News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 10)|13.8 billion LINEA tokens unlock today; Trump will begin the final round of interviews for the next Federal Reserve Chair this week2Bitcoin’s back above $94K: Is the BTC bull run back on?3BlackRock Enters Ethereum Staking With a First-of-Its-Kind ETF

Cantor Fitzgerald Discloses Major Stake in Solana ETF, Signalling Institutional Embrace

DeFi Planet·2025/12/02 19:03

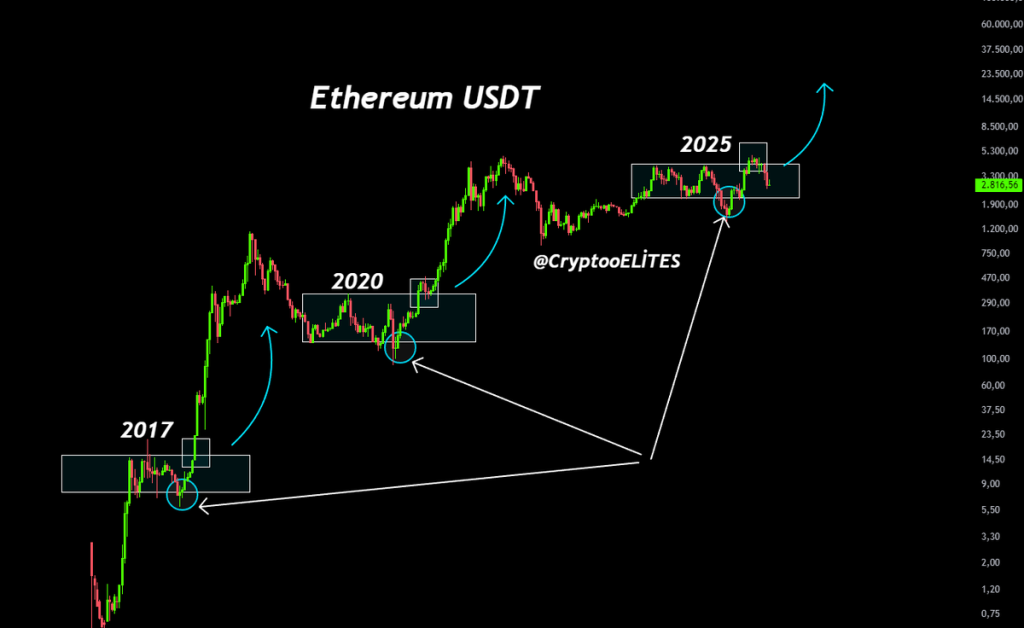

Ethereum (ETH) Price Slides; Mirrors 2017 & 2020 Patterns—Is a Breakout Ahead?

Coinpedia·2025/12/02 18:57

RootData launches exchange transparency evaluation system to promote new standards for information disclosure and compliance in the industry

Transparency has become the new battleground for compliance. RootData is joining forces with exchanges to build a trusted ecosystem, helping investors extend their lifecycle.

Chaincatcher·2025/12/02 17:40

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

Chaincatcher·2025/12/02 17:40

Sample Cases of Crypto Losses: A Map of Wealth Traps from Exchange Runaways to Hacker Attacks

Bitpush·2025/12/02 17:32

Musk calls Bitcoin an energy-based "physics currency"

