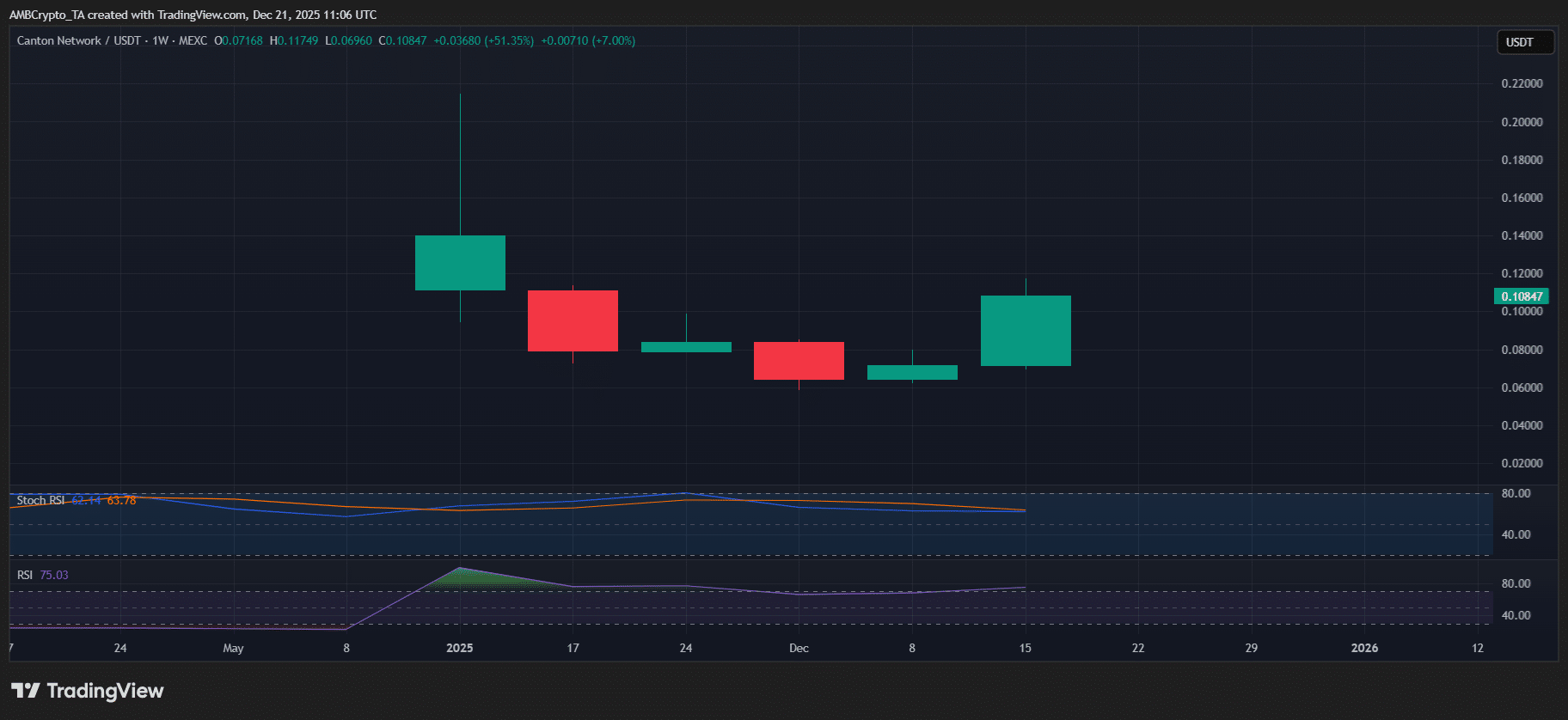

Canton [CC] topped this week’s gainers with a sharp 50% rally from the $0.07 open. In fact, the rally has pushed CC back to mid-November levels, clearly reclaiming multiple resistance zones in one clean move.

That said, the “overheating” question is now on the table. From the technical front, CC’s RSI jumped from 60 to nearly 80 in just a week, highlighting strong momentum but also flashing overbought conditions.

Consequently, after such a fast, decisive move, some cooling wouldn’t be surprising, especially with Canton now pressing into the $0.10 supply zone, a level it couldn’t crack last month.

Source: TradingView (CC/USDT)

Notably, this is where Canton’s recent strategic roadmap comes into play.

Initially, CC’s weekly rally was largely “hype-driven,” sparked by an SEC-linked boost, as AMBCrypto recently noted. However, as that momentum has continued, key fundamentals have started to align.

As a result, what began as speculative enthusiasm is now evolving into a more structurally supported move, making a sustained breakout for Canton look increasingly likely.

