News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Fluent partners with Databricks and appoints Virginia Marsh to lead data monetization, adapting to the post-cookie era with privacy-first solutions. - The U.S. advertising market is projected to grow at 8.5% CAGR, with retail media expanding 15–20% YoY, driven by first-party data. - Fluent's commerce media segment saw a 121% YoY revenue increase in Q2 2025, contributing 36% of total revenue and showing a path to profitability. - Fluent's integrated data clean room and cross-platform collaboration differe

- Tether's USDT0 and XAUt0 deployment on Polygon in August 2025 enhances cross-chain liquidity and institutional-grade DeFi utility. - USDT0's $1.6B market cap and XAUt0's gold-backed lending capabilities drive institutional adoption through Polygon's $1.3B liquidity hub. - The integration enables seamless RWA tokenization and 100% increased chain accessibility, positioning Polygon as a critical omnichain coordination layer. - Investors gain exposure to asset-backed digital liquidity trends as Tether's eco

- India's automotive sector is accelerating EV transition through 2025-26 budget reforms, doubling EV infrastructure funding to ₹4,000 crore for 72,000 charging stations by 2026. - Maruti Suzuki adjusts EV strategy amid global supply chain disruptions, scaling back e-Vitara production but committing ₹700 billion to Gujarat's EV manufacturing hub with battery localization. - TATA.ev expands charging networks to 30,000 stations by 2027 via Open Collaboration 2.0, addressing reliability issues through .ev ver

