Bitcoin Price Prediction: BTC Price Over $100,000 AGAIN Soon?

Bitcoin Open Interest Surge: A Potential Breakout Signal

Recent data indicates a steady rise in Bitcoin's open interest within perpetual futures markets. This surge suggests heightened trading activity, which often precedes a Bitcoin price breakout . Analysts highlight that while a significant price movement is expected, the direction remains uncertain and dependent on further market signals.

Bitcoin and Ethereum Options Set to Expire

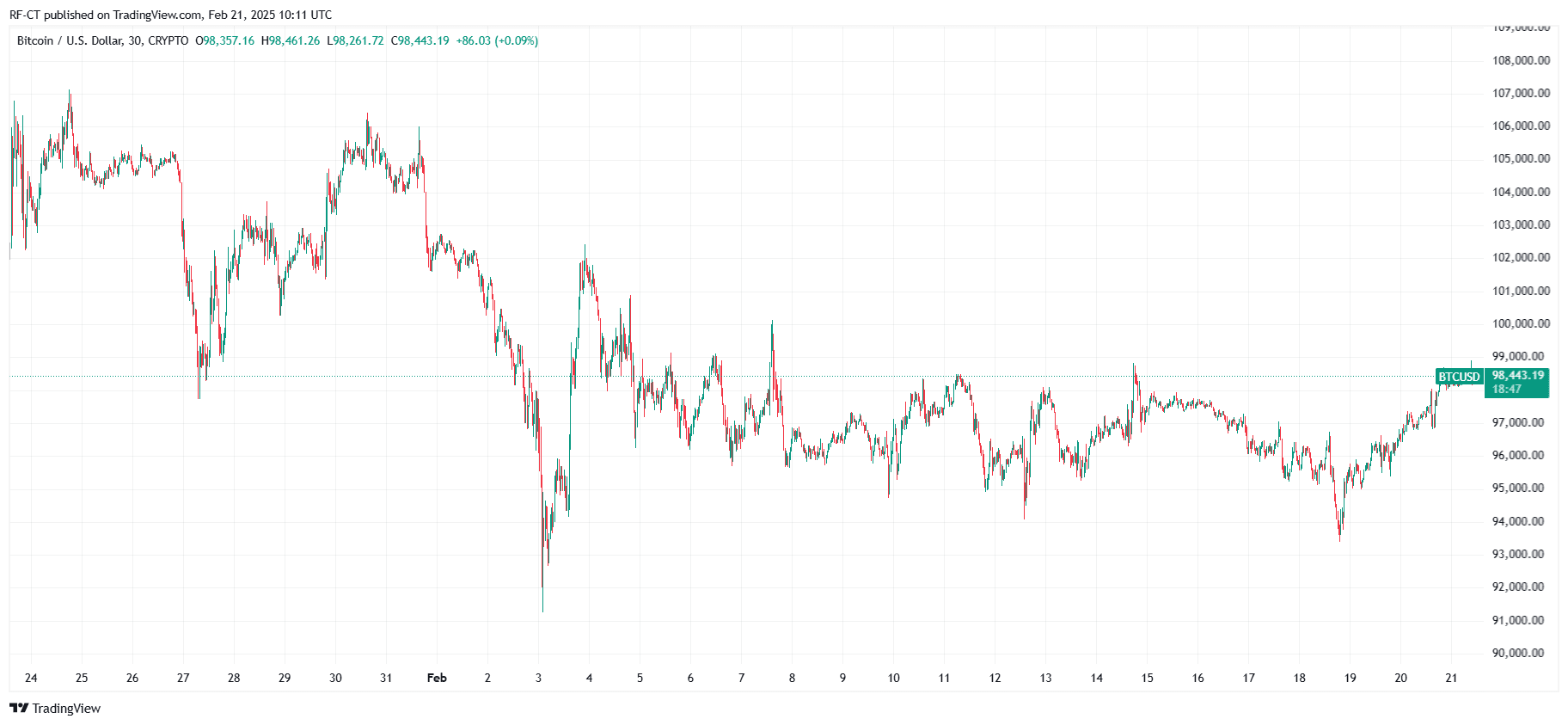

Today, Bitcoin and Ethereum options worth approximately $2.04 billion are set to expire. These expirations frequently cause increased market volatility as traders rebalance their positions. The maximum pain price—the level at which the most options expire worthless—is $98,000 for Bitcoin and $2,700 for Ethereum. Since Bitcoin is trading near these levels , its price action may be influenced by option settlement pressures.

Bitcoin Price Prediction: BTC Price Over $100,000 AGAIN Soon?