Bitpush·2025/12/02 17:31

EU Banks Launch Coordinated Push for Euro-Pegged Stablecoin by 2026

Kriptoworld·2025/12/02 16:00

Best Crypto to Stock Up On Ahead of the Santa Rally 2025: REACT, SUI, and LINK

Cryptodaily·2025/12/02 16:00

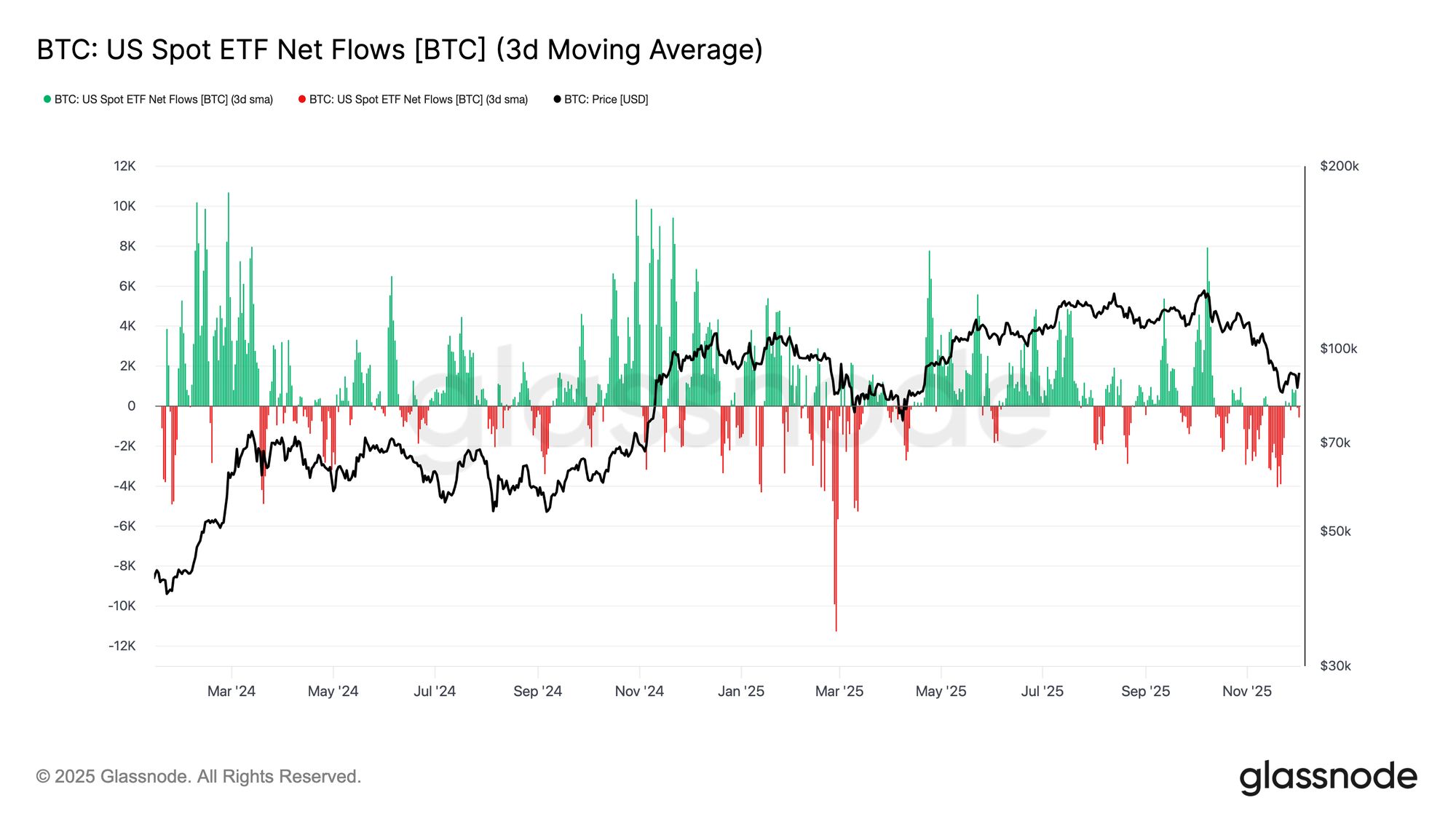

Echoes of Early 2022

Bitcoin stabilizes above the True Market Mean, but market structure now mirrors Q1 2022 with over 25% of supply underwater. Demand is weakening across ETFs, spot, and futures, while options show compressed volatility and cautious positioning. Holding $96K–$106K is critical to avoid further downside.

Glassnode·2025/12/02 16:00

Flash

- 04:03Celo plans to upgrade its token economic model and will solicit public feedback, proposing to introduce a buyback and burn mechanism.Jinse Finance reported that Rene, Chairman of the Celo Foundation, stated that the CELO token economic model will be upgraded, considering the introduction of a token buyback and burn mechanism to improve the long-term economic structure. He indicated that as network activity grows, the current model needs to be redesigned to better accommodate the increasing demand for transaction fees. The upgrade process will be carried out in four phases: first, public consultation on the Celo forum; in the coming weeks, researchers, token economists, and ecosystem contributors will be invited to participate; then, research modeling will be conducted; the third phase will be community review; and finally, the process will be completed through governance procedures. The entire process will be advanced rapidly, transparently, and in a community-driven manner, led by the Celo Foundation and cLabs.

- 04:03American Federation of Teachers Urges Senate to Reject Cryptocurrency Market Structure BillJinse Finance reported that the American Federation of Teachers has called on Senate leadership to shelve the "Responsible Financial Innovation Act," stating that the bill would weaken investor protections and expose pensions to new risks. The union pointed out that this legislation would undermine the safeguards of traditional securities and would also allow tokenized stocks to be traded without standard registration and disclosure requirements. This warning comes as discussions around the cryptocurrency market structure bill are becoming increasingly intense; industry groups are deeply divided on the issue, and lawmakers have hinted that the prospects for the bill's passage are already dim.

- 03:40Trump hints: If Federal Reserve governors' appointments are signed by an autopen, he may seek to remove themJinse Finance reported that U.S. President Trump hinted that if the appointment letters of Federal Reserve governors appointed by former President Biden were signed by an autopen, he might seek to remove them from office. This is his latest move to strengthen control over the central bank. However, this action is unlikely to succeed. Trump previously claimed he would revoke executive orders signed by Biden using an autopen, but aside from attracting attention, it achieved little. Any attempt to declare appointments approved by the Senate invalid would almost certainly face legal challenges from the appointees. Nevertheless, these remarks still represent Trump's latest encroachment on the central bank's independence. At a political rally in Pennsylvania, Trump stated: "I heard that maybe an autopen signed those appointment letters. If it really was an autopen—maybe I'm wrong, but we will find out." According to procedural rules, after a nominee is approved by the Senate, the president completes the appointment process by signing the appointment letter, formally establishing their federal office. Trump then suggested that if an official he appointed also used an autopen in a similar way, he might "kick that person out." He asked Treasury Secretary Scott Bessent, who was attending the rally with him, to investigate the matter. "Can you check on that?" Trump continued. "Scott, okay, because I heard the autopen may have signed all four, or some of them—let's just check two of them. So look into this." The Federal Reserve declined to comment.

News