As short-term price fluctuations in cryptocurrency markets challenge investor psychology, long-term expectations are being reassessed. According to Alice Liu, Research Director at CoinMarketCap (CMC), the next major crypto bull cycle will commence in the first quarter of 2026. This prediction suggests that the market has not yet reached its long-term peak despite the current price pressure on Bitcoin $90,357.50 and altcoins. Institutional investor behavior and regulatory developments are highlighted as key foundations for this expectation.

Short-Term Fluctuations and Institutional Selectivity

Although Bitcoin briefly reclaimed the $90,000 level recently, it is still about 30% below its October peak. According to CNBC host Dan Murphy, approximately $20 billion in leveraged positions were liquidated during the recent downturn. During the same period, funding rates in perpetual futures turned negative, indicating investors’ shift towards stablecoins to avoid risk.

CMC data reveals that the total crypto market value has increased by 1.1% over the past 72 hours. Notably, institutional inflows towards Ethereum $3,093.86 stand out. BlackRock’s ETHA ETF has seen an inflow of $53 million, while there have been outflows from Bitcoin ETFs. Meanwhile, the BNB Chain ecosystem recovery bolstered its market value to $8.3 billion.

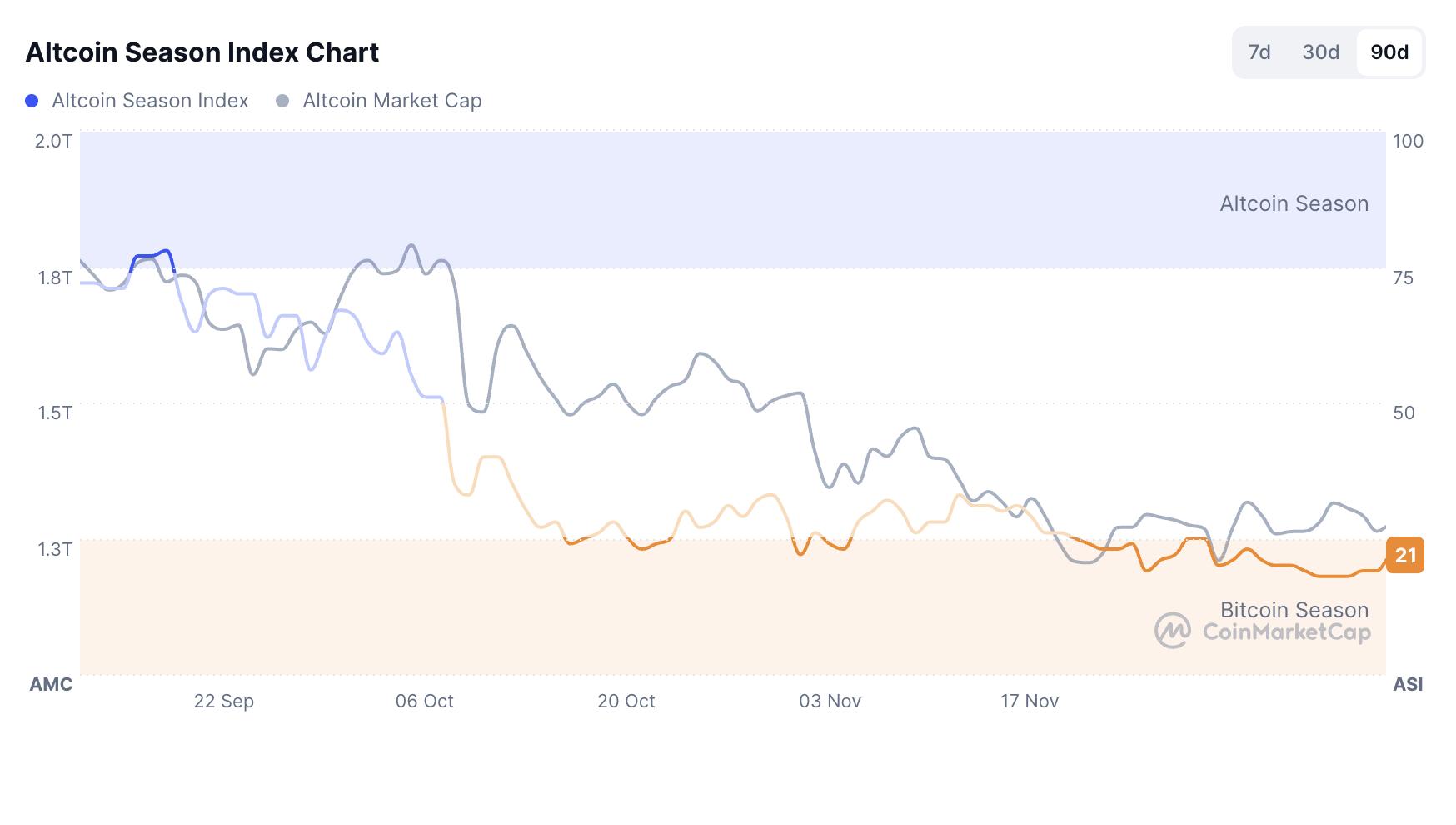

Nevertheless, leverage appetite in the market remains limited. Open positions have only increased by 1.14%, and signals from the correlation between macroeconomic indicators and crypto are not providing clear direction. Altcoins continue to underperform against Bitcoin. The CMC Altcoin Season Index remains at 22/100, indicating a sustained “Bitcoin season” in the market. Bitcoin’s dominance is at 58.55%, while Ethereum has outperformed large-scale projects with a weekly gain of 6.49%.

Long-Term Perspective: Regulation and ETF Impact

Institutional figures speaking at a CNBC panel remain optimistic in the long term despite short-term volatility. Binance CEO Richard Teng noted the rapid increase in global regulatory clarity and expanding institutional participation, describing the long-term outlook as “extremely bullish.” Ripple $2.03 CEO Brad Garlinghouse argued that regulatory changes in the U.S. and ETF adoption have not been adequately priced by the markets.

Lily Liu, President of the Solana $132.93 Foundation, emphasized that cyclical corrections are a natural part of crypto’s exponential growth nature. According to her, volatility does not weaken fundamental adoption. Indeed, since the launch of the Solana ETF, net inflows have been observed daily, indicating sustained selective institutional confidence.