Bitcoin fails to break through $90,000, triggering a new round of liquidations—chart shown below

Earlier today, bitcoin briefly approached the $90,000 mark, but this surge was short-lived.

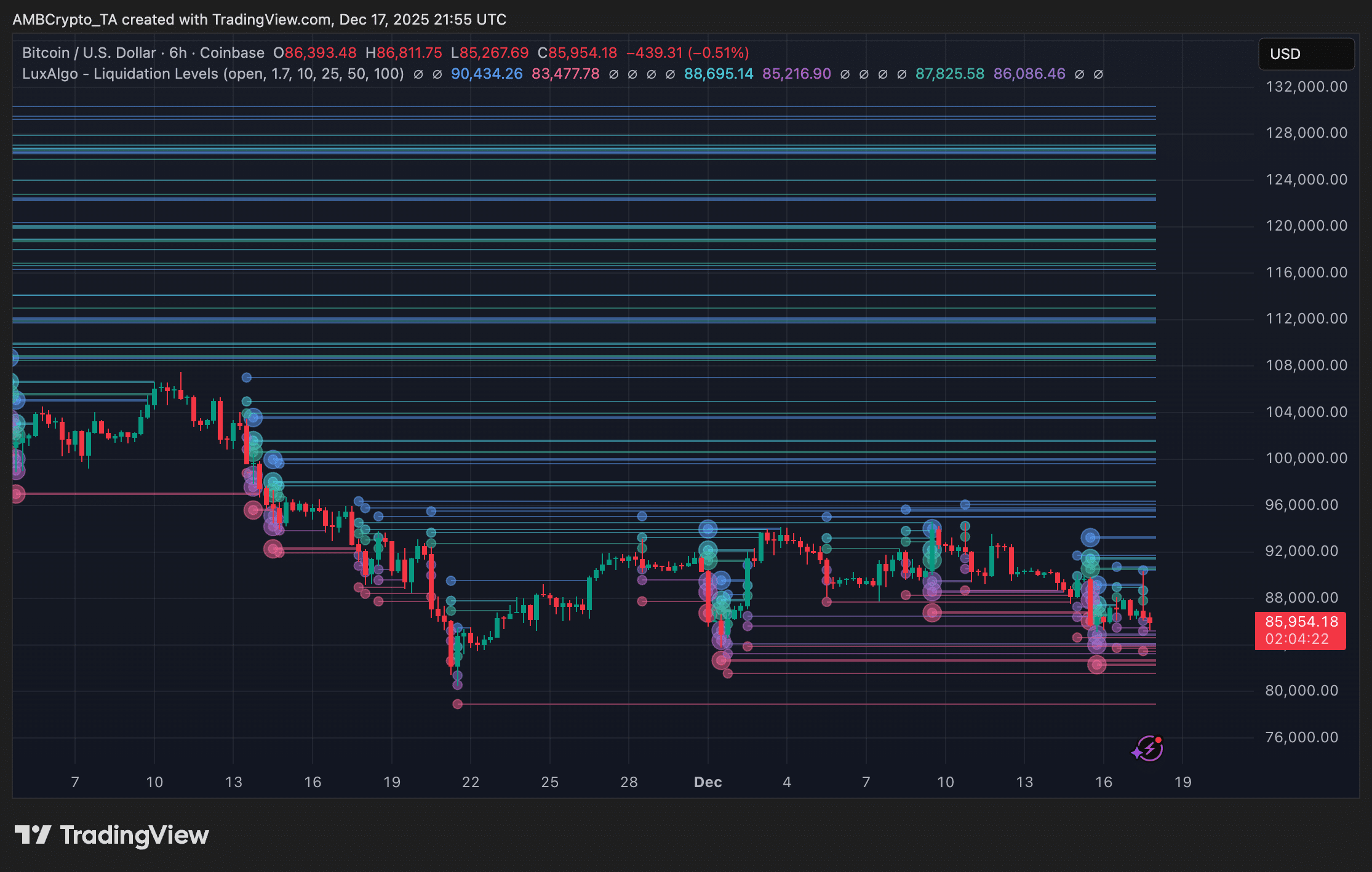

The latest liquidation data shows that this rebound was more of a liquidity grab than a breakout attempt. Before the sharp reversal, bitcoin touched a series of densely packed short liquidation levels.

Bitcoin price drops to $90,000, faces liquidation resistance.

Liquidation heatmaps show a large concentration of short liquidations between $89,500 and $90,500. This price range forms one of the strongest resistance levels on the chart.

When bitcoin's price reached this area, there was a wave of forced short covering in the market—but there was no follow-through afterwards.

This is consistent with typical liquidity hunting behavior, where the price reaches a certain level just to fill orders, and once the liquidity is exhausted, the price reverses.

Additionally, the 6-hour chart confirms this: a large cluster of short liquidation bubbles was triggered near $90,000, followed immediately by selling pressure that pushed bitcoin back below $87,000.

