News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Polymarket Traders See Bitcoin Ending 2025 Near $80K

Cryptotale·2025/12/19 11:15

Falcon Finance Funds $2.1B $USDf on Base as Network Activity Hits New Highs

BlockchainReporter·2025/12/19 11:15

Can Pump.fun survive after PUMP falls 80% amid legal woes?

AMBCrypto·2025/12/19 11:08

Ripple CEO Drops XRP Price Truth Bomb

TimesTabloid·2025/12/19 11:07

Fidelity’s Director of Global Macro Intensifies Bitcoin Outlook

Cointurk·2025/12/19 11:06

Unstoppable Crypto Bull Market: Why Sharp Drops and Fear Are Actually Bullish Signals

Bitcoinworld·2025/12/19 11:00

Bitcoin Demand Warning: CryptoQuant Signals Alarming Shift to Bear Market

Bitcoinworld·2025/12/19 10:57

Birth of a Parallel Financial System that Defied Institutions

Cryptotale·2025/12/19 10:51

Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

Cointime·2025/12/19 10:46

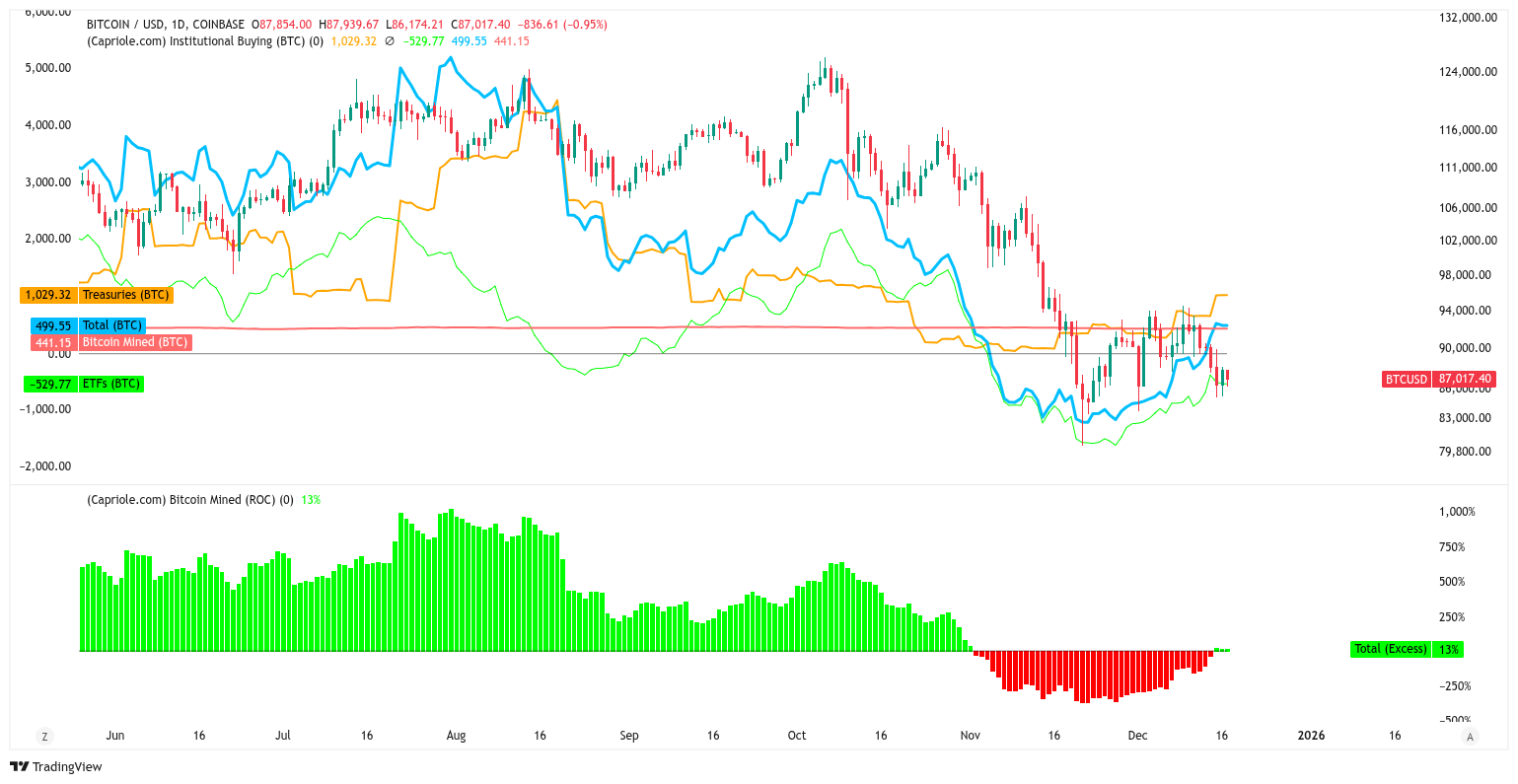

Bitcoin institutional buys flip new supply for the first time in 6 weeks

Cointime·2025/12/19 10:46

Flash

11:24

Goldman Sachs analysts predict a "Christmas rally" is coming for U.S. stocks.BlockBeats News, December 19 — Traders have spent most of December speculating whether the typical year-end "Santa Claus rally" will arrive as expected. The S&P 500 rose 0.8% on Thursday, ending a four-day losing streak after the index had been falling throughout the month. Historically, the stock market may continue to rise: data compiled by Citadel Securities shows that since 1928, the S&P 500 has had a 75% probability of rising in the last two weeks of December, with an average increase of 1.3%. The trading team at Goldman Sachs Group, including Gail Hafif, stated: "Unless there is a major shock, it will be difficult to resist the seasonal tailwinds and more favorable positioning that we are about to enter." "While we do not necessarily expect a significant rally, we do believe there is still room for gains from now until the end of the year." (Golden Ten Data)

11:23

Goldman Sachs Analyst Predicts US Stock Market Is About to See a "Santa Claus Rally"BlockBeats News, December 19th, Traders spent most of December speculating whether the typical year-end "Santa Rally" would materialize as expected. The S&P 500 index rose 0.8% on Thursday, ending a four-day losing streak that had persisted earlier in the month. Drawing on historical trends, the stock market may continue its ascent: Castle Securities' data shows that since 1928, the S&P 500 index has had a 75% probability of rising in the last two weeks of December, with an average gain of 1.3%

The Goldman Sachs trading desk team, including Gail Hafif, stated: "It will be hard to resist the seasonal tailwind we are about to enter and a more favorable positioning unless there is a significant shock. Though we do not necessarily expect a sharp rally, we do see room for further upside from here through year-end." (FXStreet)

11:22

ECB Governing Council member Escrivá: Monetary policy is expected to remain stableJinse Finance reported that European Central Bank Governing Council member Escrivá stated that he sees no reason to adjust interest rates and expects monetary policy to remain stable for the foreseeable future. On Thursday, the European Central Bank kept its policy rates unchanged and raised some growth and inflation forecasts, a move that may have closed the door to further rate cuts in the near term. In an interview, when Escrivá was asked about the next possible interest rate move, he said: "We don't know, but if necessary, we are open to any change in any direction. However, at present, we are satisfied with the current 2% interest rate level."

News