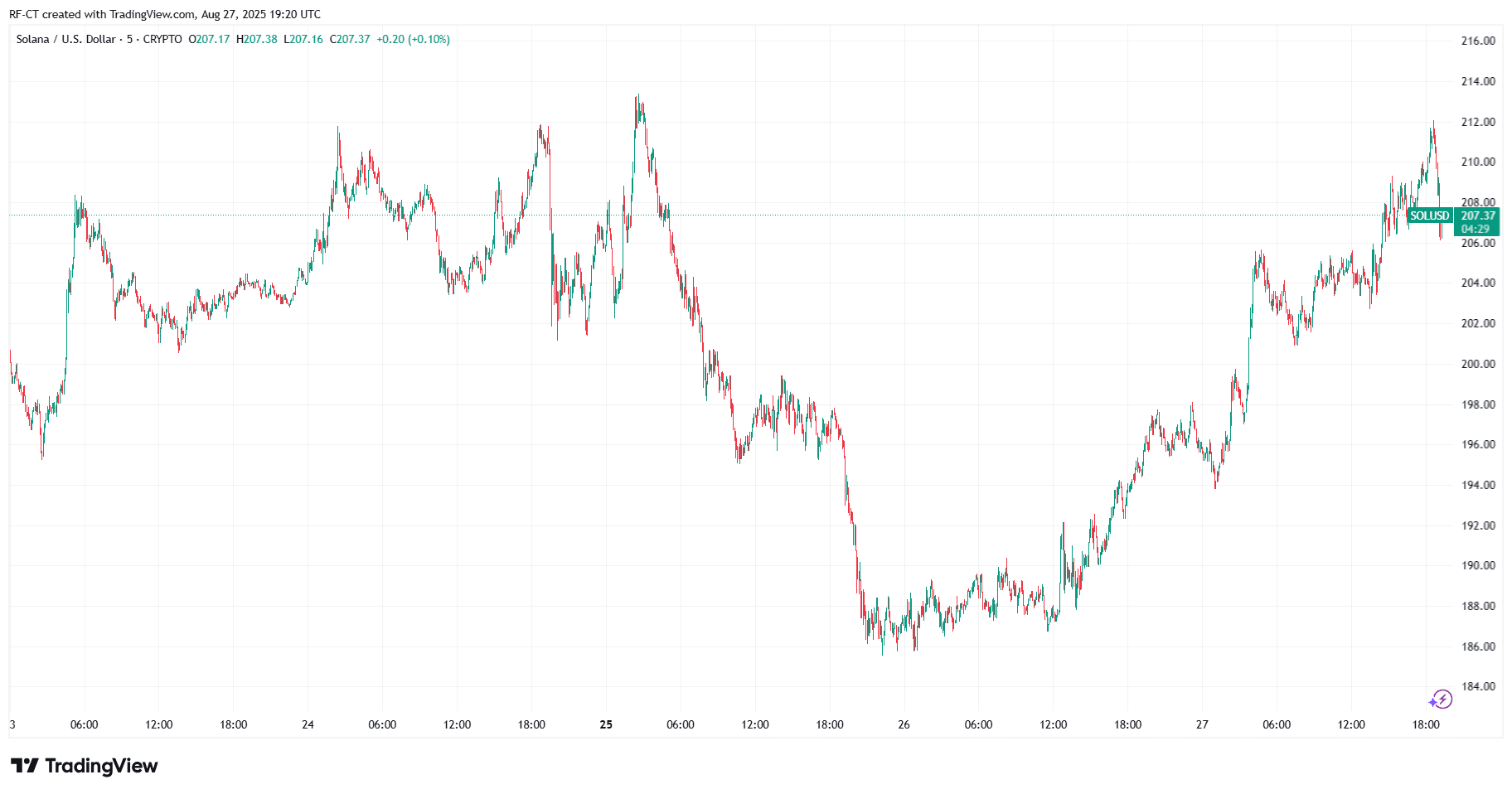

Solana is struggling with key resistance around the $205 to $215 range—will increased institutional inflows push SOL above $300, or will a failure to hold support drive it lower? Here are today’s price predictions and outlook.

- LQWD Technologies deployed 19.75 Bitcoin on Lightning Network, achieving 24% annualized yield in 24-day test. - The test validated LQWD's infrastructure efficiency, supporting 1.6M transactions for low-cost cross-border payments. - Lightning's enterprise adoption grows as Tando enables Bitcoin-M-PESA interoperability in Kenya's 34M-user ecosystem. - Corporate Bitcoin treasury trends expand as LQWD demonstrates yield generation through Lightning-based operations. - Despite adoption challenges, Lightning b

- Circle and Paxos pilot KYI tech with Bluprynt to embed verified issuer identities in stablecoins, targeting $1.6B annual fraud losses. - The blockchain-native system enables real-time token verification via wallets and explorers, aligning with U.S. regulatory shifts under the GENIUS Act. - By attaching auditable credentials to tokens at issuance, the framework strengthens transparency and compliance for major stablecoins like USDC and PYUSD. - Regulators and industry leaders endorse the initiative as a c

- The 2025 crypto market faces a pivotal shift driven by tech innovation and institutional demand, with BlockDAG, Ethereum, Hedera, and Solana emerging as key assets. - BlockDAG's hybrid DAG-PoW architecture achieves 15,000 TPS and 70% energy efficiency, positioning it as a scalable, ESG-compliant disruptor with projected 36x ROI. - Ethereum struggles with 15-30 TPS limitations despite Shanghai++ upgrades, while Solana's 65,000 TPS and developer tools drive growth but raise decentralization concerns. - Hed

- HBAR, NEAR, and XLM lead 2025 Altseason with institutional adoption, technical upgrades, and real-world utility. - HBAR gains traction via tokenized finance partnerships and Nasdaq ETF filing, NEAR boosts AI/DeFi with 16M users post-upgrade. - XLM targets cross-border payments through Archax/WisdomTree deals and Protocol 23 scalability improvements. - Technical analysis highlights key support/resistance levels ($0.265 for HBAR, $2.508 for NEAR, $0.47 for XLM) for strategic entry points. - Altseason momen

- 2025 crypto market shifts toward meme-utility hybrids (e.g., TOKEN6900) and L2 innovators (e.g., LILPEPE), outperforming legacy altcoins like XRP. - LILPEPE's EVM-compatible Layer-2 blockchain offers zero-tax trading, anti-bot measures, and $777,000 giveaways, addressing meme coin pain points. - Institutional adoption grows as projects like LILPEPE raise $22.3M in presales, contrasting XRP's regulatory uncertainty and stagnant staking yields. - Investors are advised to allocate 5-10% to high-risk meme-ut

- 08:01Data: ether.fi repurchased over 360,000 ETHFI last week, bringing the protocol's total buyback amount to $11,770,993ChainCatcher news, the ether.fi Foundation announced in a post that it spent 300,000 USDT last weekend to buy back 367,674.76 ETHFI. The total amount repurchased by the protocol has risen to 11.77 million USD. As of press time, ETHFI is priced at 0.825 USD, up 3.78% in the past 24 hours, with a total market capitalization rebounding to 640 million USD.

- 07:59[Day 4 Live] 10x Challenge: 100% Profit Achieved!In just 3 days, the streamer doubled his capital from $500 to $1000. How did he make it? Watch the live now and hear their secrets! Join the live: https://www.bitget.com/zh-CN/live/room/1381819355970064384

- 07:47Enterprise payment and financial platform Airwallex completes $330 million financing round, led by AdditionJinse Finance reported, citing Bloomberg, that corporate payments and financial platform Airwallex has completed a $330 million financing round at a valuation of $8 billion, led by Addition, with participation from Activant, Lingotto, and TIAA Ventures. In addition, Airwallex announced that San Francisco will become its second global headquarters, and the U.S. team plans to expand to over 400 people in the coming year.