News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 15)|EDCON 2025 Ethereum Developer Conference Set to Open Soon; Major Token Unlocks Scheduled This Week; Tether Launches New USD Stablecoin for US Market2Chainlink Could See Further Gains After SBI Partnership, Bitwise ETF Filing and Large Exchange Outflows3Ethereum Co-Founder Says AI-Led Governance Could Be Exploited, Urges Info-Finance Oversight

Tether plans stablecoin for the US market (USAT)

CryptoValleyJournal·2025/09/15 22:57

Polymarket is booming: An overview of 10 ecosystem projects

A range of third-party ecosystems has emerged around Polymarket, including data/dashboards, social experiences, front-end/terminal, insurance, and AI agents.

链捕手·2025/09/15 22:53

Symbiotic, Chainlink, and Lombard launch industry-first layer for cross-chain Bitcoin transfers

Cryptobriefing·2025/09/15 22:33

Brazil Explores Bitcoin Reserve with Parliamentary Hearing

Theccpress·2025/09/15 22:03

Brazil Considers National Bitcoin Reserve Proposal

Theccpress·2025/09/15 22:03

Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

Cointelegraph·2025/09/15 21:45

Trump Predicts a "Significant Rate Cut" by the Federal Reserve!

AICoin·2025/09/15 21:08

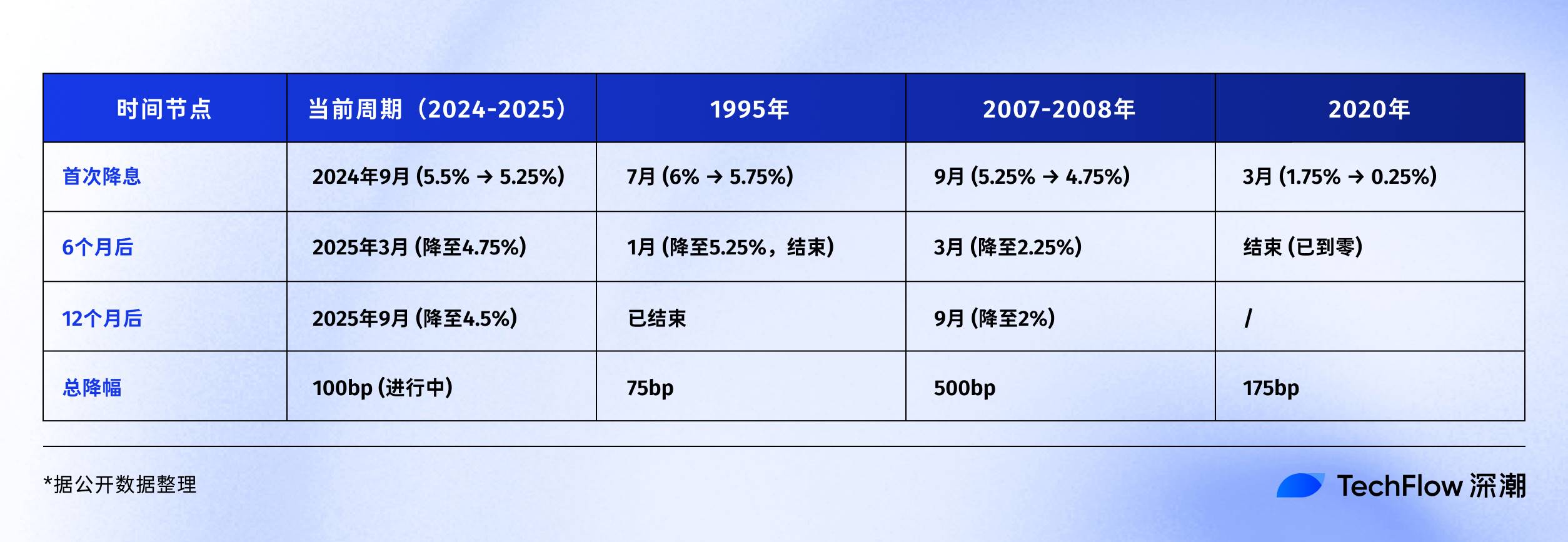

Reviewing the Fed's rate-cutting cycle: What’s next for Bitcoin, the stock market, and gold?

If history rhymes, the next 6-12 months could be a critical window.

深潮·2025/09/15 20:59

Will Tesla and xAI merge? Hedge fund tycoon: It feels inevitable

Positive remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a possible merger between Tesla and xAI.

ForesightNews·2025/09/15 20:43

Capital B Expands Bitcoin Holdings to 2,249 BTC, Yield Hits 1,536%

coinfomania·2025/09/15 20:12

Flash

- 00:59French, Austrian, and Italian regulators urge the EU to strengthen coordination of cryptocurrency regulationChainCatcher news, according to Bloomberg, after discovering differences in the implementation of cryptocurrency regulations among countries, financial regulators in France, Austria, and Italy have urged the EU's top regulatory body to directly supervise large cryptocurrency companies and tighten related rules. The EU will implement the Markets in Crypto-Assets Regulation (MiCA) at the end of 2024, requiring cryptocurrency companies to obtain a license in at least one EU member state in order to provide services across the entire EU. In a position paper released on Monday, the financial market regulators of the three countries stated that this approach exposes "significant differences" in the supervision of companies among countries, allowing companies to exploit loopholes. They suggested transferring the supervisory authority over the largest industry players to the European Securities and Markets Authority (ESMA). They also indicated that the initial implementation of MiCA has already shown limited regulatory convergence, making it difficult to ensure unified EU standards. An ESMA spokesperson responded that efforts are being made to ensure regulatory consistency, and that last year it was already considered necessary to reconsider areas where EU-level regulation should be strengthened. In addition, the three national regulators may take preventive measures to mitigate risks and have also called for strengthened regulation of global platforms, cybersecurity, and token issuance.

- 00:59The Fellowship PAC pledges to invest over 100 million dollars to support pro-innovation and pro-cryptocurrency political candidates.According to ChainCatcher, The Fellowship PAC has officially launched, pledging to invest over 100 millions USD to support pro-innovation and pro-cryptocurrency political candidates. The organization stated that its goal is to ensure the United States maintains its global leadership in digital assets and entrepreneurship, and its operations will be built on transparency and trust.

- 00:50MoonPay acquires crypto payment startup Meso Network, bringing on former PayPal and Venmo executivesChainCatcher news, according to Bloomberg, MoonPay Inc. has acquired the crypto payment startup Meso Network, moving towards building a global payment network that supports both crypto and fiat currencies, and enabling more direct competition with companies such as Circle Internet Group Inc. and Visa Inc. The terms of the deal were not disclosed. Its CEO Ivan Soto-Wright stated that the acquisition will enhance support for the U.S. banking system and optimize the developer platform to facilitate product integration. Meso co-founders Ali Aghareza and Ben Mills will serve as MoonPay’s Chief Technology Officer and Senior Vice President of Product, respectively. Previously, they worked at Braintree, a PayPal subsidiary, and Venmo. According to sources familiar with the matter, MoonPay is in talks with investors for a new round of financing, with its valuation expected to rise further from $3.4 billion in 2021. A spokesperson declined to comment. It is reported that the acquisition of Meso Network is MoonPay’s fourth acquisition this year, following the acquisitions of Iron, Helio, and the yet-to-be-announced Decent.xyz deal. Risk Warning