By TradingView -

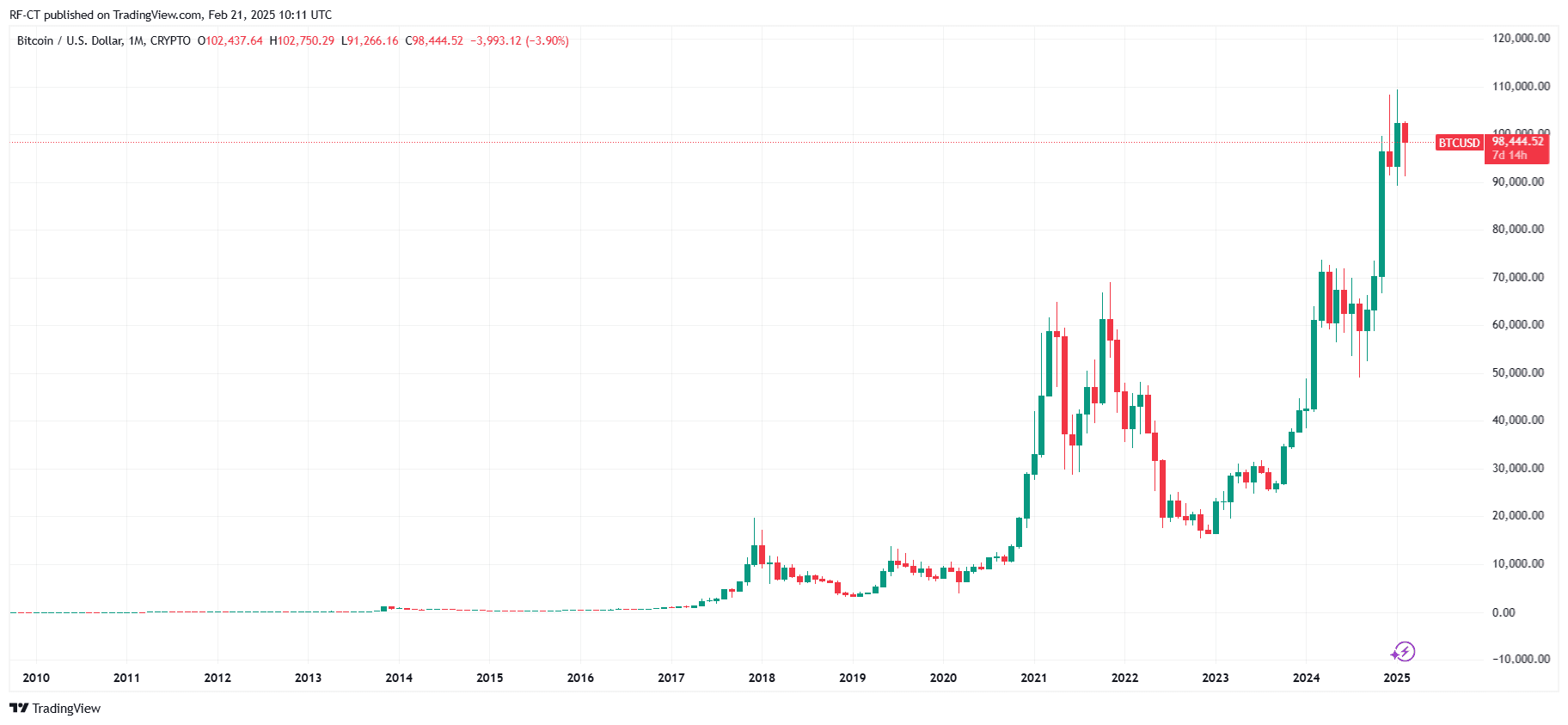

BTCUSD_2025-02-21 (1M)

By TradingView -

BTCUSD_2025-02-21 (1M)

Key Price Levels and Market Outlook

Currently, Bitcoin is trading around $98,774 , with strong support levels between $91,000 and $95,000. The resistance level is near $103,900. If Bitcoin surpasses $100,000, it could trigger bullish momentum and push prices toward new highs. Conversely, if Bitcoin falls below $91,000, increased selling pressure might drive further declines. Traders are closely monitoring these key levels amid heightened activity in Bitcoin futures and options markets.

By TradingView - BTCUSD_2025-02-21 (All)

By TradingView - BTCUSD_2025-02-21 (All)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Essence of Bitcoin and AI

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

Trump's pressure works! India's five major refineries suspend orders for Russian oil

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

Masayoshi Son takes action! SoftBank sells all its Nvidia shares, cashing out $5.8 billions to shift towards other AI investments

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.

Research Report|In-Depth Analysis and Market Cap of Allora Network (ALLO)