News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1️⃣ Ebunker ETH staking yield: 3.32% 2️⃣ stETH (Lido) 7-day average annualized yield...

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.

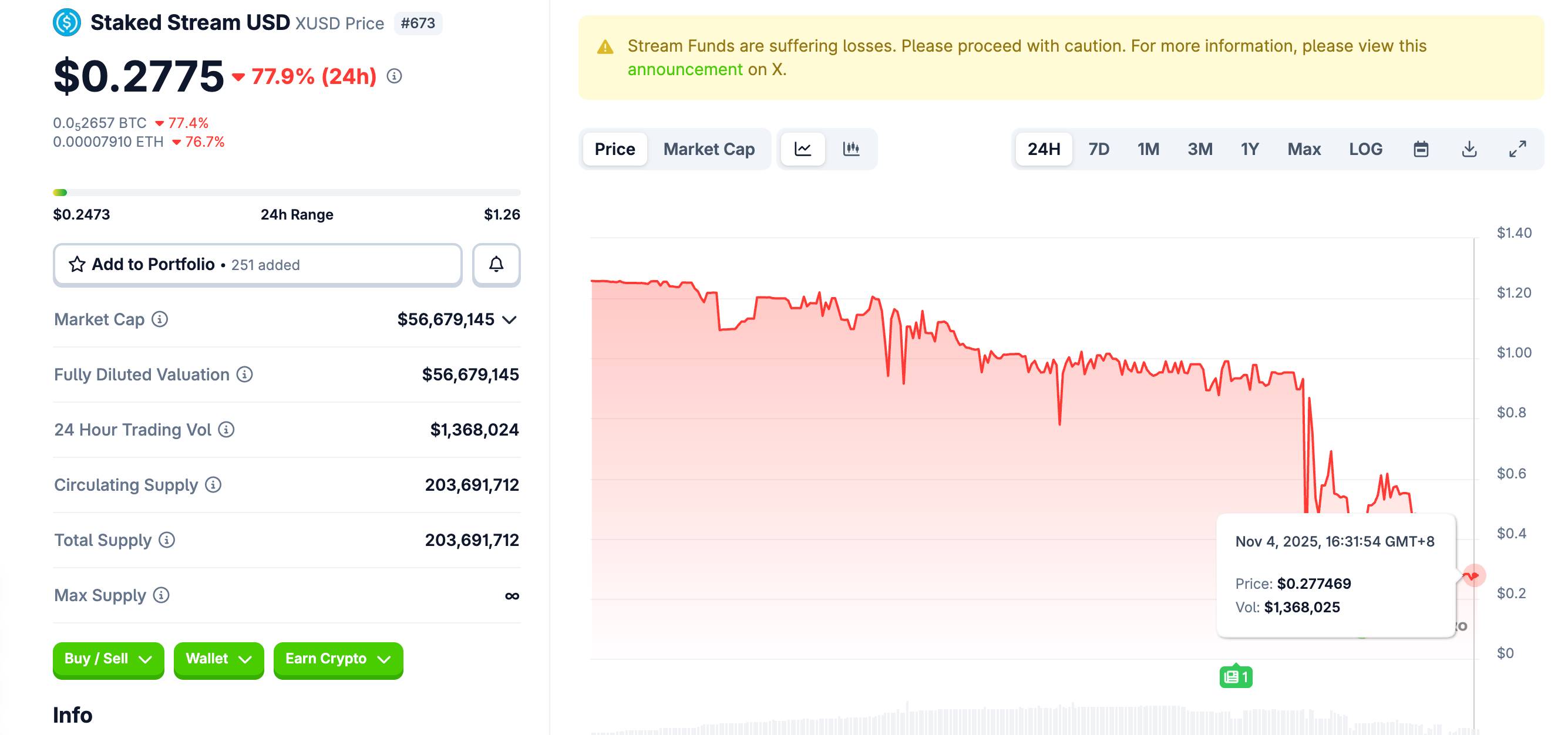

Multiple negative factors are weighing on the market! Trading sentiment in the cryptocurrency market remains sluggish, and experts had previously warned of a potential 10%-15% correction risk.

The AI stock rally has been targeted by "the Big Short" investor! Scion Asset Management, led by Michael Burry, has made a major shift in its 13F holdings, taking short positions against Nvidia and Palantir. Not long ago, he broke his long silence to warn about a market bubble.

Key metrics (from 4:00 PM Hong Kong time on October 27 to 4:00 PM Hong Kong time on November 3): BTC/USD fell by 7.3%...

The market is not performing well; I wish you peace and safety.

- 19:25The usage of the Federal Reserve's overnight reverse repurchase agreement (RRP) stands at $1.6983 billion.Jinse Finance reported that on Tuesday (November 4), the Federal Reserve's overnight reverse repurchase agreement (RRP) usage amounted to $1.6983 billion, compared to $2.3792 billion in the previous trading day.

- 18:39Data: If ETH breaks through $3,479, the cumulative short liquidation intensity on major CEXs will reach $777 millions.According to ChainCatcher, citing data from Coinglass, if ETH breaks through $3,479, the cumulative short liquidation intensity on major CEXs will reach $777 million. Conversely, if ETH falls below $3,155, the cumulative long liquidation intensity on major CEXs will reach $256 million.

- 17:34Both Bitcoin and Ethereum have fallen below the "10.11" flash crash lowChainCatcher News, according to the latest market data, major cryptocurrencies in the market have experienced a significant pullback. Bitcoin is now quoted at $101,459, and Ethereum is quoted at $3,397, both falling below the previous lows formed during the "10.11" flash crash.