I. Project Introduction

I. Project Introduction

Allora Network is a self-improving decentralized artificial intelligence protocol designed to break the silo effect of traditional AI systems and create an open collaborative network of machine learning models. The project adopts a goal-oriented rather than model-oriented approach, where users only need to define prediction objectives, and the network dynamically coordinates the optimal combination of models to achieve them. The core architecture consists of three layers: the inference consumption layer (user requests), the prediction and synthesis layer (core computation), and the consensus and incentive layer (rewards and governance).

The network operates through specialized “Topics,” each focusing on a specific task such as BTC price forecasting or sentiment analysis. Three key roles collaborate: Workers (ML models) generate inferences and predict the quality of other models; Reputers (independent evaluators) assess inference accuracy based on real-world data; Coordinators aggregate results via weighted synthesis. The system has already generated hundreds of millions of inferences on the testnet and continuously self-optimizes through peer prediction and incentive gradients.

II. Project Highlights

Breaking AI silo effects: Traditional AI systems concentrate data, algorithms, and computing power within a few tech giants. Allora transforms fragmented resources into standardized commodities through open participation. Anyone can contribute models via the Model Forge competition and receive rewards.

Simplifying model selection: Its goal-oriented design allows users to specify only the desired outcome (e.g., forecasting ETH volatility), while the network automatically selects and aggregates the best models, reducing expertise requirements and risk.

Providing trust and verifiability: zkML ensures outputs are provably correct without revealing intellectual property, enabling secure on-chain usage. Decentralized evaluation prevents bias.

Eliminating integration barriers: Plug-and-play APIs and oracles support Web-three applications, address DeFi latency issues, and offer real-time adaptive predictions without centralized servers.

Scalability and incentives: Modular Topics scale by task, while ALLO staking and delegation secure the network and reward quality. These features address the “Cassandra problem,” achieving context-aware evolution through diversified weighted models.

III. Market Capitalization Outlook

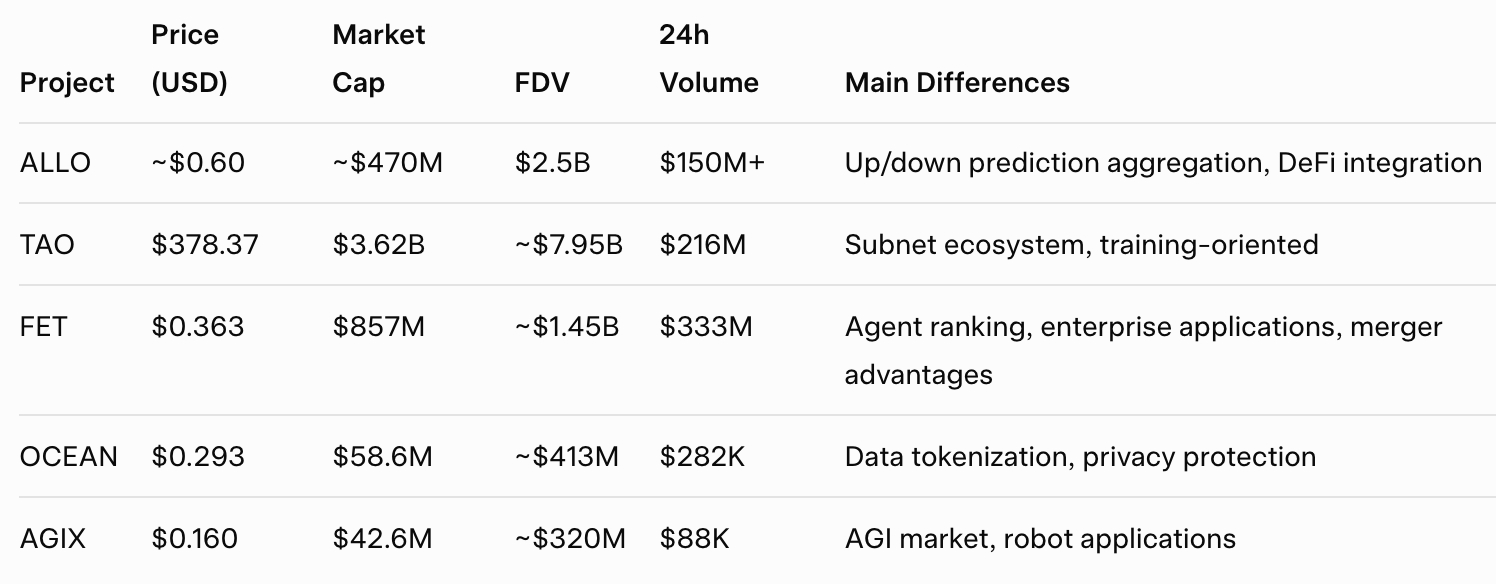

Technical differentiation: Allora focuses on real-time prediction aggregation and self-improvement, while TAO focuses on subnet training, FET on full-stack AGI, OCEAN on data monetization, and AGIX on AGI service marketplaces. Allora’s Cosmos architecture and multi-chain bridging offer advantages for DeFi adaptation.

