News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.14)|Bitwise Predicts Bitcoin Will Hit $200,000; Multiple Official Accounts Switch to Pudgy Penguin Profile Pics2BTC Dominance Hits 65% as Chart Repeats 2018 and 2021 Altcoin Setup3BlackRock Now Holds Over 2 Million ETH Through Its ETF

Pepe Price Prediction: Key Levels to Watch Next Week

Cryptoticker·2025/01/11 10:47

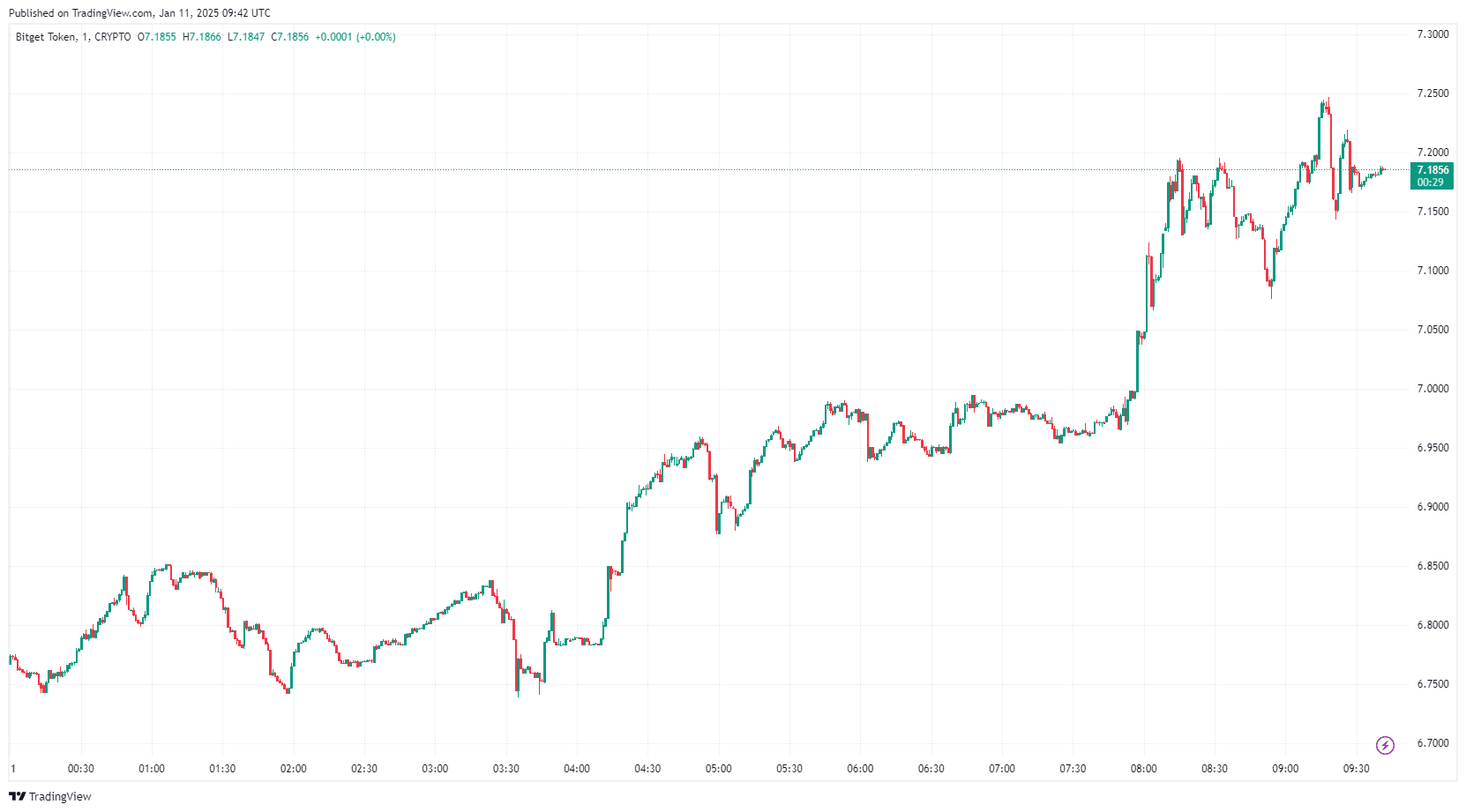

Bitget Token Price Surge amid Market Downturn: New 2025 BGB ATH?

Cryptoticker·2025/01/11 03:00

Bitcoin’s Resilience Above $94,000 May Indicate Potential for $100,000 Retest

Coinotag·2025/01/11 01:55

A comprehensive look at Pippin, which recently reached a market value of 200 million USD: An underrated dark horse in AI agent frameworks

Pippin aims to help developers and creators leverage advanced AI technology in a modular way.

