Bitcoin institutional buys flip new supply for the first time in 6 weeks

Bitcoin institutional demand is finally outpacing new supply as the market hits a key pivot point.

Key points:

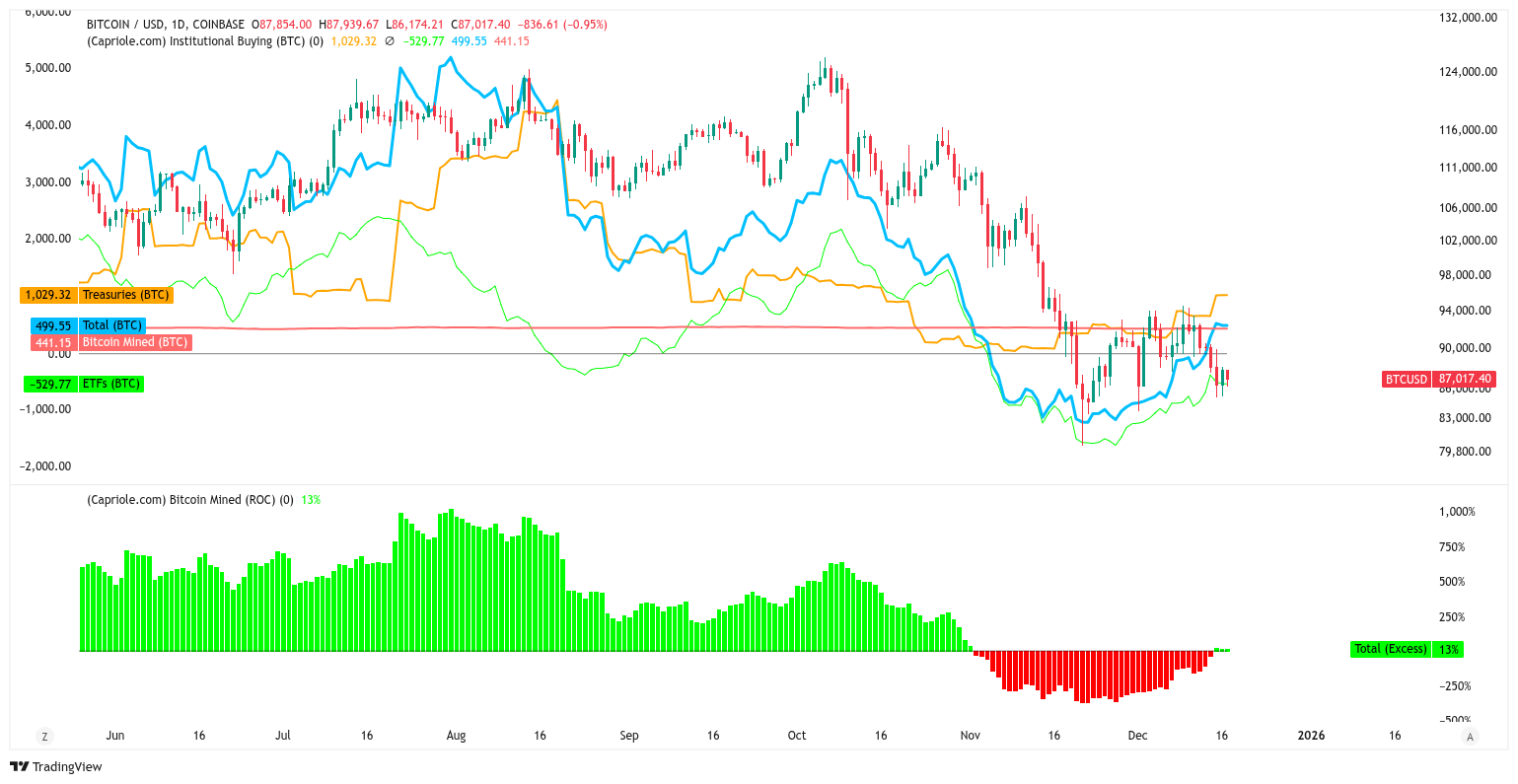

- Bitcoin institutional demand is now 13% higher than the amount of newly mined BTC on a rolling daily basis.

- New data shows institution-fueled supply reduction returning for the first time since early November.

- ETF outflows pass $600 million in just two days this week.

Institutions bounce back with BTC buys

New data from quantitative Bitcoin and digital asset fund Capriole Investments shows that institutions are buying more BTC than miners are adding.

Bitcoin is becoming a target for institutions again as price action seeks a bottom more than 30% below October’s all-time highs.

Capriole reveals that for the past three days, institutional buying has surpassed the newly mined supply.

This is the first time that corporate demand alone has had a net reduction on the BTC supply since the start of November.

The figure remains modest compared to the peak of the bull market two months ago. Currently, institutions are buying 13% more than the daily mined supply.

