News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

From Scroll’s governance suspension to Hyperliquid’s USDH battle and Ronin’s Ethereum migration, this week’s DAO proposals could reshape liquidity, incentives, and investor sentiment across DeFi.

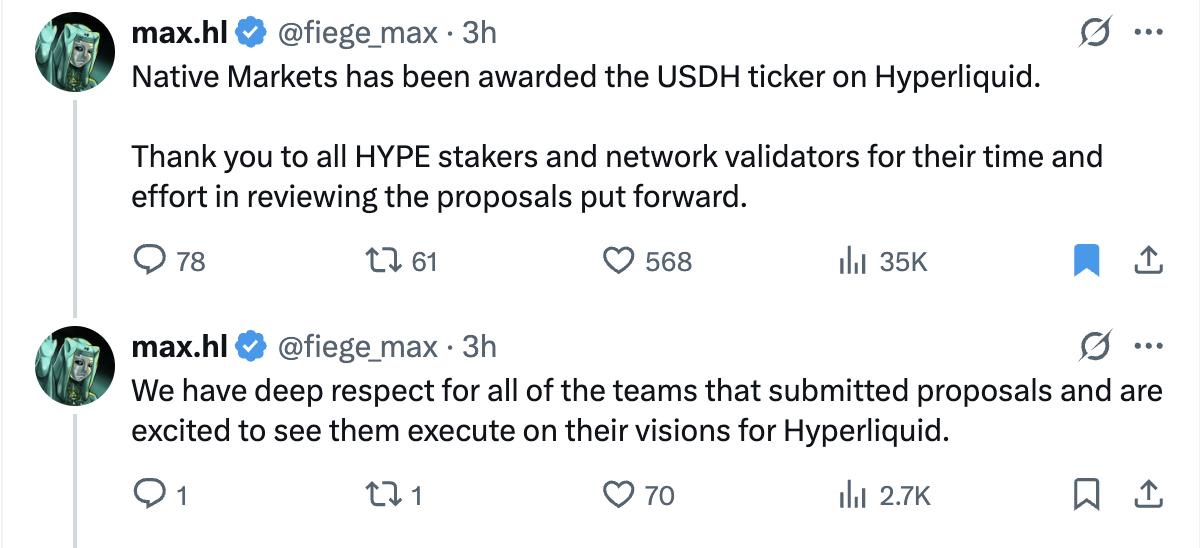

Native Markets secures USDH ticker on Hyperliquid and plans USDH HIP-1 and ERC-20 token rollout.What’s Coming: USDH HIP-1 and ERC-20 LaunchWhy It Matters for DeFi

Pakistan invites crypto companies to operate legally under its new national licensing regime.A Strategic Move Towards Fintech GrowthWhat This Means for Global Crypto Players

Bitcoin is just 0.5% away from marking its best September performance ever.What’s Fueling the Rally?Why It Matters for Investors

In 2010, websites gave away 5 Bitcoin per visitor. That’s worth over $579K today!From Freebies to FortunesThe Lesson: Never Underestimate Innovation