News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If Cook resigns, it would potentially allow Trump to gain four seats, giving him a majority on the seven-member board.

In history, September has usually been one of the worst-performing months for Bitcoin and Ethereum, known as the "September Curse," having occurred multiple times during bull market cycles.

Pantera’s $1.25 billion Solana treasury push has failed to spark gains as SOL slides nearly 10%. Weak futures demand and bearish signals point to further downside risks.

Bitcoin faces a potential correction. It must quickly reclaim $110,800. Failure to do so could trigger a further downturn. Glassnode identified a key metric. $110,800 is the average cost for new investors, based on May through July buyers. During this period, Bitcoin hit new all-time highs. Bitcoin Should Defend $110,800 Glassnode explains that the average … <a href="https://beincrypto.com/110800-bitcoins-new-key-defense-line-glassnode/">Continued</a>

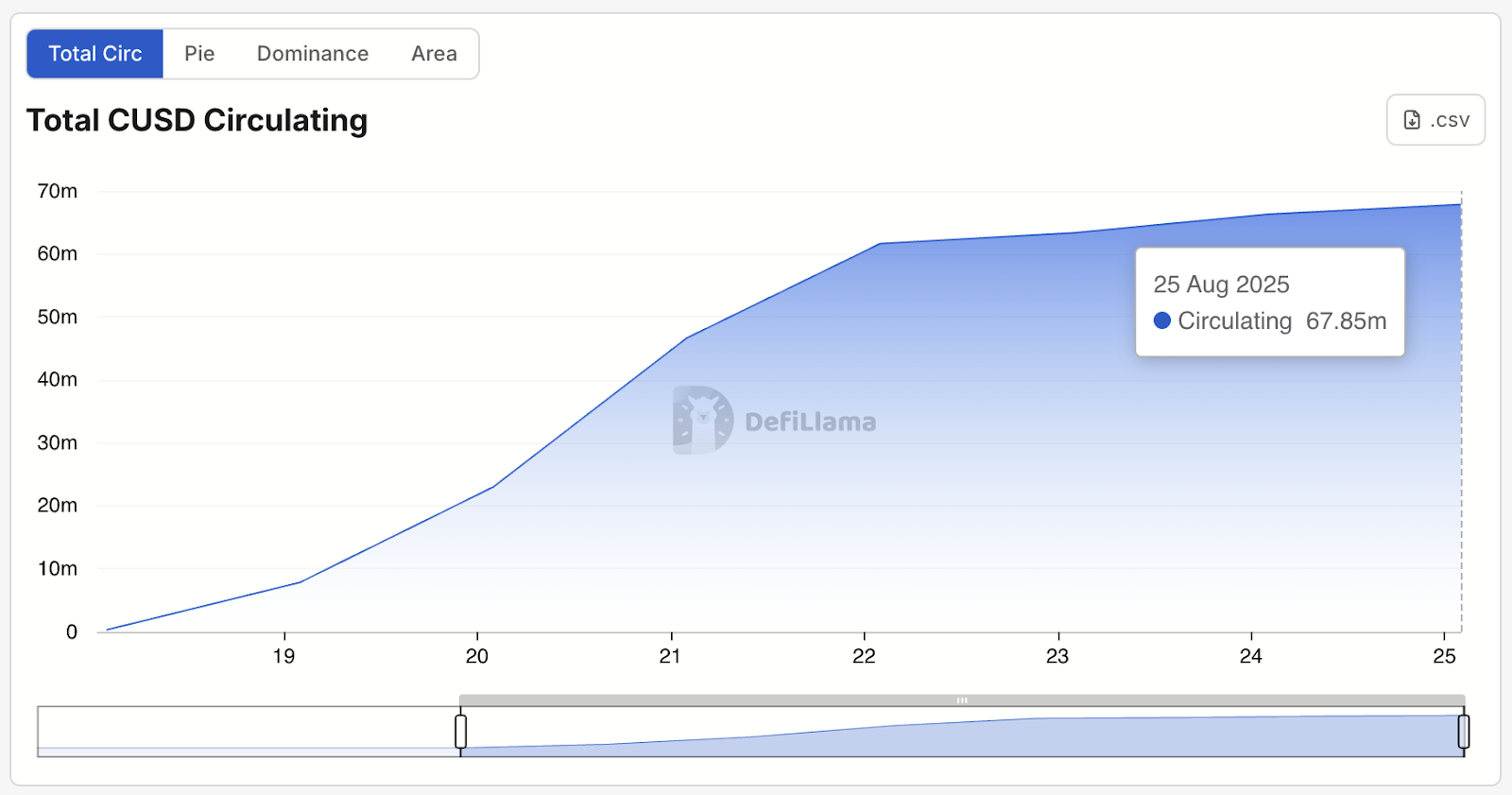

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Bitcoin’s $110,000 support is under pressure as futures and spot traders lean bearish. Without renewed demand, BTC risks sliding to $107,557.

- 17:51Data: Ethereum staking rate reaches 27.93%, Lido market share at 24.74%According to Jinse Finance, data from Dune Analytics shows that the total amount of ETH staked on the Ethereum Beacon Chain has reached 34,676,830 ETH, accounting for 27.93% of the total ETH supply. Among them, the share of staked ETH through the liquid staking protocol Lido is 24.74%. In addition, since the Shanghai upgrade, there has been a net inflow of 16,511,352 ETH.

- 17:14Law firm: After a trial period in 2025, crypto companies will face their real IPO test in 2026Jinse Finance reported that Laura Katherine Mann, a partner at the law firm White & Case, stated that 2025 will be a "test sample year" for cryptocurrency IPOs, while 2026 will be the true year of judgment, when the market will decide whether publicly listed digital asset companies are a long-term viable asset class or merely trading opportunities during a bull market. She pointed out that the composition of companies planning to go public in 2026 will be more inclined towards financial infrastructure, regulated exchanges and brokers, custody and infrastructure service providers, as well as stablecoin payment and treasury management platforms. With a more constructive regulatory environment in the United States and increasing institutionalization, the IPO window is supported; however, Mann also emphasized that valuation discipline, macro risks, and the price trends of crypto assets will ultimately determine how many deals can truly go public successfully.

- 16:44The current TVL of the RWA sector is $16.536 billions.According to Jinse Finance, data from DefiLlama shows that the total value locked (TVL) in the Real World Asset (RWA) sector is $16.536 billions. Among them: BlackRock BUIDL TVL has reached $2.499 billions; Tether Gold TVL has reached $2.255 billions; Ondo Finance TVL has reached $1.923 billions.