Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

On December 15, 2025, U.S. time, Nasdaq officially submitted Form 19b-4 to the SEC, applying to extend the trading hours of U.S. stocks and exchange products to 23/5 (23 hours of trading per day, 5 days a week).

However, the trading hours applied for by Nasdaq are not simply an extension, but a change to two official trading sessions:

Daytime trading session (4:00-20:00 EST) and nighttime trading session (21:00-4:00 EST the next day). Trading is suspended from 20:00-21:00, and all unexecuted orders are uniformly canceled during the suspension period.

Many readers became excited upon seeing the news, wondering if this means the U.S. is preparing for 24/7 tokenized stock trading. But Crypto Salad has carefully studied the document and wants to say: don't jump to conclusions yet, because Nasdaq states in the document that many traditional securities trading rules and complex orders do not apply to the nighttime trading session, and some functions will also be restricted.

We have always paid close attention to U.S. stock tokenization, believing it to be one of the most important targets for real-world asset tokenization, especially as the U.S. SEC (Securities and Exchange Commission) has been making frequent official moves recently.

This application has renewed expectations for U.S. stock tokenization, as it represents a major step for the U.S. in aligning securities trading hours closer to the 24/7 digital asset market. However, upon closer inspection:

This Nasdaq document does not mention anything about tokenization at all; it is simply an institutional reform for traditional securities.

If you want a deeper understanding of Nasdaq's actions, Crypto Salad can write a dedicated article for detailed interpretation. But today, we still want to talk about real news directly related to U.S. stock tokenization—

The SEC has officially "allowed" the U.S. securities custody giant to attempt providing tokenization services.

On December 11, 2025, U.S. time, the SEC's Division of Trading and Markets staff issued a No-Action Letter (NAL) to DTCC, which was subsequently published on the SEC's official website. The letter clearly states that provided certain conditions are met, the SEC will not take enforcement action against DTC for providing tokenization services related to its custody of securities.

At first glance, many readers think the SEC has officially "exempted" the use of tokenization technology in U.S. stocks. But upon closer examination, the reality is quite different.

So, what exactly does this letter say? How far has the latest development in U.S. stock tokenization progressed? Let's start with the main character of the letter:

I. Who are DTCC and DTC?

DTCC, or Depository Trust & Clearing Corporation, is a U.S. group company that includes different institutions responsible for custody, stock clearing, and bond clearing.

DTC, or Depository Trust Company, is a subsidiary of DTCC and the largest centralized securities depository in the U.S., responsible for the unified custody of stocks, bonds, and other securities, as well as settlement and transfer. Currently, it manages and accounts for over $100 trillion in securities assets. You can think of DTC as the ledger administrator for the entire U.S. stock market.

II. What is the relationship between DTC and U.S. stock tokenization?

In early September 2025, there was news that Nasdaq applied to the SEC to issue stocks in tokenized form. DTC was already mentioned in that application.

Nasdaq stated that the only difference between tokenized stocks and traditional stocks lies in DTC's clearing and settlement of orders.

(The above image is from Nasdaq's application proposal)

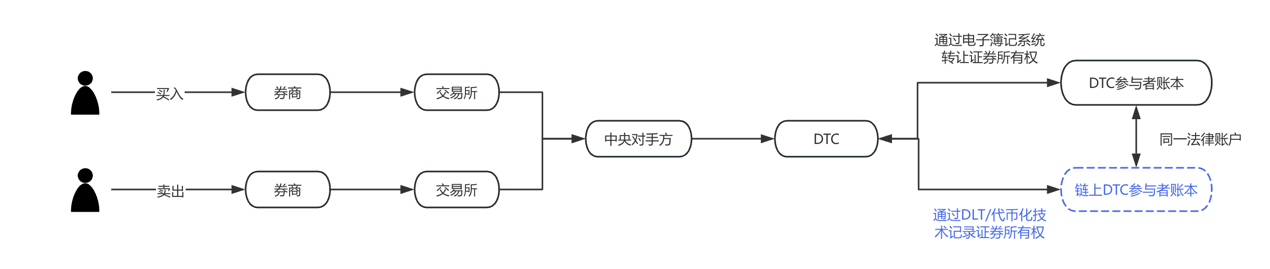

To make this easier to understand, we have drawn a flowchart. The blue part is the section that Nasdaq applied to change in its September proposal this year. It is clear that DTC is the key implementation and operational institution for U.S. stock tokenization.

