News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Worldcoin’s Price Doubles, Analysts Predict Next Altcoin Breakouts

Cryptonewsland·2025/09/15 10:24

Galaxy Digital Buys $1.55B in Solana as Price Falls 3.85%: Bullish Signal or Bearish Warning?

Cryptonewsland·2025/09/15 10:24

Solana "Signal King" goes live, longtime "ally" Multicoin bets on DAT

ChainFeeds·2025/09/15 10:22

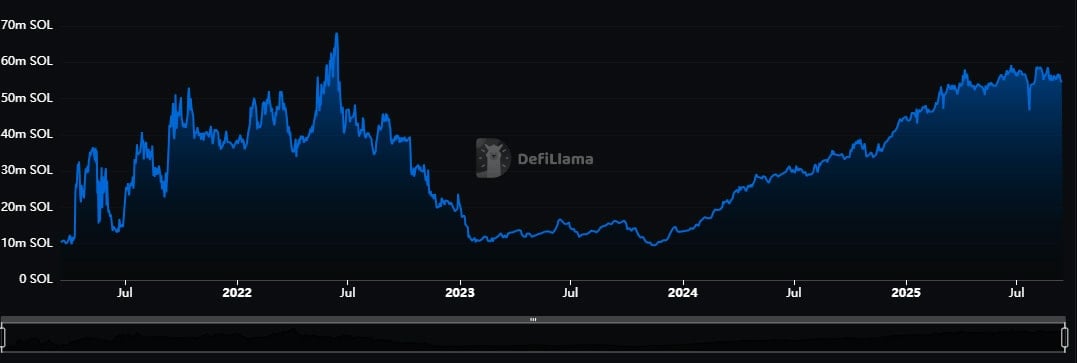

Solana DeFi TVL Hits $13,38 Billion as Users Surge

Portalcripto·2025/09/15 10:21

XRP Price Could Skyrocket, Analyst Projects New Jump With Fed Cut

Portalcripto·2025/09/15 10:21

Upcoming US Fed meeting could push Bitcoin above $120 and usher in altcoin season in 2025

Portalcripto·2025/09/15 10:21

SEC to Warn Firms Before Crypto Crackdowns

SEC Chair Paul Atkins signals a softer stance, promising warnings before crypto enforcement actions.A Break from Past Aggressive TacticsImplications for the Crypto Industry

Coinomedia·2025/09/15 10:18

Bitcoin Eyes $120K: Polymarket Users Bet Big

Polymarket users give Bitcoin a 56% chance of hitting $120,000 in September, fueling bullish speculation.Market Sentiment Turns BullishWhat Could Push Bitcoin to $120K?

Coinomedia·2025/09/15 10:18

Monero Rallys 7% Despite 18-Block Reorg Scare

Monero jumps 7% even after Qubic’s 18-block reorg attack reversed 117 transactions.What Happened in the Reorg Attack?Community Response and Market Reaction

Coinomedia·2025/09/15 10:18

$353M in Token Unlocks Coming This Week

Over $353M in tokens will unlock this week, with $FTN leading at $89.8M on Sept 19. Here’s what investors should know.Why Token Unlocks MatterWhat Should Investors Do?

Coinomedia·2025/09/15 10:18

Flash

06:37

Michael Lorizio: If the unemployment rate rises by 0.1% each month, the Federal Reserve's rate cut potential is being underestimatedChainCatcher News, according to Golden Ten Data, Michael Lorizio, Head of US Rates and Mortgage Trading at Manulife Investment Management, stated that the US inflation rate in November was significantly lower than economists' forecasts, and the unemployment rate unexpectedly rose. He pointed out that although the federal government shutdown caused some data distortion, there is limited room for current inflation data to significantly exceed expectations. If the labor market continues on a trajectory where the unemployment rate rises by 0.1 percentage points each month, the potential for further rate cuts next year may be underestimated.

06:30

Data: USDC circulating supply decreased by approximately 1.3 billions in the past 7 daysPANews reported on December 20 that, according to official data, in the 7 days ending December 18, Circle issued approximately 4.7 billion USDC and redeemed about 6 billion USDC, resulting in a decrease in circulation of around 1.3 billion tokens. The total USDC in circulation is 77.2 billion tokens, with reserves of about 77.5 billion US dollars. Of these reserves, overnight reverse repo agreements in US Treasuries account for approximately 53.3 billion US dollars; US Treasuries with maturities of less than 3 months account for about 14.3 billion US dollars; deposits at systemically important institutions are around 9.2 billion US dollars; and other bank deposits are about 700 million US dollars.

06:25

About 250 million Lighter tokens were transferred from the token contract 3 hours ago.Foresight News reported that, according to on-chain data, the Lighter token contract transferred approximately 250 million tokens about 3 hours ago. The purpose of the token transfer is still unclear, but the community speculates that it may be used for airdrop distribution.

News