News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 10)|13.8 billion LINEA tokens unlock today; Trump will begin the final round of interviews for the next Federal Reserve Chair this week2Bitcoin’s back above $94K: Is the BTC bull run back on?3BlackRock Enters Ethereum Staking With a First-of-Its-Kind ETF

Bitcoin Down: Why This Week Is Crucial to Close 2025

Cointribune·2025/12/02 03:33

Wallets, Warnings, and Weak Links

The most important thing is to maintain basic security habits.

Block unicorn·2025/12/02 02:48

Strategy new ‘last resort’ to sell Bitcoin could trigger on 15% dip – sets $1.4B cash reserve contingency

CryptoSlate·2025/12/02 02:19

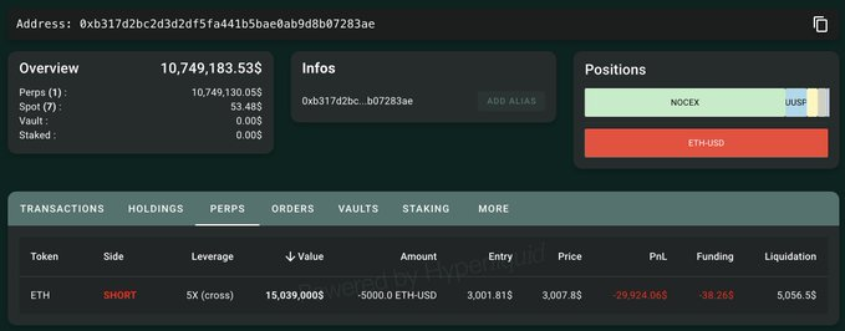

OG whale dumps ETH, is Bitmine insolvent?

AICoin·2025/12/02 01:52

AiCoin Daily Report (December 2)

AICoin·2025/12/02 01:51

Has the "major correction" just begun?

Bitpush·2025/12/02 01:51

Fed vs BOJ: December Global Market 'Scripted Drama', Will Bitcoin Crash First?

In November, the US Dollar Index fluctuated due to expectations surrounding Federal Reserve policies and the fundamentals of non-US currencies; in December, attention should be paid to the impact of the Federal Reserve's leadership transition, the Bank of Japan's interest rate hike, and seasonal factors on bitcoin and the US dollar. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved.

MarsBit·2025/12/02 01:51

BTC price analysis: Bitcoin could crash another 50%

Cointelegraph·2025/12/02 00:00

BTC price dips under $84K as Bitcoin faces ‘pivotal’ week for 2025 candle

Cointelegraph·2025/12/02 00:00

Flash

- 06:59Michael Saylor: Major banks such as BNY Mellon and JPMorgan have started issuing loans collateralized by bitcoin.Jinse Finance reported that Michael Saylor, founder and executive chairman of Strategy, stated that several major banks, including BNY Mellon, Wells Fargo, Bank of America, Charles Schwab, JPMorgan, and Citigroup, have begun issuing credit backed by bitcoin as collateral.

- 06:56South Korea’s National Pension Service increases its MicroStrategy holdings to 93 million dollarsChainCatcher reported that Bitcoin Treasuries.NET posted on X, stating that the National Pension Service (NPS) of South Korea, which manages assets worth 1 trillion USD, has increased its holdings in MicroStrategy (MSTR), a listed company holding bitcoin, to 93 million USD.

- 06:53Matrixport: Bitcoin implied volatility continues to decline, with the market gradually lowering the likelihood of an upward movement by the end of DecemberJinse Finance reported that Matrixport's daily chart analysis indicates that bitcoin's implied volatility continues to decline, which in turn reduces the likelihood of a significant upward breakout by the end of the year. Today's Federal Open Market Committee meeting is the last major catalyst, but once the meeting concludes, volatility is likely to continue its downward trend until the holiday season. Without new bitcoin ETF inflows to drive directional momentum, the market may return to a range-bound state. This outcome is typically associated with further declines in volatility. In fact, this adjustment process is already underway, with implied volatility continuously decreasing and the market gradually lowering the probability of an upside surprise at the end of December.

News