News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Institutional investors increasingly adopt Bitcoin as strategic asset via decentralized governance models, mirroring industrial firms' operational agility. - Decentralized BTC-TCs empower mid-level managers for real-time decisions, using metrics like mNAV and leverage ratios to align with long-term goals. - Regulatory clarity (CLARITY Act, spot ETFs) and innovation (stablecoins, lending) normalize Bitcoin as diversification tool alongside traditional assets. - Investors prioritize transparent governance

- NMR surged 253.64% in 24 hours to $13.36, with 14,666.67% and 15,324.83% gains over the past week and month. - On-chain data shows reduced small-holdings and <10% circulating supply, reinforcing scarcity and upward pressure. - Technical indicators confirm key resistance breaks and strong momentum, with RSI in overbought territory but no bearish divergences. - A backtesting strategy using momentum and volume could capture NMR’s recent rally, aligning with its bullish on-chain and technical signals.

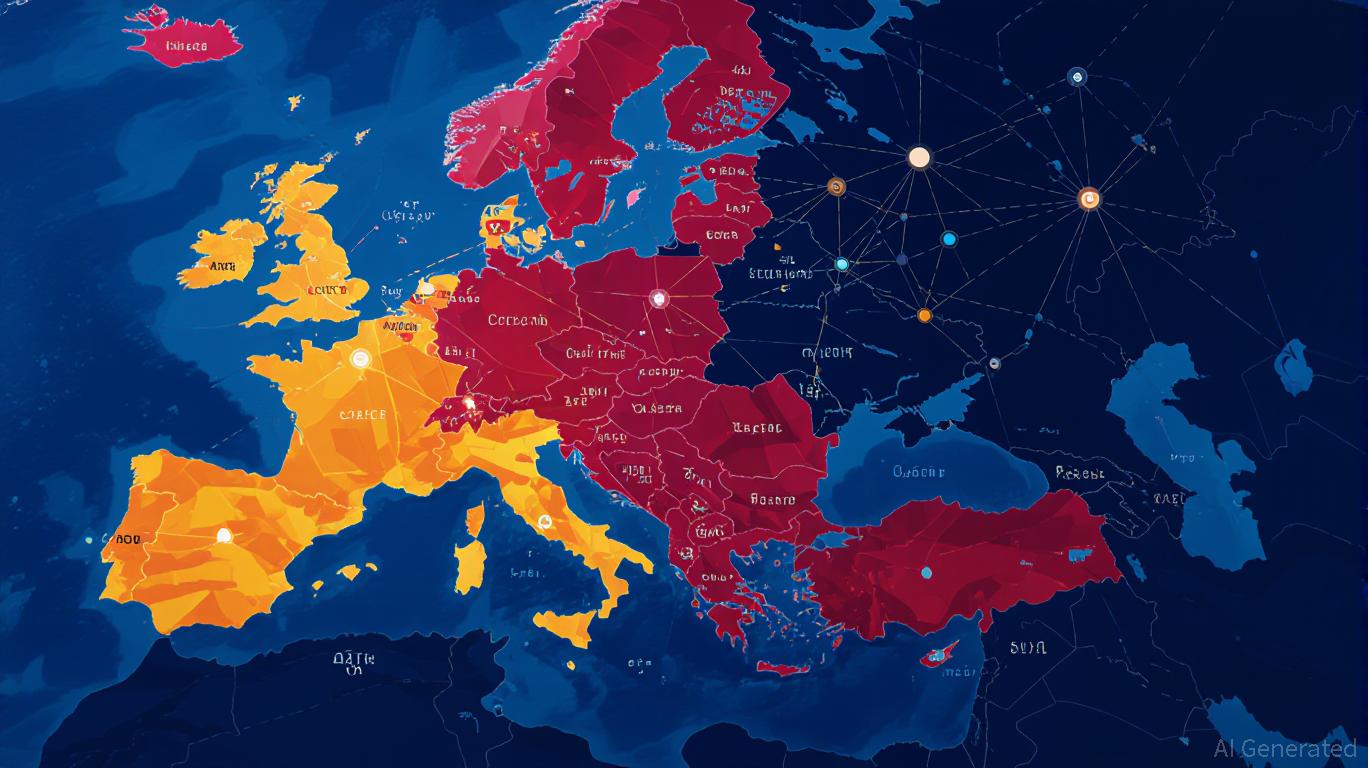

- Eastern European crypto media saw 18.3% Q2 2025 traffic decline, with 17 outlets capturing 80.71% of regional traffic amid regulatory and algorithmic shifts. - Tier-3 platforms (10,000–99,999 visits) retained 17.33% traffic through localized relevance and AI-optimized content in markets like Poland and Czech Republic. - AI-driven discovery tools and regional partnerships (e.g., Kriptoworld.hu) are reshaping distribution, with 20.6% of outlets reporting traffic from platforms like Perplexity. - Investors

