News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Four.Meme, with its diversified, efficient, fair, and transparent Launchpad mechanism, continues to dominate fundraising on the BNB Chain, setting multiple historical records.

Quick Take Crypto asset manager Grayscale has submitted a litany of Securities and Exchange Commission filings on Tuesday seeking approval for exchange-traded funds tracking Bitcoin Cash, Hedera, and Litecoin.

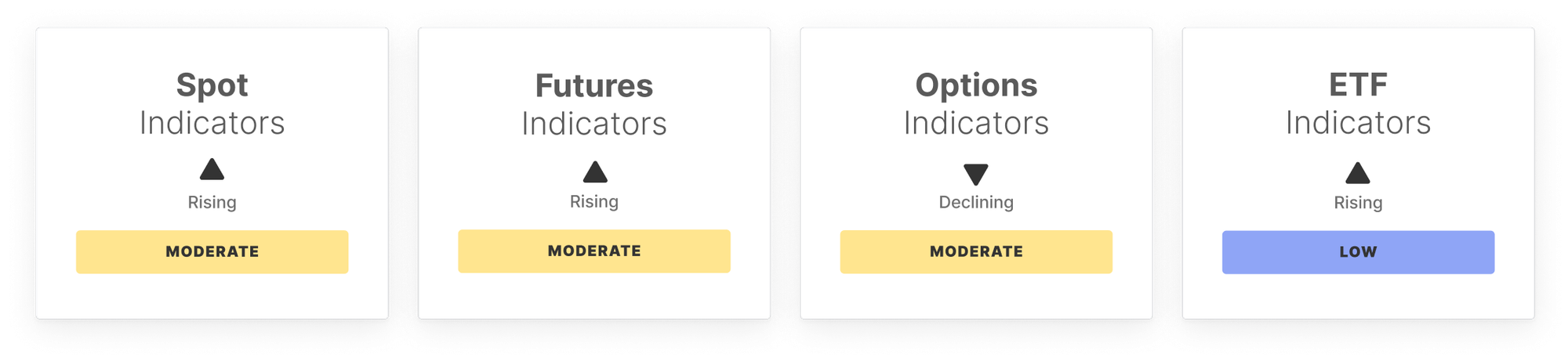

Bitcoin settled at around the Short-Term Holder cost basis but the stabilization remains fragile across the board. This week’s Market Pulse shows why cautious sentiment is still dominating.

Quick Take The combined company will be renamed Strive, Inc. and continue to trade on Nasdaq under the ticker symbol ASST. Shares of ASST closed Tuesday’s session up 17% and were up another 35% in after-hours trading on news of the merger approval.