News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Hyperliquid airdrop project ratings: Which ones are worth participating in?2Bitcoin Cash (BCH) May Sustain $600 Level After 32% Volume Spike and Growing Institutional Interest3Worldcoin (WLD) To Rise Higher? Key Breakout Signals Potential Upside Move

MDT Soars 170% After RewardMe 2.0 Token Integration

Portalcripto·2025/07/25 16:25

Ethereum Expected to Surpass $4,000: Galaxy CEO

TokenTopNews·2025/07/25 16:16

Ethereum Price Surges Past $3,700 Amid Institutional Activity

TokenTopNews·2025/07/25 16:16

CryptoQuant Insights: Bitcoin Holding Signals Potential Upside

TokenTopNews·2025/07/25 16:15

Quantum Computing Threatens Bitcoin Security: Industry Reactions

TokenTopNews·2025/07/25 16:15

Wang Feng Boosts Crypto Institutionalization with LK Crypto Launch

TokenTopNews·2025/07/25 16:15

Galaxy Digital Moves 1500 BTC to New Addresses

TokenTopNews·2025/07/25 16:15

Curve DAO Token is Up By 6%, Is This a Comeback, or Will it Fade Into the Charts?

CryptoNewsNet·2025/07/25 16:15

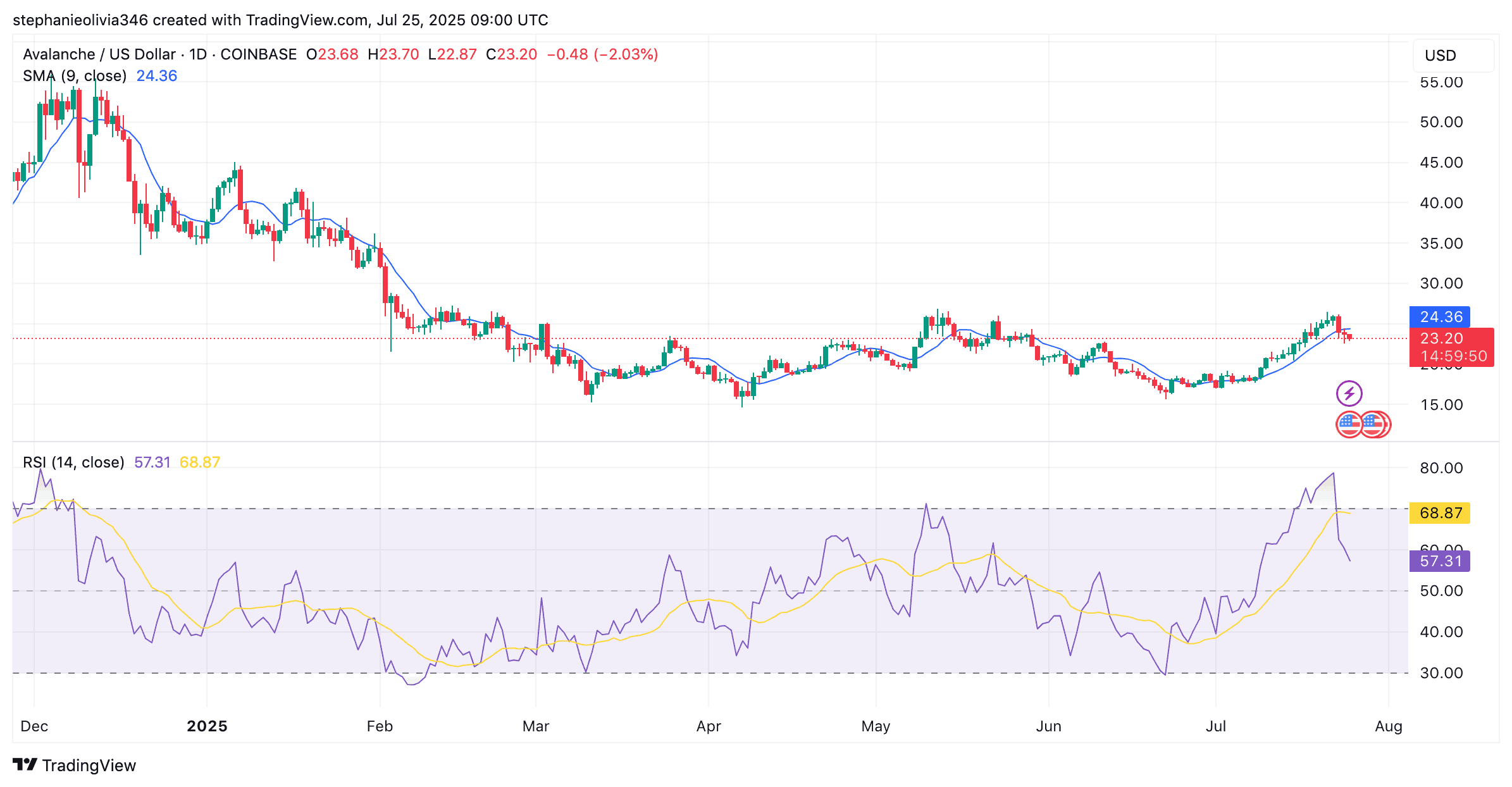

Avalanche (AVAX) Breakout Imminent? $36 Target If $27 Cracks

CryptoNewsNet·2025/07/25 16:15

BONK Drops 9% From Peak as Exchange Transfers Overwhelm Burn News

CryptoNewsNet·2025/07/25 16:15

Flash

- 11:51Tether CEO: No Bitcoin has been sold, only part of the reserves have been allocated to XXIJinse Finance reported that Tether CEO Paolo Ardoino stated on the X platform: "Tether has not sold any bitcoin, but has allocated part of its bitcoin reserves to XXI. As the world becomes increasingly uncertain, Tether will continue to invest part of its profits in safe assets such as bitcoin, gold, and land. Tether is a stable company."

- 11:21ether.fi Foundation: 73 ETH of protocol revenue was used this week to purchase 264,000 ETHFIChainCatcher news, the ether.fi Foundation released an ETHFI token buyback update on the X platform, disclosing that it has used 73 ETH (approximately $314,000) of protocol revenue to purchase 264,000 ETHFI. In addition, about 155,000 ETHFI have been burned, and approximately 108,000 ETHFI have been distributed to sETHFI holders.

- 10:52Analysis: Venezuela's inflation rate reaches 229%, USDT becomes the preferred local settlement methodJinse Finance reported that as Venezuela's annual inflation rate soared to 229%, stablecoins such as USDT have become the "de facto" currency for millions of Venezuelans within the financial system. It is reported that locals refer to Bitcoin as "exchange dollars," while the country's currency, the bolivar, has virtually disappeared from daily commercial activities. Hyperinflation, strict capital controls, and a fragmented exchange rate system have led people to increasingly prefer stablecoins over cash or local bank transfers. From small grocery stores to medium-sized businesses, USDT has replaced fiat cash as the preferred settlement method locally.