News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Michigan Advances Crypto Reserve Bill to Committee Stage

DeFi Planet·2025/09/19 18:42

Bank of Canada Advocates For A Swift Stablecoin Regulation Amid Market Boom

Cointribune·2025/09/19 18:42

Bitcoin Has 70% Chance of Fresh Highs as ETF Inflows and Metrics Signal Breakout

Cointribune·2025/09/19 18:42

XRP price outlook as REX-Osprey XRPR ETF notches $37.7m in day one volume

Coinjournal·2025/09/19 18:39

Ethena looks to gain as Mega Matrix scoops $6m ENA for treasury strategy

Coinjournal·2025/09/19 18:39

KAITO (KAITO) To Rise Higher? Key Breakout and Retest Signaling Potential Upside Move

CoinsProbe·2025/09/19 18:36

Pump.fun (PUMP) Slides Lower – Could This Emerging Pattern Spark a Bounce Back?

CoinsProbe·2025/09/19 18:36

Is World Liberty Financial (WLFI) Poised for a Breakout? Key Pattern Formation Suggests So!

CoinsProbe·2025/09/19 18:36

Solana Price Surpasses $250 – What’s Next for SOL and Altcoins?

Cryptoticker·2025/09/19 18:18

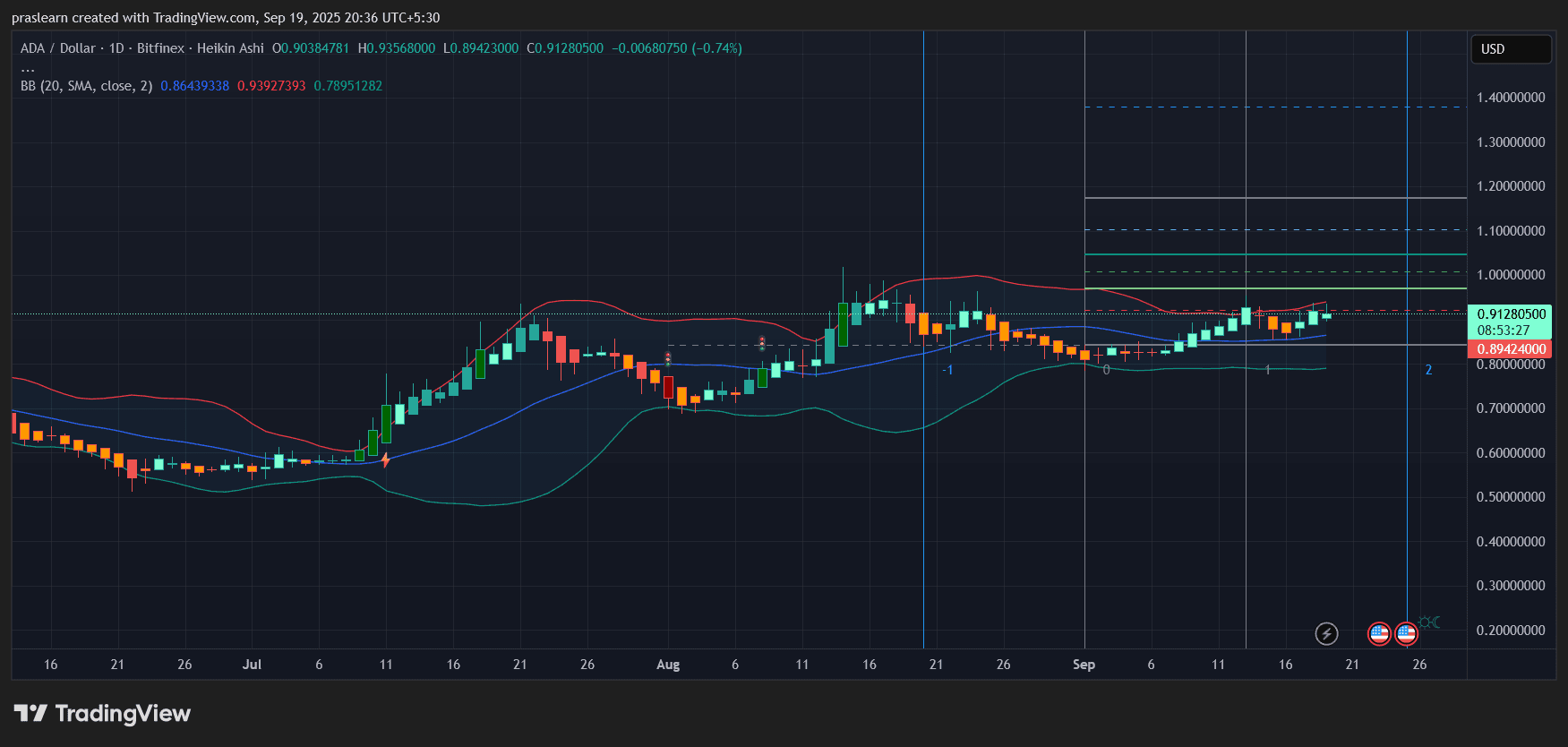

ADA Price Today: Is the Next Big Rally About to Begin?

Cryptoticker·2025/09/19 18:18

Flash

- 07:02Analysis: Bitcoin indicators show profit-taking phase is fading, with selling pressure from sellers nearing exhaustionBlockBeats News, December 6, CryptoOnchain posted on social media that the Bitcoin SOPR Ratio has dropped to 1.35, marking the lowest level since the beginning of 2024. As Bitcoin retraced to $89,700, this indicator shows that the market's profitability has been fully "reset." The phase of large-scale profit-taking by long-term holders is fading, indicating that selling pressure is nearing exhaustion. Historical data shows that when the market cools down, a drop in the SOPR Ratio to such a low level often signals the formation of a local bottom. If a trend reversal occurs at this point, it may lay the foundation for the next healthy upward movement. BlockBeats Note: The Bitcoin SOPR Ratio (short for SOPR Ratio) is a relatively advanced indicator in on-chain cryptocurrency analysis. It is a "ratio" version derived from the Spent Output Profit Ratio (SOPR), mainly used to determine whether the overall market is dominated by profits or losses, and to assist in identifying the stage of the bull or bear cycle.

- 07:02Current mainstream CEX and DEX funding rates indicate the market remains bearishBlockBeats News, December 6, according to Coinglass data, the current funding rates on major CEX and DEX platforms indicate that the market remains bearish. The specific funding rates for major cryptocurrencies are shown in the attached image. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the prices of underlying assets, typically applied to perpetual contracts. It is a capital exchange mechanism between long and short traders; the trading platform does not charge this fee. Instead, it is used to adjust the cost or yield of holding contracts, ensuring that contract prices remain close to the underlying asset prices. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates that the market is generally bullish. When the funding rate is less than 0.005%, it indicates that the market is generally bearish.

- 06:12SpaceX plans to sell internal shares at an $800 billion valuation and aims to go public in the second half of next yearForesight News reported, citing Jinse Finance, that according to sources familiar with the matter, SpaceX is in negotiations to sell internal shares, a deal that would value Elon Musk’s rocket and satellite manufacturer at $800 billions. If confirmed, this new transaction would once again make SpaceX the world’s most valuable startup, surpassing the previous record valuation of $500 billions set by OpenAI in October. This valuation marks a significant increase compared to the per-share price of $212 set in July, when the company raised funds and sold shares at a $400 billions valuation. Two people familiar with the discussions revealed that SpaceX has informed investors and representatives of financial institutions that the company plans to conduct an initial public offering (IPO) in the second half of next year. The negotiations come as SpaceX is considering selling shares held by investors.

News