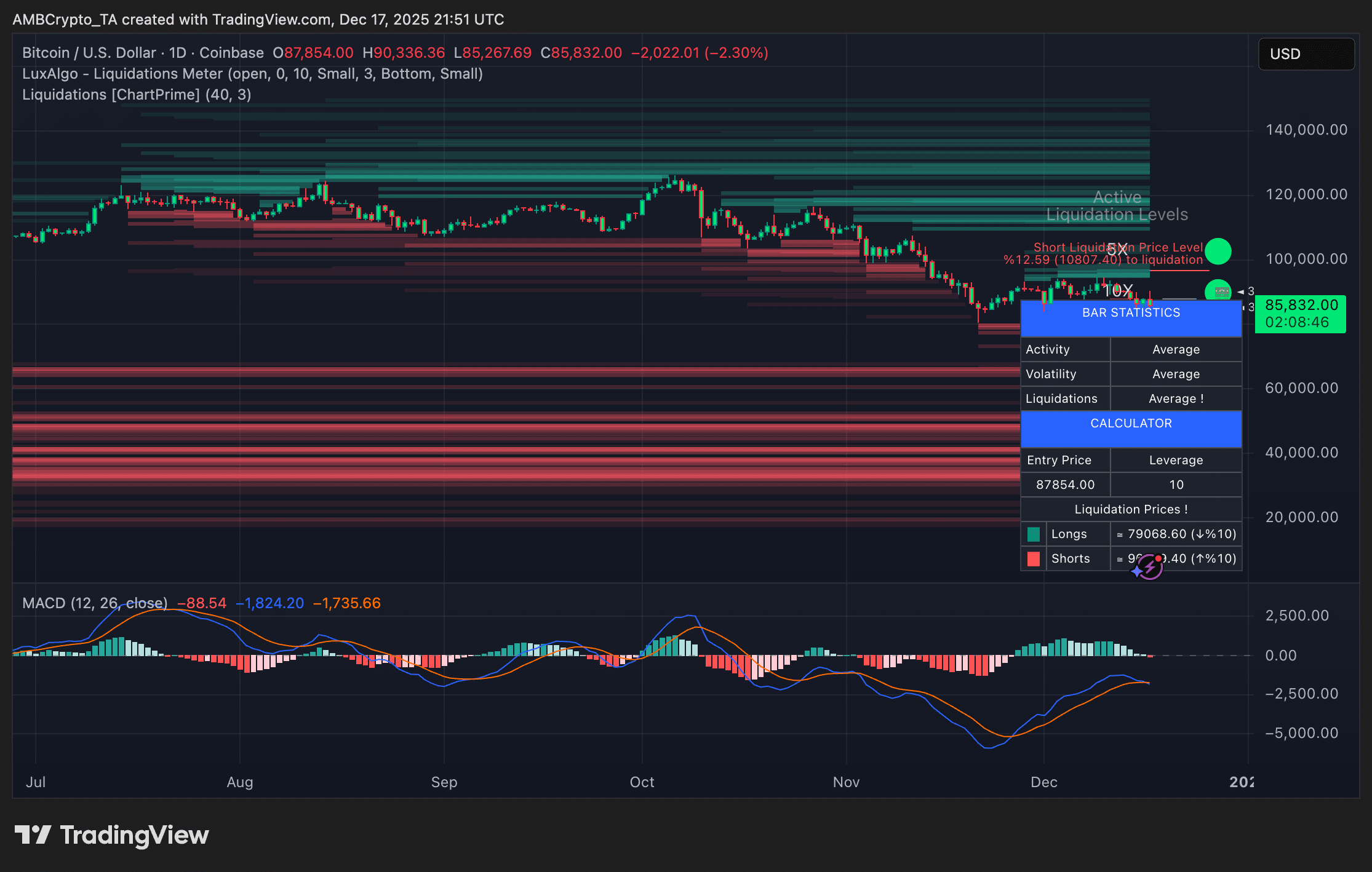

Daily chart shows weakening momentum, increased downside liquidity.

On the daily liquidation chart, most high-density liquidity is located below the current price:

- $84,000 to $82,000—a large cluster of long liquidations

- $80,000 to $78,000—the next liquidity-rich pool

- Extremely high volume short-term trades, with single trade prices all above $90,000.

This imbalance means that market makers and large participants may be more motivated to push bitcoin prices down to deeper liquidity levels, as liquidations are more profitable at those levels.

The MACD indicator also shows that momentum has been weakening for over a week, with the MACD line still firmly below the zero axis.

Reasons for bitcoin's failed breakout

The reasons for the rejection may be as follows:

These factors combined to make the market unstable from the very beginning.

What to watch next?

If bitcoin continues to move lower, the first reaction area is around $84,000, where long liquidation clusters will start to increase.

If this level is breached, it could accelerate a drop into the $82,000 to $80,000 range, which is currently the largest visible liquidity pool.

In addition, for any meaningful upside, bitcoin needs to regain liquidity above $87,500. At the same time, it must maintain upward momentum and break through $90,000, at which point new short positions will need to be established again.

Final thoughts

- Bitcoin's touch of the $90,000 mark was a liquidity chase, not a sustainable breakout.

- The largest liquidation pool is currently below the price, increasing the risk of downward price expansion.