@media (max-width:767px){.tdi_60{margin-top:0px!important}}

.tdb_single_content{margin-bottom:0;*zoom:1}.tdb_single_content:before,.tdb_single_content:after{display:table;content:'';line-height:0}.tdb_single_content:after{clear:both}.tdb_single_content .tdb-block-inner>*:not(.wp-block-quote):not(.alignwide):not(.alignfull.wp-block-cover.has-parallax):not(.td-a-ad){margin-left:auto;margin-right:auto}.tdb_single_content a{pointer-events:auto}.tdb_single_content .td-spot-id-top_ad .tdc-placeholder-title:before{content:'Article Top Ad'!important}.tdb_single_content .td-spot-id-inline_ad0 .tdc-placeholder-title:before{content:'Article Inline Ad 1'!important}.tdb_single_content .td-spot-id-inline_ad1 .tdc-placeholder-title:before{content:'Article Inline Ad 2'!important}.tdb_single_content .td-spot-id-inline_ad2 .tdc-placeholder-title:before{content:'Article Inline Ad 3'!important}.tdb_single_content .td-spot-id-bottom_ad .tdc-placeholder-title:before{content:'Article Bottom Ad'!important}.tdb_single_content .id_top_ad,.tdb_single_content .id_bottom_ad{clear:both;margin-bottom:21px;text-align:center}.tdb_single_content .id_top_ad img,.tdb_single_content .id_bottom_ad img{margin-bottom:0}.tdb_single_content .id_top_ad .adsbygoogle,.tdb_single_content .id_bottom_ad .adsbygoogle{position:relative}.tdb_single_content .id_ad_content-horiz-left,.tdb_single_content .id_ad_content-horiz-right,.tdb_single_content .id_ad_content-horiz-center{margin-bottom:15px}.tdb_single_content .id_ad_content-horiz-left img,.tdb_single_content .id_ad_content-horiz-right img,.tdb_single_content .id_ad_content-horiz-center img{margin-bottom:0}.tdb_single_content .id_ad_content-horiz-center{text-align:center}.tdb_single_content .id_ad_content-horiz-center img{margin-right:auto;margin-left:auto}.tdb_single_content .id_ad_content-horiz-left{float:left;margin-top:9px;margin-right:21px}.tdb_single_content .id_ad_content-horiz-right{float:right;margin-top:6px;margin-left:21px}.tdb_single_content .tdc-a-ad .tdc-placeholder-title{width:300px;height:250px}.tdb_single_content .tdc-a-ad .tdc-placeholder-title:before{position:absolute;top:50%;-webkit-transform:translateY(-50%);transform:translateY(-50%);margin:auto;display:table;width:100%}.tdb_single_content .tdb-block-inner.td-fix-index{word-break:break-word}.tdi_60,.tdi_60>p,.tdi_60 .tdb-block-inner>p,.wp-block-column>p{font-family:Poppins!important;font-size:16px!important;line-height:1.8!important;font-weight:400!important}.tdi_60 h1{font-family:Poppins!important}.tdi_60 h2{font-family:Poppins!important}.tdi_60 h3:not(.tds-locker-title){font-family:Poppins!important}.tdi_60 h4{font-family:Poppins!important}.tdi_60 h5{font-family:Poppins!important}.tdi_60 h6{font-family:Poppins!important}.tdi_60 li{font-family:Poppins!important;font-size:16px!important;font-weight:400!important}.tdi_60 li:before{margin-top:1px;line-height:16px!important}.tdi_60 .tdb-block-inner blockquote p{font-family:Poppins!important;font-weight:700!important;text-transform:none!important}.tdi_60 .wp-caption-text,.tdi_60 figcaption{font-family:Poppins!important}.tdi_60 .page-nav a,.tdi_60 .page-nav span,.tdi_60 .page-nav>div{font-family:Poppins!important}@media (max-width:767px){.tdb_single_content .id_ad_content-horiz-left,.tdb_single_content .id_ad_content-horiz-right,.tdb_single_content .id_ad_content-horiz-center{margin:0 auto 26px auto}}@media (max-width:767px){.tdb_single_content .id_ad_content-horiz-left{margin-right:0}}@media (max-width:767px){.tdb_single_content .id_ad_content-horiz-right{margin-left:0}}@media (max-width:767px){.tdb_single_content .td-a-ad{float:none;text-align:center}.tdb_single_content .td-a-ad img{margin-right:auto;margin-left:auto}.tdb_single_content .tdc-a-ad{float:none}}@media (min-width:1019px) and (max-width:1140px){.tdi_60,.tdi_60>p,.tdi_60 .tdb-block-inner>p,.wp-block-column>p{font-size:15px!important}.tdi_60 li{font-size:15px!important}.tdi_60 li:before{margin-top:1px;line-height:15px!important}}@media (min-width:768px) and (max-width:1018px){.tdi_60,.tdi_60>p,.tdi_60 .tdb-block-inner>p,.wp-block-column>p{font-size:14px!important}.tdi_60 li{font-size:14px!important}.tdi_60 li:before{margin-top:1px;line-height:14px!important}}@media (max-width:767px){.tdi_60,.tdi_60>p,.tdi_60 .tdb-block-inner>p,.wp-block-column>p{font-size:14px!important}.tdi_60 li{font-size:14px!important}.tdi_60 li:before{margin-top:1px;line-height:14px!important}}

