News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

BNB faces pullback risk after 10% drop as charts signal overbought levels

Coinjournal·2025/10/14 14:00

BTC price forecast: Bitcoin stays below $112k ahead of Powell speech

Coinjournal·2025/10/14 14:00

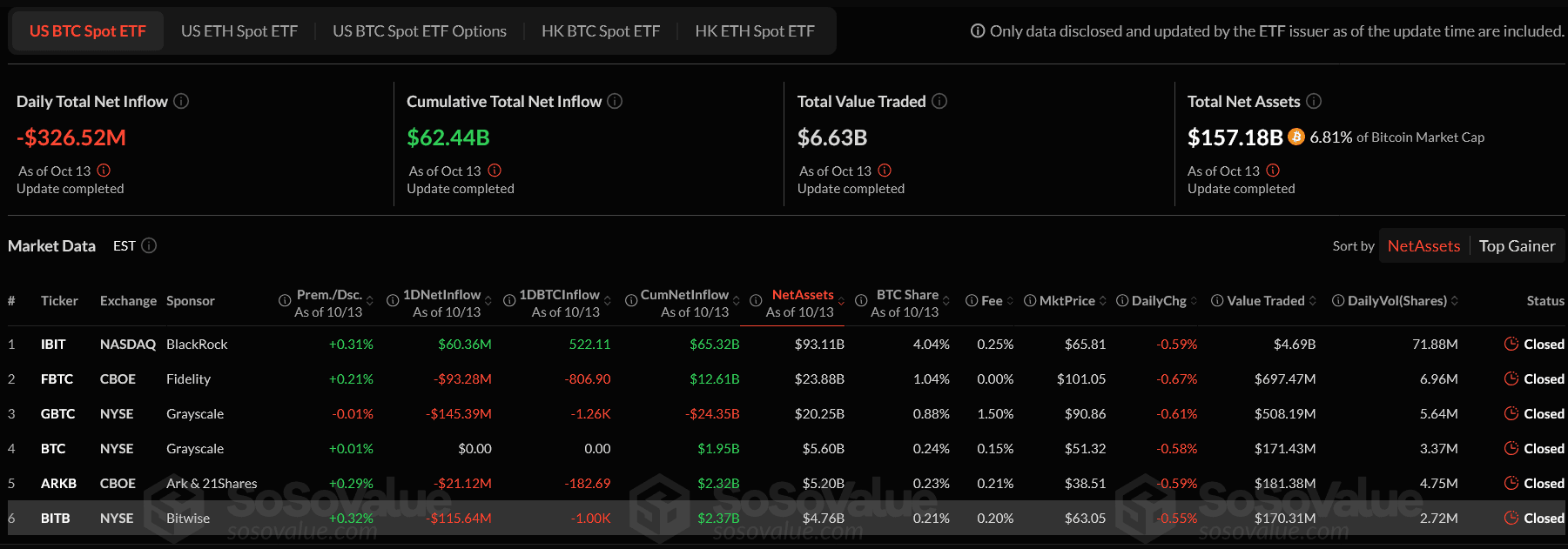

Bitcoin and Ethereum ETFs Crash with $755M Outflow

Cryptoticker·2025/10/14 13:54

Monad has opened the MON token airdrop, ending on November 3

PANews·2025/10/14 13:45

UK politics attempts to copy £5B Trump crypto script, without his levers or power

