News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

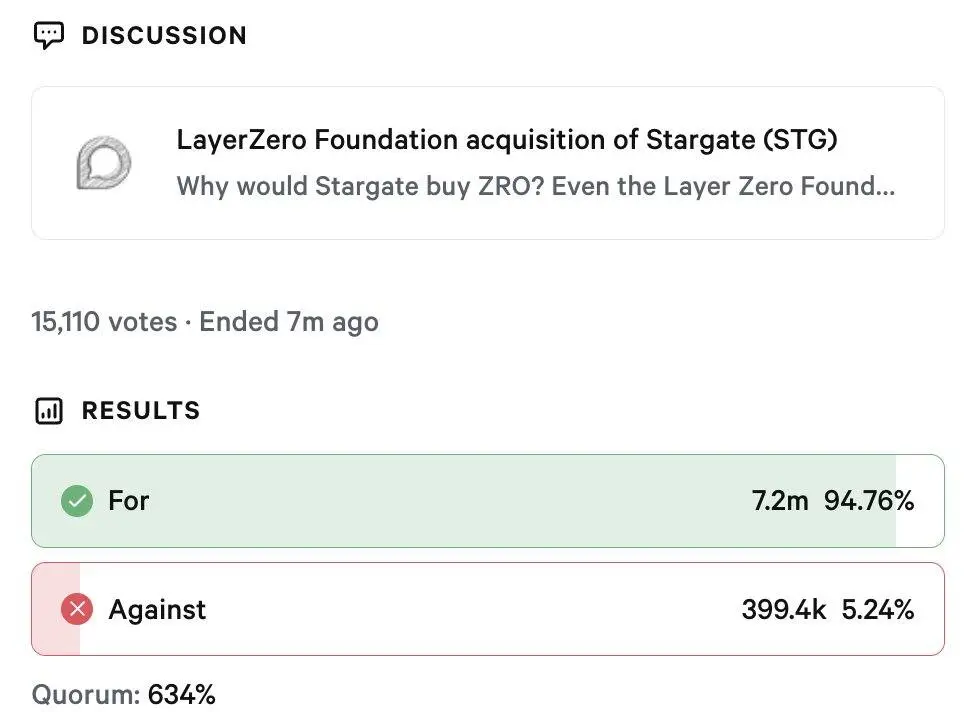

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

- 20:50Glassnode: Bitcoin illiquid supply declines as 62,000 BTC flow out from long-term holder walletsJinse Finance reported, citing Glassnode data, that since mid-October, approximately $7 billion worth of bitcoin has been transferred out of long-term holder wallets, leading to a decrease in bitcoin's illiquid supply, which could make it harder for bitcoin price rebounds to gain momentum. Glassnode pointed out that since mid-October, about 62,000 BTC have flowed out from long-inactive wallets, marking the first significant decline since the second half of 2025. In recent weeks, bitcoin's price has retreated from the historical high of over $125,000 set in early October and is currently trading around $113,550 (data from The Block). Glassnode wrote on X: "Interestingly, during this phase, whale wallets are actually still accumulating. Over the past 30 days, whale wallets have been increasing their holdings, and since October 15, they have not made any significant sales." Glassnode also noted that wallets holding between $10,000 and $1 million worth of BTC have seen the largest outflows, with continuous selling since last November. "Trend buyers have basically exited, and the demand from dip buyers is insufficient to absorb this selling pressure," Glassnode stated. "First-time buyers are staying on the sidelines, and this supply-demand imbalance is suppressing prices until stronger spot demand returns."

- 20:08Solana Co-founder: The claim that "Layer 2 inherits Ethereum's security" does not holdJinse Finance reported that Solana co-founder toly posted on X, stating that the claim "Layer 2 inherits Ethereum security" is incorrect. Over the five years of the Layer 2 roadmap, Ethereum circulating on the Solana network via Wormhole faces the same extreme risks as Ethereum on the Base network, and the returns brought to Ethereum Layer 1 validators are at the same level. From any perspective, the statement that "L2 inherits ETH security" does not hold true.

- 18:09Total open interest in Ethereum contracts across the entire network surpasses $48 billion.According to Jinse Finance, data from Coinglass shows that the total open interest of Ethereum contracts across the network has reached 1.196 million ETH, equivalent to approximately $48.56 billion.