Bu Rojdestvo arafasi, va daraxt ostida kim paydo bo‘ldi – Jim Cramer, Bitcoin’ni qizil halokat lentalariga o‘rab.

CNBC’ning g‘alati odam, bozordagi issiq fikrlar favvorasi, BTC bo‘yicha 100% ayiq (bearish) pozitsiyaga o‘tdi.

Butun dunyo bo‘ylab treyderlar eggnog ochmoqda, chunki Cramer to‘liq ayiq bo‘lganda, tarix “teskari o‘yin” deb baqiradi. O‘h, boshlandi.

Cramer la’nati

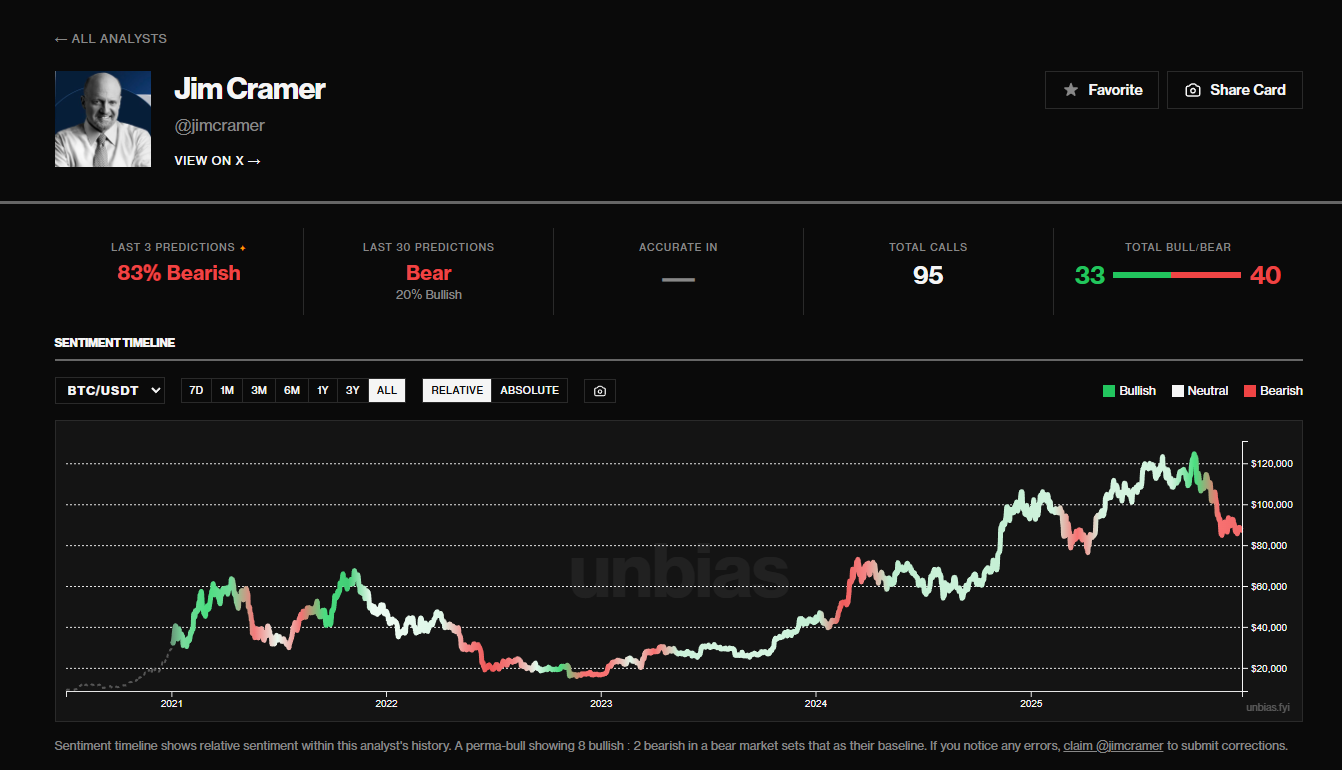

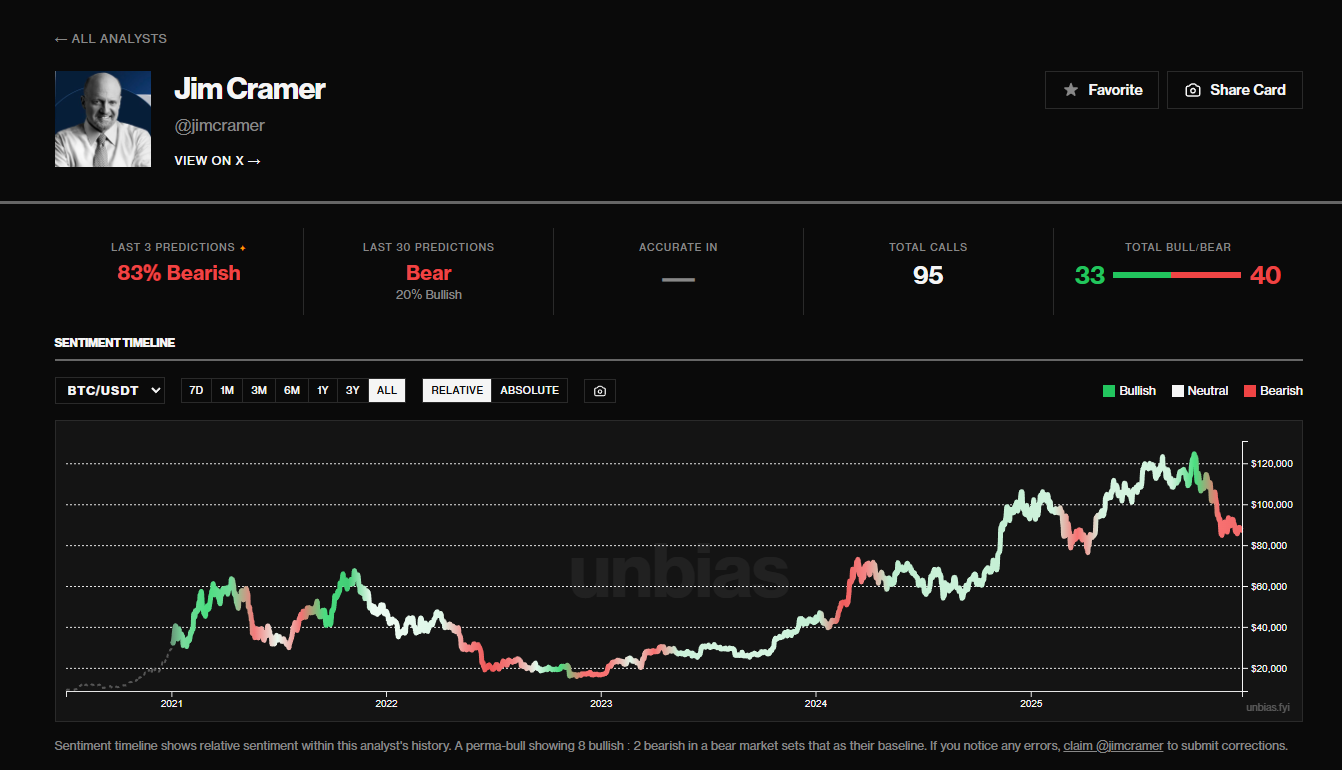

Unbias, Cramer’ning kripto bo‘yicha nutqlarini aniq kuzatib boruvchi, vaziyatni yaqqol ko‘rsatadi.