- Crypto market signals suggest altcoins may outperform Bitcoin amid waning dominance and bullish technical indicators. - Ethereum's 54% August surge and rising ETH/BTC ratio historically precede altcoin growth cycles. - Dovish Fed policy and $3B Ethereum ETF inflows create favorable conditions for altcoin capital rotation. - Institutional confidence in Bitcoin indirectly supports altcoin momentum through liquidity and risk-on appetite. - Strategic entry points for high-conviction investors include Ethereu

- EU selects Ethereum as foundational layer for digital euro, challenging U.S. stablecoin dominance and validating its scalability and compliance. - Ethereum's smart contracts, energy-efficient post-Merge model, and GDPR-aligned ZK-Rollups address scalability, privacy, and regulatory needs. - Infrastructure providers (Infura, zkSync) and DeFi platforms (Uniswap) stand to benefit from increased demand for CBDC operations and liquidity. - Geopolitical shift reduces reliance on U.S. payment systems, with Ethe

- Metaplanet allocated $887M of its ¥130.3B fundraising to Bitcoin in 2025, reflecting corporate treasury strategies shifting toward digital assets amid macroeconomic instability. - Japan's weak yen and 260% debt-to-GDP ratio drive institutional adoption of Bitcoin as a hedge against currency depreciation, with 948,904 BTC now held across public company treasuries. - Metaplanet's 1% Bitcoin supply target (210,000 BTC) and inclusion in global indices signal growing legitimacy, as regulatory reforms in Japan

- Polygon Labs addresses crypto market chaos via curation-driven governance, filtering speculative memecoins through on-chain metrics like liquidity and security audits. - Its Agglayer infrastructure enables cross-chain utility while avoiding memecoin dominance, supporting projects like Katana without compromising real-world innovation goals. - With $4.12B TVL and 22,000 active developers, Polygon's model boosts investor confidence by prioritizing quality over hype, offering a blueprint for sustainable Web

- In late August 2025, Circle minted $250M USDC on Solana in 24 hours, signaling its role as DeFi infrastructure. - Solana's low-cost, high-speed network accelerates USDC liquidity, driving DeFi growth and institutional adoption. - Partnerships with SBI Holdings and regulatory frameworks validate Solana as a compliant hub for stablecoin activity. - This surge boosts SOL demand through network effects, liquidity velocity, and institutional capital inflows.

- Thomas Lee, Fundstrat's top analyst, forecasts Q4 2025 tech growth via semiconductors/AI while shifting toward value/energy sectors. - His bullish stance on SOX and AVGO contrasts with hedging via small-cap (IWM) and inflation-linked ETFs (USAF) to balance market volatility. - Dovish Fed policy and Bitcoin's $100k milestone drive risk appetite, but Lee warns against overexposure to overvalued tech giants like Nvidia. - Investors urged to rebalance portfolios with GRNY's AI/cybersecurity focus and cyclica

- 11:54Two major whales place large bets on bitcoin's price movement, taking opposing long and short positions against each otherAccording to Jinse Finance, monitored by Lookonchain, a whale "0x50b3" opened a 20x leveraged long position on bitcoin, with a position value of $27.5 million, an entry price of $89,642.7, and a liquidation price of $83,385. Another whale "0x9311" simultaneously opened a 40x leveraged short position on bitcoin, with a position value of $20 million, an entry price of $89,502.7, and a liquidation price of $95,114.

- 11:44Data: A certain whale bought 16.35 million PIPPIN in the past 3 days, with unrealized profits exceeding $740,000.ChainCatcher News, according to OnchainLens monitoring, in the past 3 days, a certain whale spent 23,736 SOL (worth about $3.3 million) to purchase 16.35 million PIPPIN at an average price of $0.2. The current unrealized profit on this position exceeds $740,000.

- 11:35Western Union launches stablecoin payment cardOn December 6, it was reported that Western Union is developing a prepaid payment card loaded with stablecoins, specifically designed for high-inflation countries such as Argentina, aiming to help remittance recipients maintain their purchasing power. The company's CFO, Matthew Cagwin, stated that this is an extension of the existing U.S. prepaid card and is being developed in partnership with Rain, allowing users to convert stablecoins into local cash. Western Union also plans to launch its own stablecoin, USDPT, on the Solana network in 2026.