III. What does the newly released No-Action Letter say?

Many people directly equate this document with the SEC agreeing to let DTC use blockchain for U.S. stock bookkeeping, but this is not accurate. To understand this correctly, you must be aware of a provision in the U.S. Securities Exchange Act:

Section 19(b) of the Securities Exchange Act of 1934 stipulates that any self-regulatory organization (including clearing agencies) must submit a rule change application to the SEC and obtain approval when changing rules or making significant business arrangements.

Both of Nasdaq's proposals were submitted based on this provision.

However, the rule filing process is usually lengthy, possibly taking months and up to 240 days. If every change requires an application and approval, the time cost would be too high. Therefore, to ensure its securities tokenization pilot activities can proceed smoothly, DTC applied for an exemption from fully complying with the 19b filing process during the pilot period, and the SEC agreed.

In other words, the SEC has only temporarily exempted DTC from some procedural filing obligations, not substantively approved the application of tokenization technology in the securities market.

So, how will U.S. stock tokenization develop next? We need to clarify the following two questions:

(1) What pilot activities can DTC carry out without filing?

Currently, U.S. stock custody and bookkeeping operate as follows: suppose a broker has an account at DTC, DTC uses a centralized system to record every stock and share bought and sold. This time, DTC proposes: can we offer brokers an option to record these stock holdings again in the form of blockchain tokens?

In practice, participants first register a qualified, DTC-approved Registered Wallet. When a participant sends a tokenization instruction to DTC, DTC will do three things:

a) Move these stocks from the original account to a general ledger pool;

b) Mint tokens on the blockchain;

c) Send the tokens to the participant's wallet, representing the participant's rights to these securities.

After this, these tokens can be transferred directly between these brokers, without each transfer having to go through DTC's centralized ledger. However, all token transfers will be monitored and recorded in real time by DTC through an off-chain system called LedgerScan, and LedgerScan's records will constitute DTC's official ledger. If a participant wishes to exit the tokenized state, they can send a "detokenization" instruction to DTC at any time, DTC will destroy the tokens and re-record the securities rights back to the traditional account.

The NAL also details technical and risk control restrictions, including: tokens can only be transferred between DTC-approved wallets, so DTC even has the authority to forcibly transfer or destroy tokens in wallets under certain circumstances, the token system and DTC's core clearing system are strictly isolated, etc.

(2) What is the significance of this letter?

From a legal perspective, Crypto Salad needs to emphasize that the NAL is not equivalent to legal authorization or rule change, it does not have general legal effect, but only represents the SEC staff's enforcement attitude under established facts and assumptions.

There is no separate provision in the U.S. securities law system that "prohibits the use of blockchain for bookkeeping." Regulators are more concerned about whether, after adopting new technology, the existing market structure, custody responsibilities, risk control, and reporting obligations are still being met.

In addition, in the U.S. securities regulatory system, NALs have long been seen as important indicators of regulatory stance, especially when the subject is a systemically important financial institution like DTC. Their symbolic significance actually outweighs the specific business itself.

From the disclosed content, the premise for the SEC's exemption is very clear: DTC is not directly issuing or trading securities on-chain, but is tokenizing existing securities rights within its custody system.

This type of token is actually a "rights mapping" or "ledger expression," used to improve back-end processing efficiency, rather than changing the legal nature or ownership structure of the securities. The related services operate in a controlled environment and on a permissioned blockchain, with participants, usage scope, and technical architecture all strictly limited.

Crypto Salad believes this regulatory attitude is very reasonable. The most common financial crimes with on-chain assets are money laundering and illegal fundraising. Tokenization technology is new, but it cannot become an accomplice to crime. Regulators need to affirm the potential of blockchain in securities infrastructure while upholding the boundaries of existing securities law and custody systems.

