News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- The Fed's 2022-2024 rate hikes and Trump's pro-crypto agenda create macroeconomic tensions, positioning Bitcoin as a strategic hedge against policy uncertainty. - Bitcoin's 2023-2025 rebound to $124,000 reflects regulatory clarity (ETF approvals), fixed supply advantages, and Trump's "Strategic Bitcoin Reserve" policy promises. - Trump's 2025 CBDC ban and Fed policy divergence highlight Bitcoin's dual role: hedging dollar devaluation (-0.29 correlation) while benefiting from low-rate liquidity (+0.49 wit

- Anthropic's copyright settlement with U.S. authors avoids $900B+ penalties, marking a pivotal shift in AI's legal and data compliance strategies. - The case clarifies "fair use" ambiguities, requiring AI firms to prove legal data sourcing amid rising regulatory demands like the EU AI Act. - Industry trends show a shift from shadow libraries to licensed data marketplaces, increasing costs but creating opportunities for compliant data infrastructure firms. - Long-term profitability now hinges on balancing

- Celebrity-backed meme coins like CR7 and YZY exploit influencer hype and pre-launched allocations to manipulate markets, causing rapid 90-98% price collapses through rug pulls and cross-chain sniping. - Dynamic fee structures and insider-controlled liquidity pools create asymmetric advantages, with projects like YZY allocating 94% of tokens to pre-funded wallets for immediate dumping. - Regulators struggle to address these schemes: the SEC's 2025 stance excludes meme coins as securities, while Canada's C

- Approval of Canary's MRCA ETF could trigger a 2025 altcoin bull run via institutional demand and regulatory clarity. - SEC's evolving stance, including staking guidance and in-kind mechanisms, supports MRCA's U.S.-focused altcoin index. - XRP, SOL, and ADA show technical strength, with potential $4-8B inflows from Grayscale XRP and 75% Solana ETF approval odds. - MRCA's cold storage and proof-of-stake staking align with institutional risk preferences but lacks FDIC-like protections. - If approved, MRCA c

Will Google really build a permissionless and fully open public blockchain?

- Celebrity-backed meme coins like YZY and TRUMP exploit centralized tokenomics, with insiders controlling 90%+ supply to manipulate liquidity pools and trigger $2B+ retail losses. - Experts label these projects liquidity traps lacking utility, as SEC investigates their failure to meet Howey Test standards for securities. - Investors are urged to avoid centralized liquidity traps, diversify speculative exposure, and scrutinize tokenomics for manipulation risks.

- Trump's 2025 attempt to remove Fed Governor Lisa Cook over alleged mortgage fraud reignites debates about central bank independence and political interference risks. - The Fed insists removals require proof of misconduct, not policy disagreements, warning Trump's action could erode its credibility and market trust. - Markets reacted with a 15-year high in 10-year Treasury yields, signaling fears of politicized monetary policy and inflationary pressures. - Legal challenges over Cook's dismissal risk setti

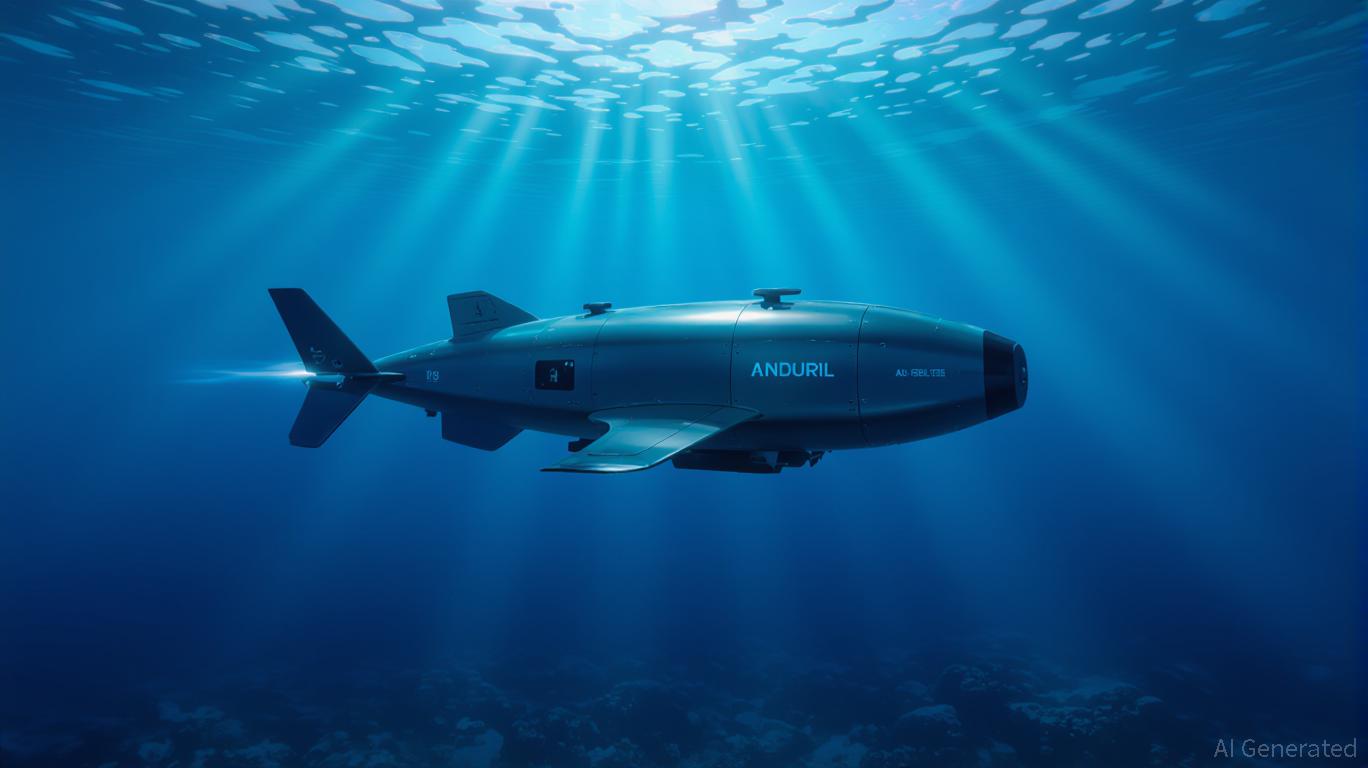

- Global underwater defense market to hit $25.63B by 2032, driven by AI-driven startups like Anduril outpacing legacy firms. - Anduril’s AI-native UUVs enable real-time threat detection and modular design, contrasting legacy contractors’ slower, rigid systems. - Ghost Shark program with Australia showcases rapid deployment and strategic geopolitical positioning in Indo-Pacific security. - Investors should prioritize startups with AI-integrated, scalable platforms and government partnerships for high-growth

- 2025 crypto market shifts as contrarians target undervalued L1 blockchains (Cardano, Polkadot) and AI-driven DeFi projects amid AI speculation peaks. - Cardano's $0.35 price (~$1.50 potential) and Polkadot's $3.83 valuation ($15 2027 target) reflect institutional inflows and technical upgrades. - MAGACOIN FINANCE ($12.8M raised) and Unilabs Finance ($30M AUM) offer asymmetric upside through presale traction and AI-powered DeFi tools. - Contrarian strategies emphasize DCA into infrastructure projects whil