Ularning boshqaruv panelida Cramer’ning so‘nggi Bitcoin haqidagi chiqishlari "to‘g‘ridan-to‘g‘ri ayiqcha" yoki “ayiqcha (noziklik bilan)” deb tasniflangan, xuddi u allaqachon yutqazgan tikishni sug‘urtalayotgandek.

unbias.fyi

Endi uzoq muddatli qabul qilish haqidagi ertaklar yo‘q.

Yo‘q, Cramer qorong‘u tomon, soxta derivativlar, nihoyatda yuqori yelkali savdo va qarzga botgan “Bitcoin soxta kompaniyalari”ga diqqat qaratgan. Xuddi u BTC bozor tuzilmasida Death Star’ning egzoz portini topgandek.

Lekin bu kripto kauboylarini kuldira oladigan kosmik hazil mana shu.

Buni Cramer la’nati deyishadi, ya’ni Cramer nimani reklama qilsa yoki sotilsa, narxlar teskarisiga uchadi degan ishonch.

Uning eng baland qichqiriqlari tez-tez bozorni teskari aylantirgan, shuning uchun odamlar uning prognozlarini mast va televizorda baqirayotgan Delphi orakulidan chiqqan kontrarian signal deb hisoblashadi.

Eng tez kripto yangiliklari agregatori

Kuniga 200+ kripto yangilik. Bir nechta tilda va darhol.

Inverse Cramer Tracker ETF

Bu faqat Bitcoin afsonasi emas. Uning “teskari indikator” obro‘si shu darajaga chiqib ketdiki, hatto Inverse Cramer Tracker ETF chiqarilib, uning aksiyalari tanloviga qarshi tikish imkonini berdi. Rostdan ham.

Ha, u yomon davomi kabi so‘nib ketdi, lekin afsona yashaydi. CryptoQuant’dan Ki Young Ju X’da to‘g‘ri aytdi:

“SHOSHILINCH: Jim Cramer Bitcoin bo‘yicha 100% ayiqcha. Rojdestvo muborak.” Ha, ha, ha, albatta.

SHOSHILINCH: Jim Cramer Bitcoin bo‘yicha 100% ayiqcha.

Rojdestvo muborak 🎄

— Ki Young Ju (@ki_young_ju) December 24, 2025

Eng baland ovozga qarshi tikish eng katta dividendlarni olib keladimi?

Nega bu qadar quvonch? Tahlilchilar aytishicha, Bitcoin hozir juda nozik chegarada, $93k rad etilishi va $81k qo‘llab-quvvatlashi orasida siqilib turibdi.

Glassnode’ning 17-dekabr “Week On-chain” hisobotida falokat haqida yozilgan, ya’ni taklif kuchaymoqda, talab so‘nib bormoqda.

Ular aytishicha, oxirgi davrda bozor notekis harakatda, bu Cramer’ning ayiqcha nidosi eng zo‘r xarid signali sifatida yangrashi uchun ideal vaziyat.

Treyderlar pichirlashadi: agar BTC ayiqlarga qarshi chiqib, yuqoriga uchsa, demak, kayfiyat “juda salbiy” bo‘lib ketganini inkor qilib bo‘lmas. Lekin agar u qo‘llab-quvvatlashni sindirsa-chi?

Demak, bazm tugadi va Cramer oxirida kuladi. Shunday bo‘lsa-da, bu kripto to‘qnashuvida eng baland ovozga qarshi tikish ko‘pincha eng katta dividendlarni beradi.

Bu safar Cramer la’natini inkor qilishga kim jur’at qiladi?

Muallif: András Mészáros Kriptovalyuta va Web3 eksperti, Kriptoworld asoschisi Boshqa maqolalar Blokcheyn sohasini yoritishda ko‘p yillik tajribaga ega András DeFi, tokenizatsiya, altcoin va raqamli iqtisodiyotga ta’sir qiluvchi kripto tartibga solishlari haqida chuqur tahliliy maqolalar yozadi.

📅 Nashr etilgan sana: 27-dekabr, 2025 • 🕓 Oxirgi yangilanish: 27-dekabr, 2025

unbias.fyi

unbias.fyi