Chaincatcher·2025/01/10 23:55

Best New Meme Coins with 1000X Potential: BTFD Coin’s Presale Rally Sparks Buzz While Pudgy Penguins and Osaka Protocol Thrive

CryptoNewsFlash·2025/01/10 22:33

Standard Chartered launches crypto custody services in Europe

Grafa·2025/01/10 22:10

72 hours after the market crash: Which on-chain tokens are rising against the trend?

Odaily·2025/01/10 18:55

Elon Musk’s Grok Says Cardano (ADA) Will Trade At This Price On January 31, 2025

Timestabloid·2025/01/10 18:01

Fantom (FTM) Climbs 3% While Whale Sell-Off Puts Recovery at Risk

Fantom struggles to recover from a 20% weekly drop despite a 3% daily gain. Weak whale activity and market trends weigh on recovery efforts.

BeInCrypto·2025/01/10 18:00

Flash

- 12:29The US CLARITY Act May Accelerate the Institutionalization of CryptocurrencyAccording to ChainCatcher, as reported by CoinDesk, Benchmark analyst Mark Palmer pointed out that the passage of the U.S. CLARITY Act will establish a clear regulatory framework for the digital asset market, distinguishing whether cryptocurrencies are classified as commodities or securities. The act is expected to resolve the longstanding legal uncertainties faced by traditional financial institutions and accelerate the entry of institutional investors such as asset management companies and hedge funds. The report indicates that compliant platforms like Galaxy Digital and a certain exchange will hold advantageous positions in this wave of institutionalization. Although the SEC currently maintains a constructive stance, the lack of written regulations still exposes the industry to the risk of policy reversals.

- 12:29Data: Last week, publicly listed companies worldwide made a net purchase of $628 million in BTC as Strategy resumes buyingAccording to ChainCatcher, citing SoSoValue data, as of July 14, 2025 (Eastern Time), the total net weekly inflow of Bitcoin allocated by global publicly listed companies (excluding mining companies) reached $628 million last week. Strategy (formerly MicroStrategy) resumed Bitcoin purchases last week, investing a total of $472.5 million to acquire 4,225 Bitcoins at an average price of $111,827, bringing its total holdings to 601,550 Bitcoins. Japanese listed company Metaplanet continued its buying streak for the fifth consecutive week, investing $93.6 million last week to acquire 797 Bitcoins at an average price of $117,451, raising its total holdings to 16,352 Bitcoins. Five other companies made new purchases last week, with three of them increasing their holdings by more than $10 million. UK digital advertising company The Smarter Web invested $29.1 million to acquire 275 Bitcoins at an average price of $105,837, bringing its total holdings to 1,275 Bitcoins; Japanese listed company Remixpoint invested $13.89 million to acquire 116.72 Bitcoins at an average price of $118,993, bringing its total holdings to 1,168.28 Bitcoins; US tech company KULR invested $10 million to acquire 90 Bitcoins at an average price of $111,111, bringing its total holdings to 1,021 Bitcoins; Japanese apparel company ANAP invested $5.21 million to acquire 44.56 Bitcoins at an average price of $116,918, bringing its total holdings to 229.23 Bitcoins; French Web3 services company Blockchain Group invested $3.23 million to acquire 29 Bitcoins at an average price of $109,733, bringing its total holdings to 1,933 Bitcoins. On July 9, Japanese listed company Remixpoint announced a financing plan of 31.5 billion yen (approximately $215 million), with all proceeds to be used for Bitcoin purchases. The company aims to increase its Bitcoin holdings from the current 1,168 to 3,000 in the near term. Remixpoint also announced that it will pay its new CEO, Yoshihiko Takahashi, in Bitcoin, marking the first time a Japanese listed company has adopted such a compensation structure. As of press time, the global publicly listed companies (excluding mining companies) included in the statistics collectively hold a total of 672,590 Bitcoins, with a current market value of approximately $8.19 billion, accounting for 3.38% of Bitcoin's circulating market capitalization.

- 12:20Bitget Debuts as Official Partner of MotoGP at the German Grand PrixAccording to ChainCatcher, Bitget, as an official partner of MotoGP, made an appearance at the Sachsenring circuit in Germany from July 11 to July 13. Through interactive exhibition areas, racing simulators, and co-branded merchandise, Bitget provided tens of thousands of on-site spectators with an immersive viewing experience. This marks Bitget’s second offline appearance since partnering with MotoGP, aiming to bridge the gap with users through sports scenarios and to further integrate Web3 with sports culture. Bitget has also launched a dedicated event page, consolidating race information, interactive activities, and multiple rewards. Users can participate in the event to win MotoGP tickets, limited-edition merchandise, and trading bonuses. An online racing game will be introduced in the future to further enhance user engagement. Previously, Bitget announced a multi-million dollar sponsorship agreement with the FIM Road Racing World Championship Grand Prix (MotoGP), becoming its official regional partner. This is also MotoGP’s first collaboration with a crypto company. As the premier motorcycle road racing event under the Fédération Internationale de Motocyclisme (FIM), MotoGP is often referred to as the F1 of motorcycle racing, renowned worldwide for its extreme speed and competitive spirit.