News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 06) | Monad Plans to Launch Mainnet and Native Token MON on November 24; U.S. Government Shutdown May Delay Crypto Market Structure Legislation Until 20262Bitcoin and Ether ETFs record fifth consecutive day of outflows as crypto prices remain under pressure3Monero (XMR) jumps to 5-month high as privacy coins lead surprise market rally

Cardano (ADA) to $1: What Remains

CryptoNewsNet·2025/08/23 19:20

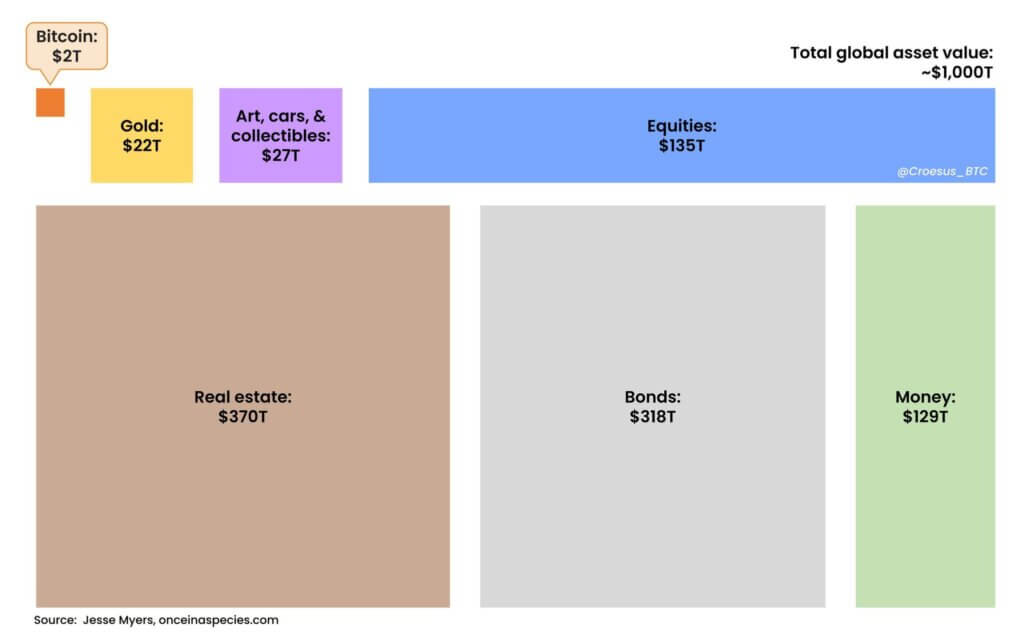

Real estate’s quiet crash: your home is worth less than ever in Bitcoin

CryptoNewsNet·2025/08/23 19:20

Anonymous Hacktivist Group Founder Spearheads Meme Coin While Facing 5 Years in Prison

CryptoNewsNet·2025/08/23 19:20

Eric Trump Makes Bitcoin Price Predictions as He Reportedly Gets Ready to Visit Metaplanet

CryptoNewsNet·2025/08/23 19:20

Europe Fast-Tracks Digital Euro as US Stablecoin Law Raises Global Stakes

European policymakers are accelerating work on the digital euro after Washington’s landmark stablecoin legislation heightened fears of eroding the euro’s global influence.

DeFi Planet·2025/08/23 19:10

Check If Your Bitcoins are Threatened by Quantum

Cointribune·2025/08/23 19:10

The US Crypto Market in Danger Facing DeepSeek's New AI Chip

Cointribune·2025/08/23 19:10

SharpLink Gaming Launches $1.5B Buyback Program to Strengthen Ethereum Holdings

Cointribune·2025/08/23 19:10

James Wynn Bets Big: 25x Ether Long as Token Breaks Records

Cointribune·2025/08/23 19:10

Render (RENDER) To Soar Further? Key Harmonic Pattern Hints at Potential Upside Move

CoinsProbe·2025/08/23 19:05

Flash

- 07:36VanEck: Digital asset treasuries continued to accumulate crypto assets in October, and market demand for "trusted privacy solutions" appears to be rebounding.Jinse Finance reported that VanEck released its October 2025 Crypto Monthly Review Report, which pointed out that even amid severe market volatility, Digital Asset Treasuries (DATs) continue to increase their holdings. For Ethereum and Solana, October was one of the strongest months of accumulation this year. However, despite ongoing accumulation, the market value of Digital Asset Treasuries still declined due to token price corrections. The most noteworthy aspect among Digital Asset Treasuries this month is their innovation in financing models: DFDV issued tradable warrants (each share corresponds to 0.1 warrant), allowing holders to gain potential returns through this tool—an innovative adjustment to the traditional equity-linked financing model. BNMR raised funds through a “stock + warrant” hybrid approach, issuing about 5.2 million shares and 10.4 million warrants, aiming to expand its crypto asset holdings by the end of the year. In Japan, Metaplanet specifically secured $500 million in debt financing to support a stock buyback plan—a rare signal of confidence during a period of industry volatility. Amid market turmoil, a quiet revolution is taking place in the field of privacy technology. As the longest-standing zero-knowledge proof blockchain project, Monero (Zcash, ZEC) surged 162% in October. In the crypto industry, attention to privacy technology experiences cyclical fluctuations every few years. From 2016 to 2018, privacy coins were almost synonymous with “regulatory risk”; by 2021, they were gradually marginalized in terms of functionality. However, as blockchain monitoring technology continues to strengthen, the market’s demand for “trusted privacy solutions” seems to be on the rise again.

- 07:35Bitget US stock futures cumulative trading volume surpasses $1 billion, with popular trading targets including TSLA, MSTR, and AAPL.ChainCatcher reported that Bitget's US stock contract section has surpassed a cumulative trading volume of 1 billion USD. According to platform data, technology-related assets continue to be favored by traders, with the Top 3 most popular trading assets being Tesla (TSLA), MicroStrategy (MSTR), and Apple (AAPL), with cumulative trading volumes of 380 million USD, 262 million USD, and 87 million USD, respectively. Previously, Bitget had launched 25 USDT-margined perpetual contracts for US stocks, covering popular sectors such as technology and internet, semiconductor chips, financial trusts, aviation industry, and consumer dining. The platform supports flexible leverage from 1 to 25 times, and the fee rate does not exceed 0.06%, providing users with a more convenient experience than traditional brokers and banks. On this basis, Bitget has recently added contracts for Netflix (NFLX), Futu (FUTU), JD.com (JD), Reddit (RDDT), and the Nasdaq 100 Index Fund (QQQ), further expanding its product matrix and continuously improving the panoramic exchange (UEX) ecosystem layout.

- 07:18A new wallet bets on ZEC and earns $2.7 million in three days, with a liquidation price of $373.13According to ChainCatcher, Lookonchain monitoring shows that a newly created wallet address (0x96ea) has opened a large long position in Zcash (ZEC), with an unrealized profit of $2.7 million. This wallet holds 32,000 ZEC (worth $16.3 million), with a liquidation price of $373.13.