News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Best Meme Coins to Buy – Pudgy Penguins Price Prediction

Cryptonomist·2025/12/21 11:12

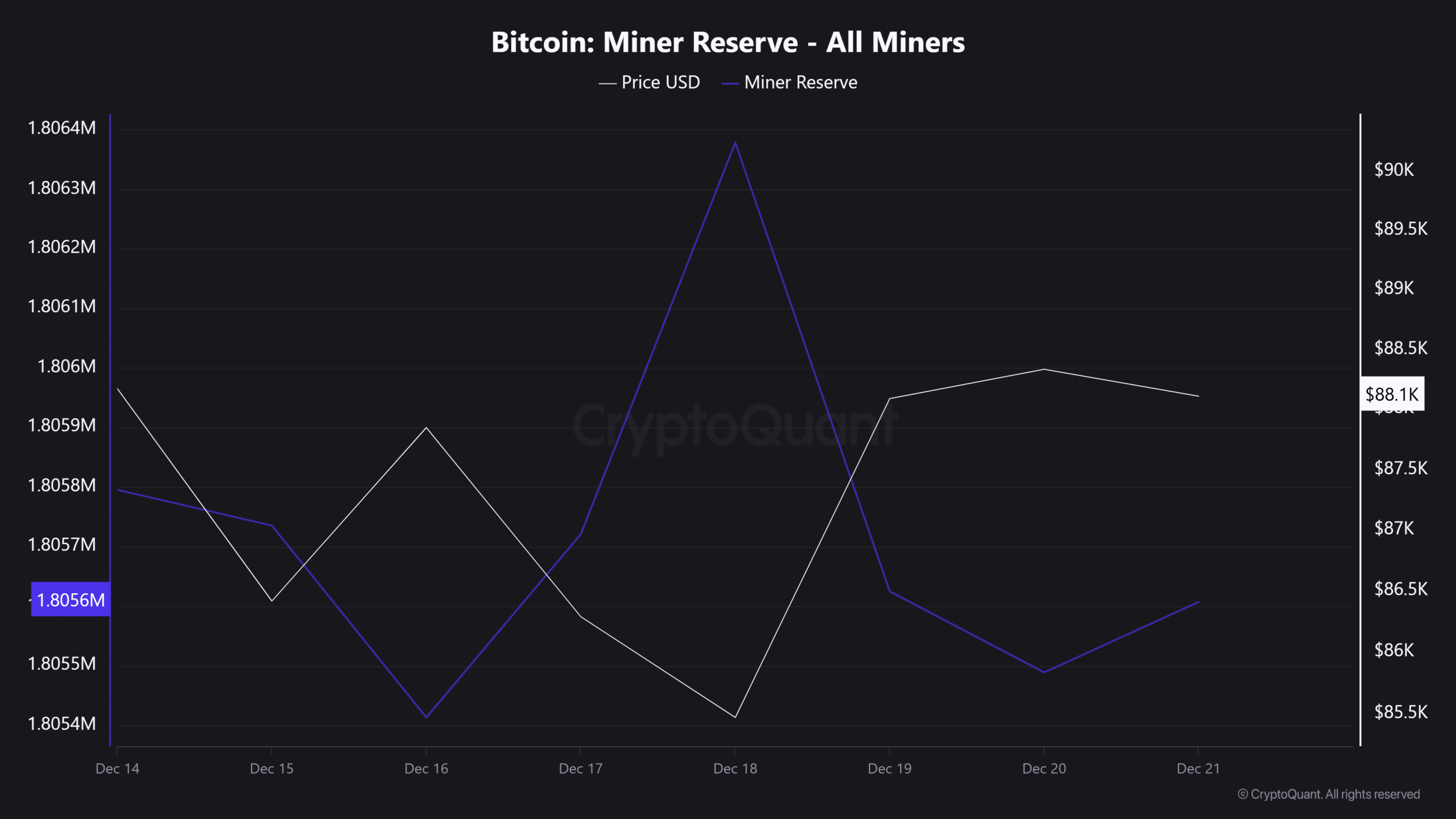

Bitcoin holds $85K despite miner stress – Is ‘buy the fear’ back?

AMBCrypto·2025/12/21 11:03

Analyst Sends Critical Warning to XRP Holders: Largest Bear Trap In History

TimesTabloid·2025/12/21 11:03

Shiba Inu Targets 25x, Yet Ozak AI Prediction Leans Toward a Triple-Digit Run

Cryptodaily·2025/12/21 11:00

Analyst Warns: “The Biggest Threat to Bitcoin is on the Way, Developers are Asleep”

BitcoinSistemi·2025/12/21 10:36

How ETFs Are Reshaping Crypto Market Structure and Flows

Cryptotale·2025/12/21 10:30

Mutuum Finance (MUTM): The Next Big Crypto Set to Explode in 2026

TimesTabloid·2025/12/21 10:03

Analyst: This Heat Map Shows Where XRP Wants to Go

TimesTabloid·2025/12/21 10:03

How DOGEBALL ($DOGEBALL) Uses DOGE Familiarity to Stand Out in the Best Meme Coin Whitelist Race

BlockchainReporter·2025/12/21 09:57

Anome Protocol’s Destiny Platform Welcomes FLOKI Community with New Gaming Room

BlockchainReporter·2025/12/21 09:30

Flash

11:30

Federal Reserve's Hammarsk: More concerned about persistently high inflation, inclined to keep interest rates stable until spring. Fed's Harker stated that after three consecutive rate cuts in recent meetings, there is no need to adjust rates in the coming months. Harker opposes recent rate cuts because she is more concerned about persistently high inflation rather than potential labor market vulnerabilities. Harker is not a voting member of the rate-setting committee this year but will become a voting member next year. "My basic expectation is that rates can be maintained at the current level for some time, at least until spring. Until we get clearer evidence showing that either inflation is falling back to target levels or the labor market is experiencing more substantial weakness," she said in an interview with The Wall Street Journal's Take On the Week podcast on Thursday.

11:22

Federal Reserve's Harker: The neutral interest rate may be higher than generally expectedAccording to Odaily, Federal Reserve's Harker stated that the positive inflation data in November may be due to data collection distortions caused by the government shutdown in October and the first half of November, which underestimated the 12-month price growth. While the Bureau of Labor Statistics reported a 2.7% year-on-year increase in November CPI, the adjusted estimate, accounting for data measurement difficulties, brings it closer to the generally expected level of 2.9% or 3.0%. In addition, Harker's core concern regarding rate cuts lies in her view that the neutral interest rate level is higher than commonly believed, and that the economy itself is poised to maintain robust growth momentum next year. The neutral interest rate cannot be directly observed, but can be inferred from the state of the economy. (Golden Ten Data)

11:21

Federal Reserve's Harker: November Inflation May Have Data Collection Distortions, Neutral Rate May Be Higher Than Widely ExpectedBlockBeats News, December 21st, the Federal Reserve's Harker stated that the November inflation data was positive, possibly due to data collection distortions caused by the government shutdown in October and the first half of November, underestimating the price growth over the 12 months. Although the Labor Department reported a 2.7% year-on-year increase in the CPI in November, estimates adjusted for the difficulties in measuring the data brought it closer to the 2.9% or 3.0% level widely expected by forecasters. Furthermore, Harker's concern about cutting interest rates lies in her view that the neutral interest rate level is higher than commonly believed and that the economy itself has the momentum to maintain robust growth next year. The neutral interest rate cannot be directly observed but can be inferred from the state of the economy. (Krypton Capital)

News