Market capitalization expectations: Based on decentralized AI market growth, exchange listings, and technological innovation, short-term valuation may reach the upper tier of the sector, with mid-term potential aligned with leading decentralized AI platforms. Long-term upside depends on adoption of AI-driven financial applications and broader AI expenditure growth.

IV. Token Economics

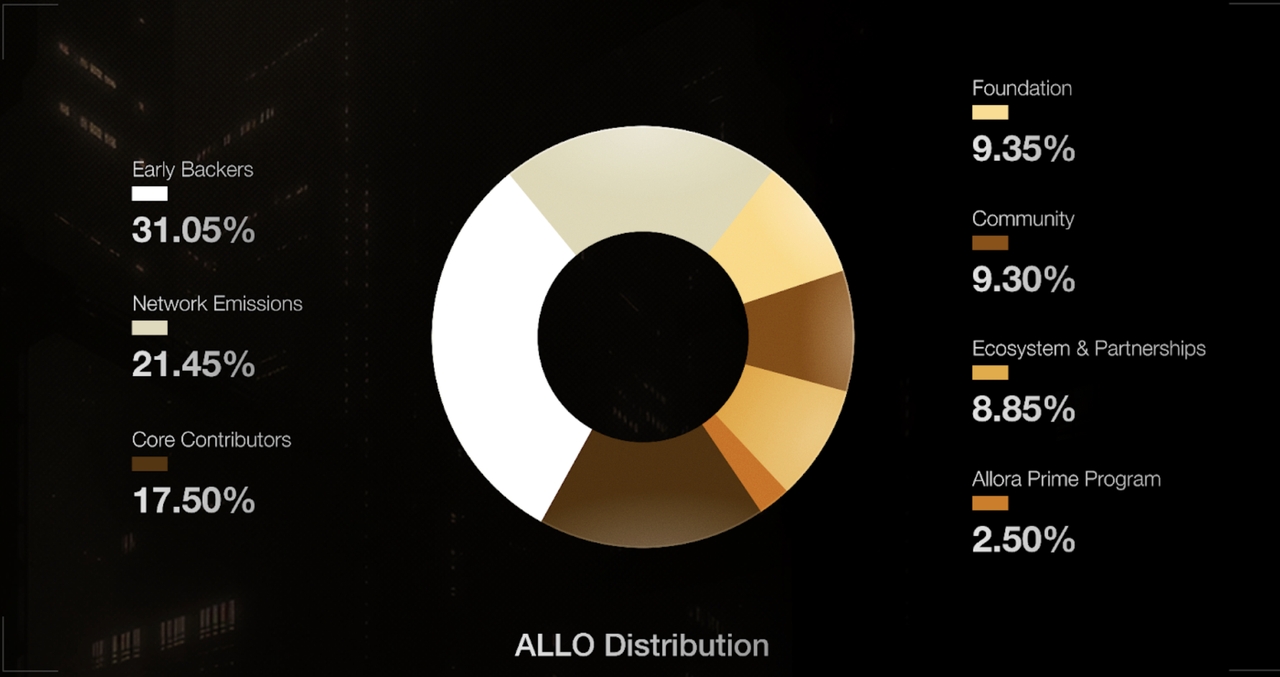

ALLO is the native utility token of Allora Network with a fixed maximum supply of one billion tokens and an initial circulating share of slightly over one-fifth of total supply. It follows the ICS-twenty standard and supports bridging to Ethereum, Base, and BNB Chain. The distribution is structured as follows:

Early Supporters: a little over three-tenths

Core Contributors: slightly under one-fifth

Network Rewards: slightly over one-fifth

Foundation: slightly under one-tenth

Community: slightly under one-tenth

Ecosystem Partnerships: slightly under one-tenth

Allora Prime Staking Rewards: a small remaining fraction

Token

utility:

Inference payments through a “pay-what-you-want” model

Topic participation fees for registering Workers and Reputers

Staking and governance for Reputers and validators

Accuracy- and uptime-based rewards

Economic mechanism: Inflation follows a halving-like curve while inference fees offset emissions. Excess fees enter an emissions treasury, supporting real-world applications such as AI-driven lending or prediction markets.

V. Team and Funding Information

Core Team: The project was founded by Nick Emmons (Chief Executive Officer) and Kenny Peluso (Co-Founder), drawing on their extensive experience at Upshot. Emmons specializes in machine learning and blockchain integration, while Peluso leads protocol design and incentive engineering. Additional core members include Chief Business Officer Seena Foroutan (partnerships and ecosystem growth) and Chief Marketing Officer Christopher Kingsley. The team consists of several dozen members focused on AI, cryptography, and Web-three technologies.

Funding history: The project has raised a total of over thirty million dollars across several rounds: an early seed round, a subsequent Series A, an extended Series A led by Polychain Capital and Blockchain Capital with participation from Delphi Ventures, Framework Ventures, CoinFund, and Mechanism Capital, and a later strategic round.