Audiera [BEAT] — Creator-economy token reinforced bullish conviction

Audiera [BEAT] emerged as the second-biggest weekly gainer, rallying 40% from the $2 open. In doing so, BEAT showed strong technical resilience, breaking through a key overhead resistance.

Moreover, this move marked BEAT’s seventh consecutive green weekly close, reinforcing a bullish market structure. That said, the rally is unfolding alongside a few important variables.

For one, the broader market remains in a risk-off environment. Meanwhile, BEAT’s Futures liquidity appears to be overheating. So, looking ahead, what happens once the market flips back to risk-on?

With BEAT nearing the $3 level, sentiment could turn cautiously optimistic.

Uniswap [UNI] — DEX token showed early signs of bottoming out

Uniswap [UNI] secured third place on this week’s gainers list with a 20% run. Notably, much like Canton, UNI had an eventful week, with three back-to-back developments helping spark renewed FOMO.

From a technical standpoint, the timing couldn’t have been better.

After four straight red weekly closes pushed UNI’s RSI deep into oversold territory, this week, price responded with a sharp bounce, naturally raising questions around a potential bottom.

That said, it’s still too early to confirm a full trend reversal.

However, as AMBCrypto noted, bullish signals are building. If UNI can break the $7 level in the coming days, then a V-shaped recovery could start to take shape, making UNI one of the more compelling setups to watch.

Other notable winners

Outside the majors, altcoin rockets stole the spotlight this week.

BitLight [LIGHT] led the charge with a massive 274% jump, followed by Luxxcoin [LUX] climbing 214%, and Fasttoken [FTN] rounding out the leaderboard with a strong 139% gain.

Weekly losers

XDC Network [XDC] — Enterprise-focused blockchain couldn’t hold key support

XDC Network [XDC] topped this week’s losers chart with an 8% dip. At first glance, the move doesn’t look dramatic. However, when seen weekly, the dip further confirms that bearish control remains firmly intact.

Since topping out at $0.10 in mid-July, XDC has printed four lower lows, indicating that bulls have failed to defend key levels. Naturally, a reversal has struggled to materialize, which is why even an 8% dip holds weight.

Zooming in further, the bearish structure becomes even more apparent. Notably, three of those four lower lows have formed in Q4 alone, effectively dragging XDC back to mid-November territory.

Source: TradingView (XDC/USDT)

That means XDC has wiped out all of its post-election gains.

From an investor standpoint, that likely means many hype-driven buyers have either exited or are stuck holding unrealized losses. Because of this, holding and confirming a solid support zone is now critical.

Otherwise, if conviction continues to weaken, XDC could easily drift back toward pre-election levels near $0.02.

Hyperliquid [HYPE] — Derivatives platform erased its Q4 gains

Hyperliquid [HYPE] emerged as the second-biggest weekly loser. Notably, just like XDC, HYPE continues to signal a bearish market outlook, with back-to-back red weekly closes indicating weak investor conviction.

As a result, stress is rising among HODLers.

For instance, AMBCrypto reports that a major HYPE whale is now sitting on about $22 million in unrealized losses. Because of this, maintaining key support levels is critical to reignite FOMO and prevent broader capitulation.

Looking at the price, HYPE is hovering near the $20 level, with RSI pushing deeper into oversold territory. If bulls step in, price could chop sideways. However, if support fails, HYPE risks sliding back to its April lows.

MemeCore [M] — Meme-focused L1 saw bears regain control

MemeCore [M] took the third spot on this week’s losers list. However, unlike its counterparts, M is showing relatively strong resilience. From a technical perspective, bulls haven’t fully abandoned the altcoin.

In fact, this week’s drawdown comes right after last week’s 40% rally, indicating that buyers quickly stepped in around the $1.20 level. As a result, this zone has become a key support to watch.

Looking at the daily chart, strong bullish intervention hasn’t yet emerged, with only a minor 0.4% intraday gain. That said, if buying pressure ramps up next week, M could quickly reinforce $1.20 as a solid bottom.

Other notable losers

In the broader market, downside volatility hit hard.

FOLKS [FOLKS] led the losers with a steep 75% drop, followed by TOMI [TOMI] falling 73%, and Legacy Token [LGCT] slipping 59% as momentum sharply cooled.

Conclusion

This week was a rollercoaster. Big pumps, sharp dips, and nonstop action. As always, stay sharp, do your own research, and trade smart.

Final Thoughts

- Canton [CC], Audiera [BEAT], Uniswap [UNI] led the week in gains.

- XDC Network [XDC], Hyperliquid [HYPE], MemeCore [M] saw significant declines.