News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

At over $3,600 an ounce, everyone’s buying gold

CryptoSlate·2025/09/07 10:00

Toyota Launches Blockchain Solution to Transform Vehicles Into Digital Assets

Coinspaidmedia·2025/09/07 09:40

Bitcoin Mining Difficulty Hits New Record As Miner Revenues Fall

Bitcoin’s network difficulty climbed above 136 trillion, marking its fifth consecutive increase since June and creating tougher conditions for miners.

BeInCrypto·2025/09/07 09:02

Are crypto treasury companies a marvel of financial engineering or a ticking time bomb?

CryptoSlate·2025/09/07 09:00

Worldcoin Price Rallies Amid New Quantum Security Commitment

Worldcoin rallied on the launch of its quantum-secure APMC initiative, with inflows and accumulation signaling a potential breakout above $1.08

BeInCrypto·2025/09/07 08:26

Polygon developer calls World Liberty Financial the ‘scam of all scams”

CryptoSlate·2025/09/07 08:15

SEC Eyes Cross-Border Crypto Pump-and-Dump Enforcement, Could Include Bitcoin Cases

Coinotag·2025/09/07 08:15

Michael Saylor’s Net Worth May Be Linked to MicroStrategy Stock Gains and Large Bitcoin Holdings

Coinotag·2025/09/07 08:15

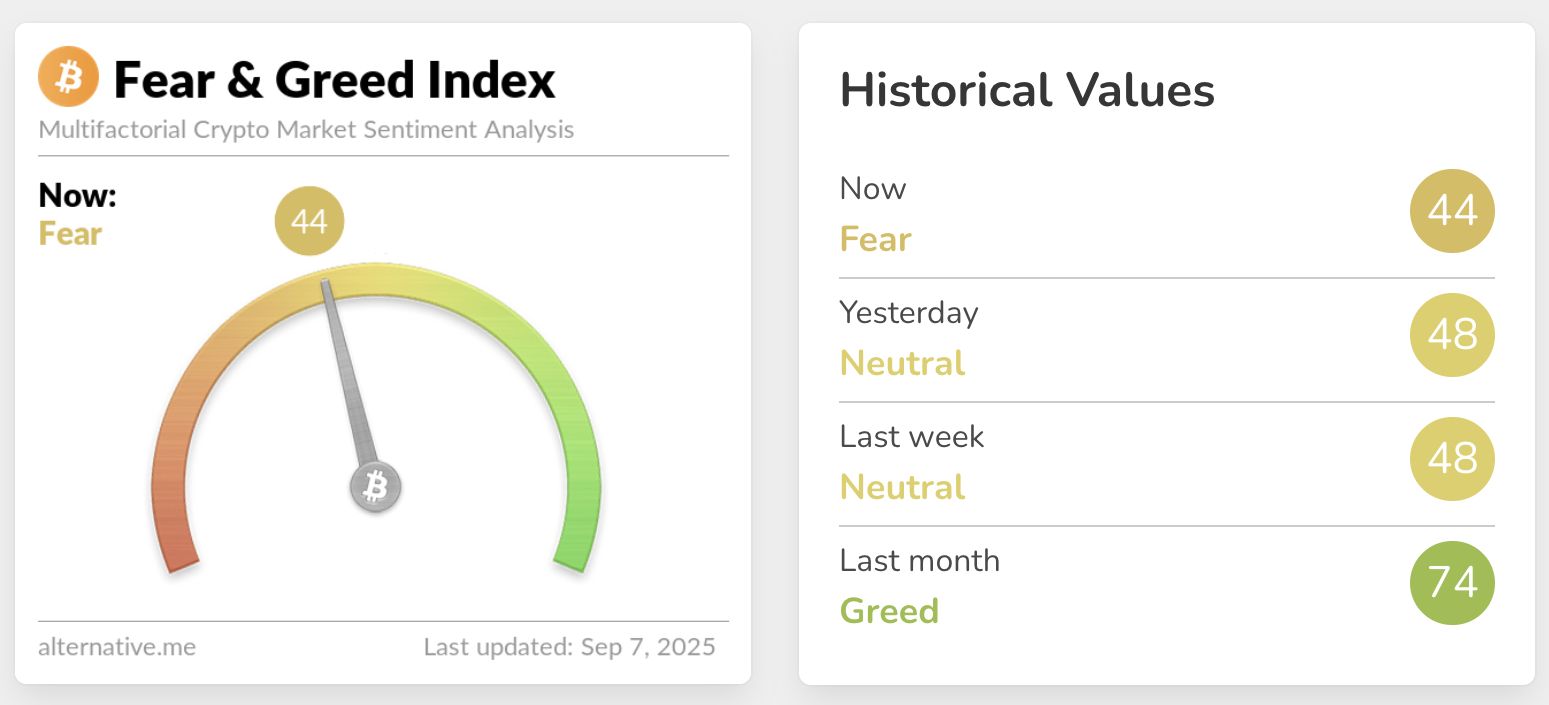

Traders Weigh Which Major Asset May Lead Next Move as Bitcoin Remains Indecisive and Sentiment Cools

Coinotag·2025/09/07 08:15

A Beginner’s Guide to Maximum Extractable Value (MEV)

Cryptotale·2025/09/07 08:00

Flash

18:35

Platinum prices hit a 17-year highPlatinum prices have reached a 17-year high, becoming the third precious metal to break records this year after gold and silver.

18:27

ECB completes digital euro preparations, expected to launch in the second half of 2026The ECB has completed preparations for the digital euro and is now awaiting action from political institutions. ECB President Lagarde emphasized that interest rate decisions are made using a data-driven approach, and inflation is expected to reach the 2% target by 2028. The digital euro is prioritized as a strategic financial tool and is expected to be launched in the second half of 2026.

18:24

Data: 20.0002 million POL transferred from an anonymous address, worth approximately $2.13 millionChainCatcher reported, according to Arkham data, at 02:17, 20,000,240.35 POL (worth approximately $2.13 million) were transferred from one anonymous address (starting with 0x171c...) to another anonymous address (starting with 0x8e54...).

News