CryptoSlate·2025/10/14 13:35

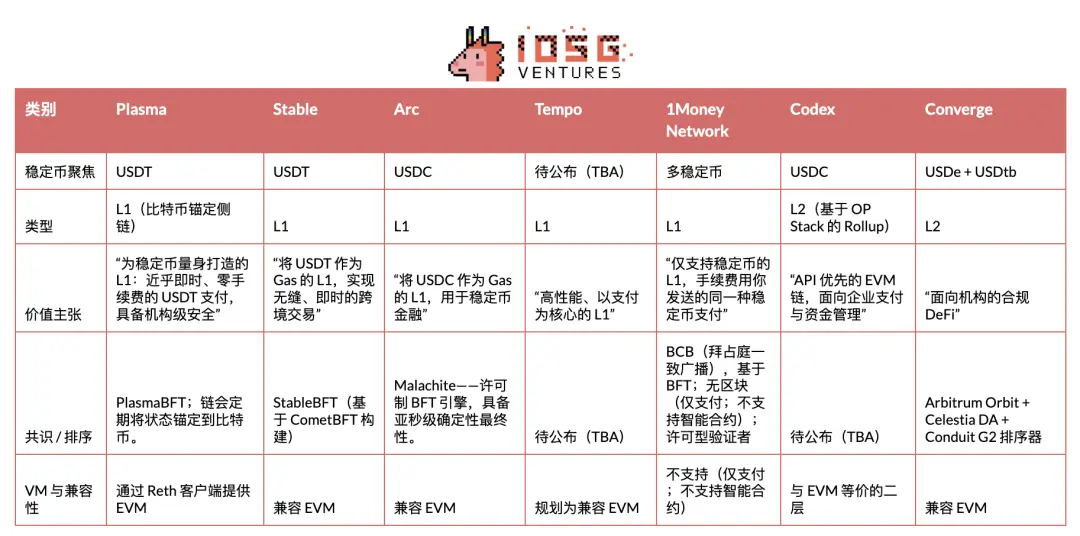

IOSG | In-depth Analysis of Stablecoin Public Chains: Plasma, Stable, and Arc

A deep dive into the issuers behind it, market dynamics, and other participants.

深潮·2025/10/14 13:31

Japan Could Make a Major Change To Crypto Trading Rules

Japan’s financial regulators are preparing a pivotal legal change to treat crypto as a financial product, giving the FSA broader authority to tackle insider trading and tighten oversight of Web3 markets.

BeInCrypto·2025/10/14 13:23

Whale Activity Boosts WLFI Price Amidst Stablecoin Growth

Coinlineup·2025/10/14 13:09

DekaBank Partners with Börse Stuttgart for Retail Crypto Expansion

Coinlineup·2025/10/14 13:09

Vaulta continues to expand its institutional-grade service offering and launches the all-new financial management platform, Omnitrove.

Omnitrove is committed to bridging native crypto assets with the real-world financial infrastructure, providing a unified interface, AI smart tools, and real-time prediction capability to empower diverse digital asset management scenarios and applications.

BlockBeats·2025/10/14 13:06

Flash

07:36

Institutions: If the unemployment rate rises by 0.1% per month, the Fed's room for interest rate cuts is underestimated. in November, the US inflation rate was far below economists' forecasts, while the unemployment rate unexpectedly rose that month. Due to information distortion and incompleteness caused by the 43-day federal government shutdown, investors have been reluctant to over-interpret this data. Michael Lorizio, Head of US Rates and Mortgage Trading at Manulife Investment Management, said: "Even taking this into account, it highlights that the current inflation data has very limited room for a significant upside surprise. If the labor market continues on its current trajectory, with the unemployment rate rising by 0.1 percentage points per month, I think the potential for further rate cuts next year may be somewhat underestimated."

06:37

Michael Lorizio: If the unemployment rate rises by 0.1% each month, the Federal Reserve's rate cut potential is being underestimatedChainCatcher News, according to Golden Ten Data, Michael Lorizio, Head of US Rates and Mortgage Trading at Manulife Investment Management, stated that the US inflation rate in November was significantly lower than economists' forecasts, and the unemployment rate unexpectedly rose. He pointed out that although the federal government shutdown caused some data distortion, there is limited room for current inflation data to significantly exceed expectations. If the labor market continues on a trajectory where the unemployment rate rises by 0.1 percentage points each month, the potential for further rate cuts next year may be underestimated.

06:30

Data: USDC circulating supply decreased by approximately 1.3 billions in the past 7 daysPANews reported on December 20 that, according to official data, in the 7 days ending December 18, Circle issued approximately 4.7 billion USDC and redeemed about 6 billion USDC, resulting in a decrease in circulation of around 1.3 billion tokens. The total USDC in circulation is 77.2 billion tokens, with reserves of about 77.5 billion US dollars. Of these reserves, overnight reverse repo agreements in US Treasuries account for approximately 53.3 billion US dollars; US Treasuries with maturities of less than 3 months account for about 14.3 billion US dollars; deposits at systemically important institutions are around 9.2 billion US dollars; and other bank deposits are about 700 million US dollars.

News