News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 13)|SEC Proposes "Token Taxonomy"; US House Passes Bill to End Government Shutdown; Trump Signs Temporary Funding Bill at 10:45am (UTC+8) 2Bitcoin’s 4-year cycle is broken, and this time, data proves it3Price predictions 11/12: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, LINK, BCH

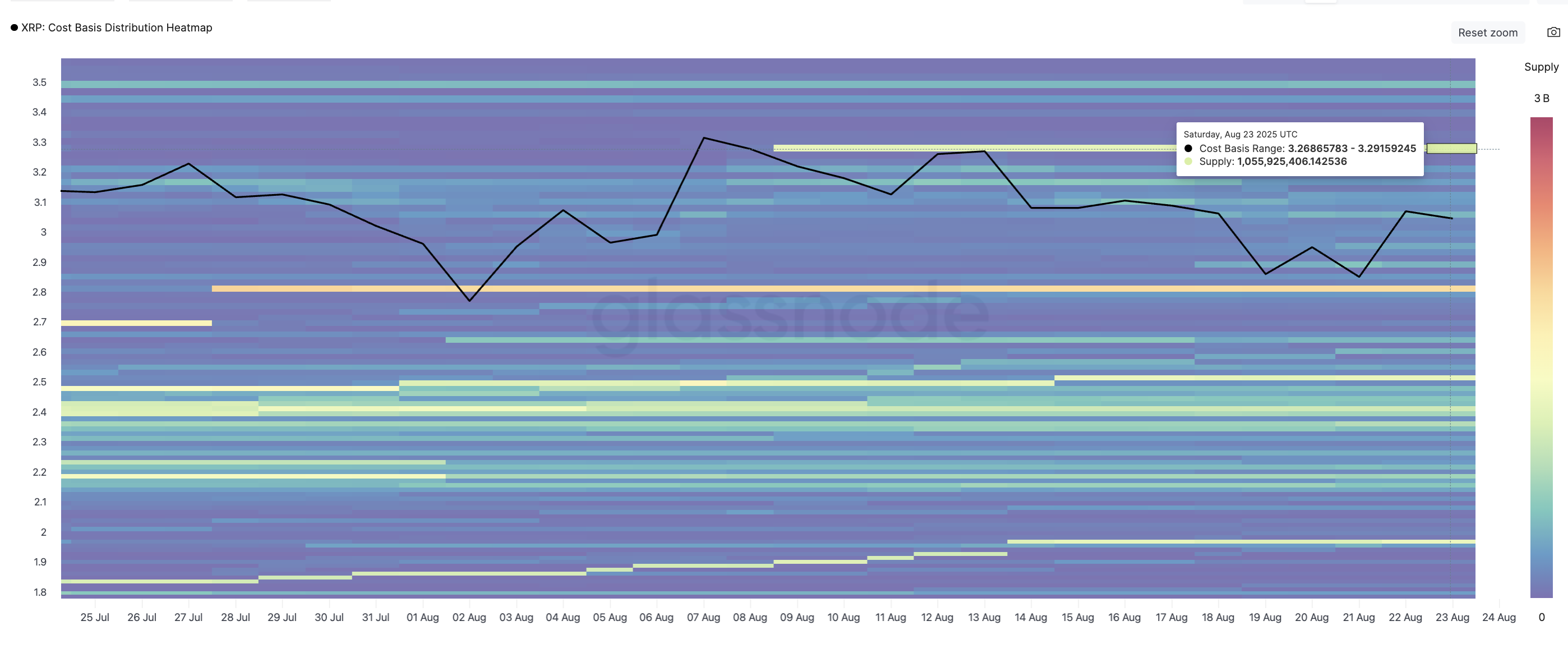

XRP Price Rally Hinges on Breaking This Key Resistance Zone

CryptoNewsNet·2025/08/24 12:20

Australian CEO faces allegations of misleading investors over crypto firm collapse

CryptoNewsNet·2025/08/24 12:20

Cardano’s Lace Wallet to Integrate XRP, Earns Praise & Participation from Lawyer John Deaton

CryptoNewsNet·2025/08/24 12:20

Here’s How Blockchain Will Take Over the IPO Market in 5 Simple Steps

CryptoNewsNet·2025/08/24 12:20

Crypto: Digital Asset Lending Reaches $61.7B and Finally Surpasses Its 2021 Record

Cointribune·2025/08/24 12:05

River Reports Bitcoin’s Surge In Monetary Share

Cointribune·2025/08/24 12:05

Bitcoin: The Bull Run Continues!

Cointribune·2025/08/24 12:05

Saga (SAGA) To Rise Higher? Key Emerging Fractal Signaling Potential Bullish Move

CoinsProbe·2025/08/24 12:05

Bitcoin Price Prediction: BTC Consolidates as Market Awaits THIS Next Big Move

Cryptoticker·2025/08/24 11:55

ChainOpera AI is launching a full-stack collaborative AI economy, with 3 million users and 10,000 developers already joining the Agent Social Network.

Empowering Everyone to Easily Create an AI Agent

BlockBeats·2025/08/24 10:20

Flash

- 03:41Polymarket quietly relaunches US trading platform in Beta modeChainCatcher News, according to Bloomberg, the decentralized prediction market platform Polymarket has quietly relaunched in the United States in Beta mode. Founder Shayne Coplan reportedly stated at Cantor Fitzgerald's crypto conference that the US platform is "live and running," allowing selected users to place bets on real contracts. It is reported that the platform is in the final stage before officially opening in the US. This soft relaunch marks a milestone for Polymarket after resolving an enforcement case with the US Commodity Futures Trading Commission (CFTC) in 2022, which forced the company to move overseas and resulted in a $1.4 million fine. In July 2025, Polymarket acquired the licensed derivatives exchange and clearinghouse QCX, laying a regulatory foundation for its return to the US. After moving overseas, Polymarket achieved significant growth, especially during last year's US presidential election. Last month, the platform set records for monthly trading volume, active traders, and the number of newly listed markets. However, its licensed US competitor Kalshi surpassed it in trading volume in October. After a full relaunch in the US, the platform is expected to launch its native cryptocurrency POLY, as confirmed by Polymarket Chief Marketing Officer Matthew Modabber. This news has attracted more traders to participate in its prediction markets, as they hope to meet undisclosed airdrop eligibility requirements. As the prediction market sector gradually matures and becomes a legitimate fusion of information and finance, Polymarket has significantly expanded its influence by adding major new partners.

- 03:41Telcoin approved to establish the first regulated digital asset bank in the US, set to launch the first bank-issued stablecoin eUSDChainCatcher news, according to Businesswire, Telcoin announced that it has obtained the final charter license issued by the Nebraska Department of Banking and Finance and will launch the first digital asset custodian in the United States—Telcoin Digital Asset Bank. This charter license enables Telcoin to directly connect U.S. bank accounts with regulated "digital cash" stablecoins. Its flagship product, eUSD, will become the first bank-issued, on-chain U.S. dollar stablecoin. This is also the first banking license that explicitly authorizes connecting U.S. consumers with DeFi.

- 03:41Data: ICP drops over 20% in 24 hours, C98 rises over 6%According to ChainCatcher, spot market data from a certain exchange shows significant market volatility. ICP has dropped 20.37% in the past 24 hours, while C98 has risen 6.23% in the past 24 hours and has shown a rebound after bottoming out. At the same time, PIVX has also shown a rebound after bottoming out, with an increase of 5.75%. Among other tokens, ZEC, BARD, and SKY all experienced a "surge and pullback" pattern, with declines of 8.42%, 5.82%, and 6.67% respectively.