IV. The Latest Progress in U.S. Stock Tokenization

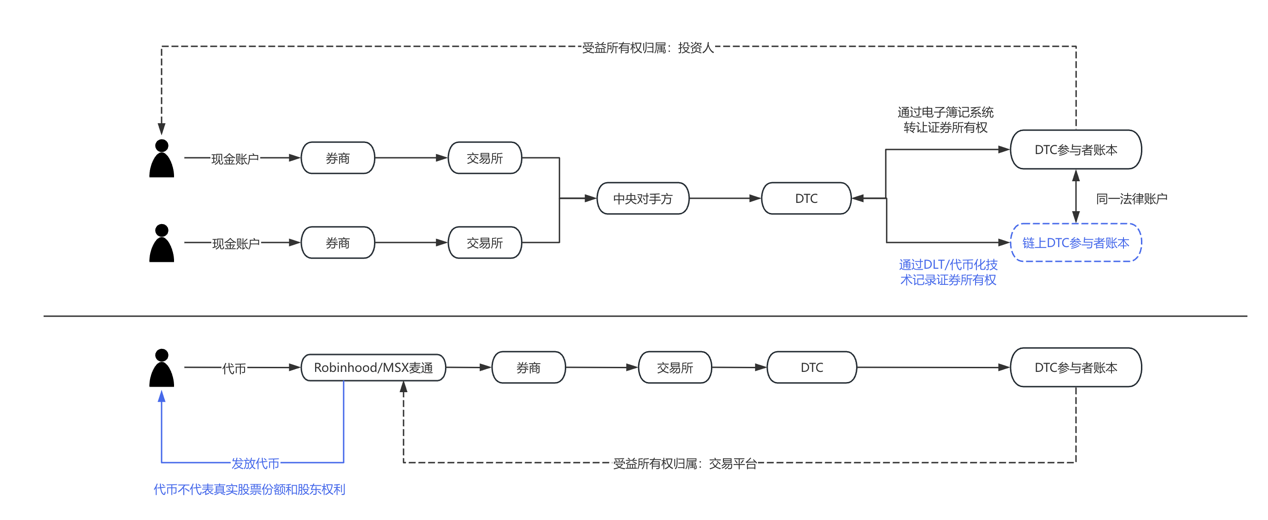

The discussion on U.S. stock tokenization has gradually shifted from "whether it is compliant" to "how to implement it." If we break down current market practices, we can see at least two parallel but logically different paths emerging:

- Represented by DTCC and DTC, there is a tokenization path led by official opinion, whose core goal is to improve settlement, reconciliation, and asset circulation efficiency, mainly serving institutions and wholesale market participants. In this model, tokenization is almost "invisible"—for end investors, stocks are still stocks, only the back-end system has undergone a technical upgrade.

- In contrast, brokers and trading platforms may play a front-end role. For example, Robinhood and MSX have been exploring products in crypto assets, stock fractional trading, and extended trading hours in recent years. If U.S. stock tokenization matures in terms of compliance, these platforms are naturally positioned as user entry points. For them, tokenization does not mean reshaping the business model, but is more likely a technological extension of the existing investment experience, such as closer-to-real-time settlement, more flexible asset splitting, and the integration of cross-market product forms. Of course, all this still depends on the gradual clarification of the regulatory framework. Such explorations usually operate near the regulatory boundary, balancing risk and innovation. Their value lies not in short-term scale, but in validating the next generation of securities market forms. In reality, they are more like providing samples for institutional evolution, rather than directly replacing the existing U.S. stock market.

To make this more intuitive, see the comparison chart below:

V. Crypto Salad's Viewpoint

From a more macro perspective, the real problem U.S. stock tokenization is trying to solve is not to "turn stocks into coins," but how to improve asset circulation efficiency, reduce operating costs, and reserve interfaces for future cross-market collaboration, all while maintaining legal certainty and system security. In this process, compliance, technology, and market structure will continue to interact, and the evolution path will inevitably be gradual rather than radical.

It is foreseeable that U.S. stock tokenization will not fundamentally change the way Wall Street operates in the short term, but it has already become an important project on the U.S. financial infrastructure agenda. This interaction between the SEC and DTCC is more like an institutional "trial run," setting preliminary boundaries for broader future exploration. For market participants, this may not be the end, but it is truly a starting point worth continuous observation.