Bitcoin institutional demand vs. mined supply. Source: Capriole Investments

Bitcoin institutional demand vs. mined supply. Source: Capriole Investments

As noted by Capriole founder Charles Edwards earlier this month, the intervening period between the $126,000 highs and recent lows of $80,500 has been marked by significant stress for market players, including businesses opting to create Bitcoin corporate treasuries.

Attention has focused on Strategy, the company with the world’s largest such treasury, which has continued to add to its BTC holdings despite falling prices and stock performance.

Referencing its own AI-based analysis, Capriole’s Edwards this week highlighted a “broken corporate ‘flywheel,' evidenced by record discounts to NAV among treasury companies and rising leverage.”

Despite Bitcoin looking attractive when judged by network fundamentals, the pressure from corporate treasuries could be complicating the “path of least resistance” for price recovery, the analysis added.

Bitcoin ETF outflows meet “strategic accumulation”

Summarizing the status quo Wednesday, onchain analytics platform CryptoQuant described a “market in transition, where short-term pessimism contrasts with strategic accumulation.”

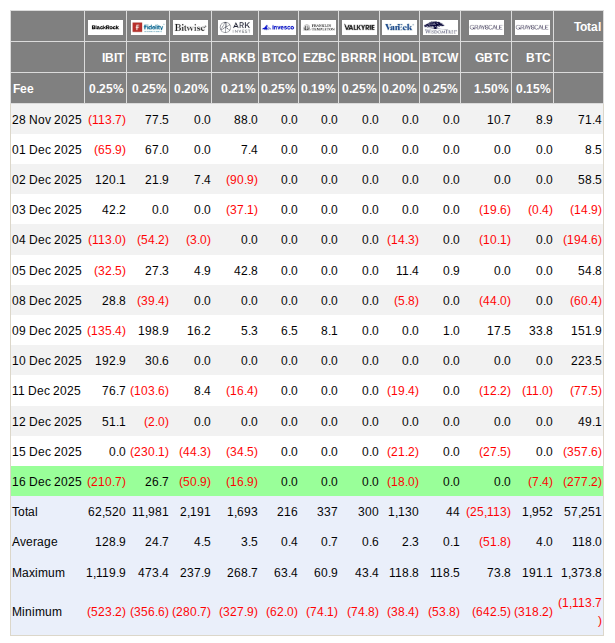

Network fundamentals, it noted, support market entries, even as capital outflows from investment vehicles such as the US spot Bitcoin exchange-traded funds (ETFs).

“This divergence between institutional outflows and the conviction of major players underscores that Bitcoin oscillates between immediate stress and long-term expectations of appreciation,” contributor GugaOnChain concluded in one of CryptoQuant’s Quicktake blog posts.

US spot Bitcoin ETF netflows (screenshot). Source: Farside Investors

US spot Bitcoin ETF netflows (screenshot). Source: Farside Investors

Data from sources including UK-based investment company Farside Investors put net ETF outflows since Monday at $635 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Whale Selling Pressure Crushes ETF Optimism: Price Could Plummet to $1.50

Block Sec Arena Partners with Fomo_in To Deliver Comprehensive Security and Growth Solutions for Blockchain Startups

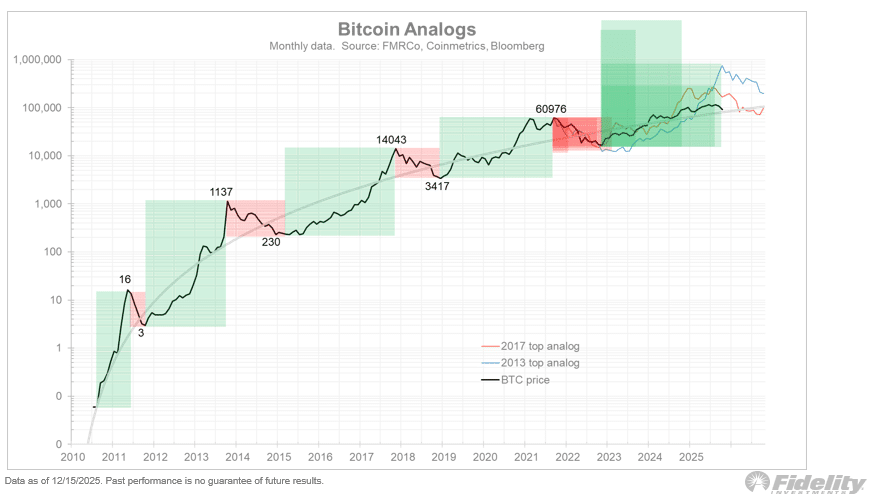

Bitcoin – Could 2026 be an ‘off year’ for BTC’s price?

Netflix acquires gaming avatar maker Ready Player Me