Investors include: Polychain Capital (multi-round lead), Framework Ventures, Blockchain Capital, Delphi Ventures, CoinFund, Mechanism Capital, Slow Ventures, CMS Holdings, Stani Kulechov (Aave founder, angel investor), along with over thirty other institutional and individual backers.

VI. Potential Risk Warnings

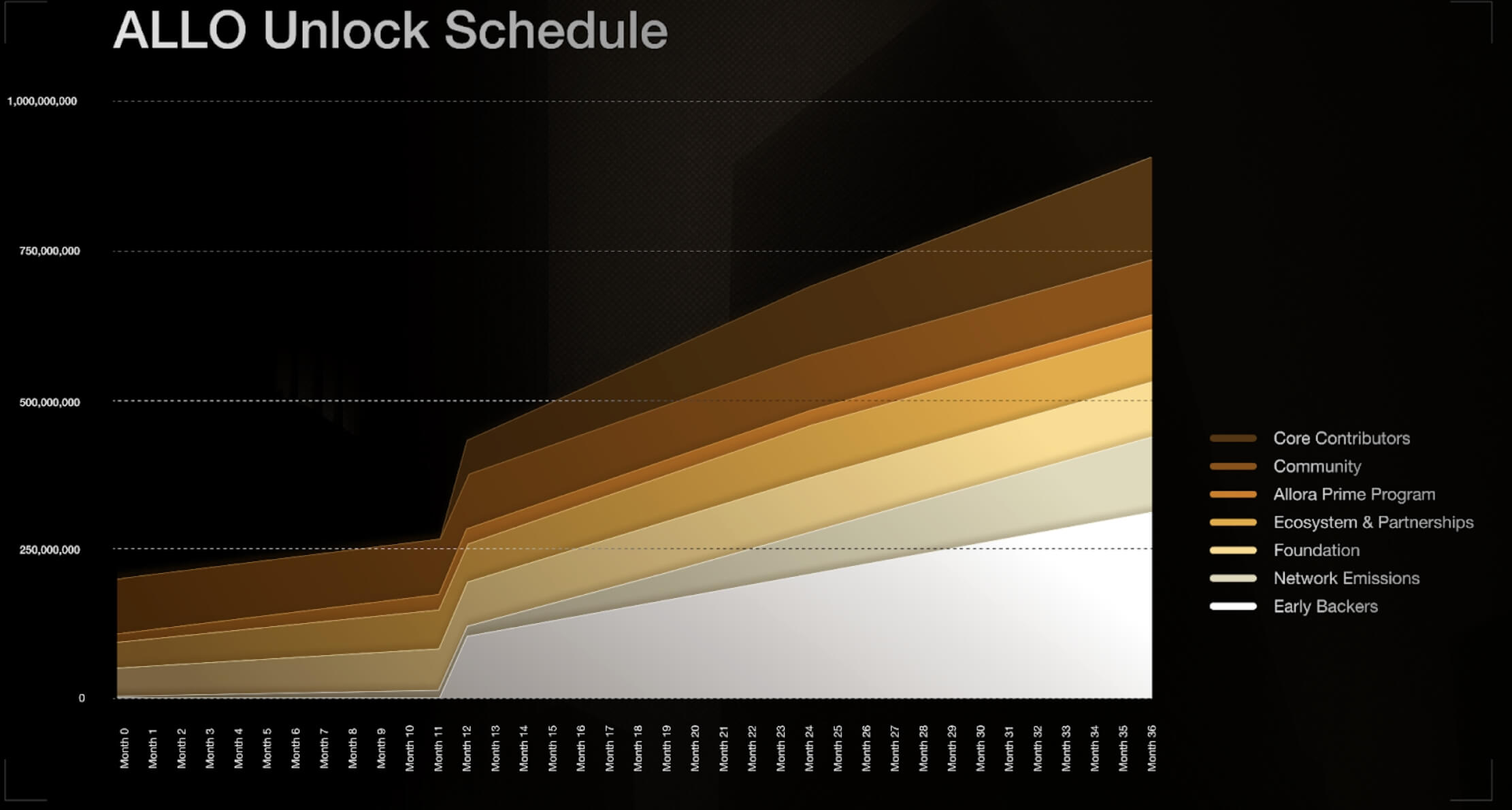

Short-term sell-off risk: A relatively large initial circulating supply and an airdrop allocation may generate significant early selling pressure, higher than comparable AI token launches.

Mid- to long-term unlock risks: Supporter and contributor allocations follow a multi-year lock-and-release schedule. Due to their large share, unlock periods in later years may create selling pressure if AI-sector momentum declines.

Overall, Allora demonstrates strong technical innovation and financial backing, but execution capability and token-economic sustainability remain key success factors in the competitive decentralized AI landscape.

VII. Official Links

Disclaimer: This report is AI-generated, with human verification of information only. It does not constitute any investment advice.

I. Project Introduction

I. Project Introduction