News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Massive $755M ETF Outflows Hit Bitcoin and Ethereum

Bitcoin and Ethereum ETFs saw combined outflows of $755M on October 13, sparking concerns over market sentiment.Investor Sentiment Appears to Be CoolingWhat Could Be Driving These Outflows?

Coinomedia·2025/10/14 06:39

Bitcoin Rallies After Negative Crowd Sentiment

Bitcoin often surges after days of extreme negative sentiment, proving crowd FUD is a strong contrarian indicator.Santiment Identifies Key Contrarian SignalsUnderstanding the Sentiment-Price Connection

Coinomedia·2025/10/14 06:39

BNB Hits New High Then Slides — Here’s Why Traders Should Be Cautious

BNB’s record high may be deceptive, as bearish signals and negative funding rates point to waning confidence and a potential pullback toward key support levels.

BeInCrypto·2025/10/14 06:30

Ethereum Price Breaks $4.200, Whale Accumulation Suggests Bullishness

Portalcripto·2025/10/14 06:27

Bitcoin Dominates Fund Flows With $2.67B Influx, But Still Trails 2024’s Peak

CryptoNewsNet·2025/10/14 06:27

India eyes CBDC, restates opposition against unbacked ‘crypto’

CryptoNewsNet·2025/10/14 06:27

DOGE Faces Rejection at $0.22 as Dogecoin Treasury Firm Eyes Public Listing

CryptoNewsNet·2025/10/14 06:27

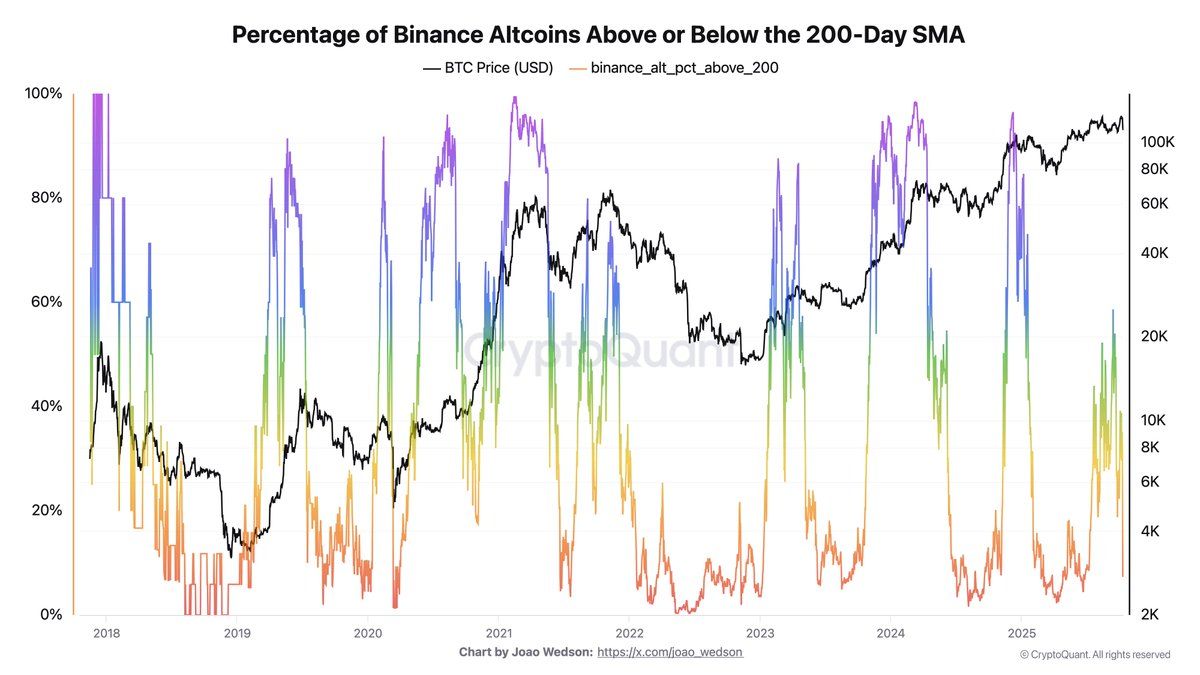

Why Analysts Say Now Could Be the Smartest Time to Buy Altcoins

CryptoNewsNet·2025/10/14 06:27

Wall Street Expands into Cryptocurrencies: Citi Makes Announcement

CryptoNewsNet·2025/10/14 06:27

Ethereum (ETH) Forms Key Bearish Setup — Could a Downside Move Follow?

CoinsProbe·2025/10/14 06:18

Flash

04:08

Analysis: Market Focus Shifts to Bank of Japan Governor Kazuo Ueda's Press ConferenceAccording to an analysis report by the financial website Investinglive, cited by Odaily, the Bank of Japan raised interest rates by 25 basis points to 0.75%, in line with market expectations. This marks the highest level of Japanese interest rates in thirty years and highlights the Bank of Japan's gradual move away from its ultra-loose monetary policy. Given the continued strength of inflation data and increasingly confident signals from policymakers, the market has fully priced in the rate hike decision. From a market perspective, this policy adjustment lacked surprises, reducing the volatility risk that previous policy changes had caused. Unlike past instances that triggered significant unwinding of yen carry trades, the yen's reaction this time may be more influenced by policy guidance rather than the rate hike itself. The market's focus quickly shifted from the rate hike to the central bank's forward guidance and Governor Kazuo Ueda's assessment of future policy directions. During the press conference, Kazuo Ueda is likely to adopt a cautious tone, emphasizing that future adjustments will depend on whether inflation is sustainable and demand-driven. He is expected to stress the importance of wage growth, household consumption, and corporate investment, while also pointing out the recent rise in Japanese government bond yields and the necessity of avoiding financial market turmoil. (Golden Ten Data)

04:06

State Street: Bank of Japan's dovish rate hike, Kazuo Ueda may take a neutral stanceAccording to Odaily, Masahiko loo, Senior Fixed Income Strategist at State Street Global Advisors, stated that the market may interpret the Bank of Japan's rate hike as dovish, leading to short-term volatility in the yen. However, supported by the Federal Reserve's accommodative policy and Japanese investors increasing their hedge ratios from historical lows, the longer-term target of 135-140 remains unchanged. The focus now shifts to the tone and forward guidance of Bank of Japan Governor Kazuo Ueda's press conference—which is likely to be neutral, suggesting a gradual normalization in 2026-27, without being overly dovish or hawkish. Kazuo Ueda needs to maintain a delicate balance. (Golden Ten Data)

04:04

The 10-year Japanese government bond yield rises to 2%, the highest level since May 2006.According to Odaily, the yield on 10-year Japanese government bonds rose by 3.5 basis points to 2%, reaching the highest level since May 2006. (Golden Ten Data)

News