News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Morning Briefing (Nov 3) | Dash: This month's strong price performance attributed to strengthened fundamentals; Total open interest in ZK contracts surpasses $100 million, hitting a new all-time high; Bitcoin production cost rises to $112,084, approaching record levels2Bitcoin Short-Term Holders Face -1.4 P/L Ratio as Losses Deepen3Fed to Resume Treasury Purchases in Early 2026 as U.S. Economy Gains Relief

Ethereum Hong Kong Hub Launched at Digital Asset Forum

Coinlineup·2025/11/03 05:09

Top Crypto Picks 2025: BlockDAG Raises Over $435M In Presale While Solana, XRP, & Sui Trail Behind

Coinlineup·2025/11/03 05:09

Crypto Market Cautious Amid Fed Rate Speculation

Coinlineup·2025/11/03 05:09

Web3’s Future Focuses on Real Economic Utility

Coinlineup·2025/11/03 05:09

![[100% Win Rate Whale] Adds Another 140 BTC, Becomes [Heavy Holder Whale]!](https://img.bgstatic.com/multiLang/image/social/4a63a919063f3087e47ea7968a76880e1762143848305.png)

[100% Win Rate Whale] Adds Another 140 BTC, Becomes [Heavy Holder Whale]!

AICoin·2025/11/03 04:27

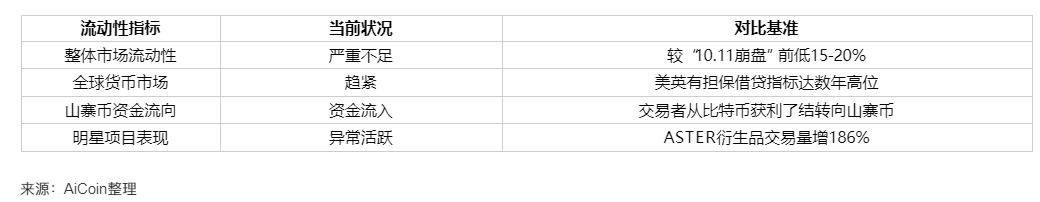

AiCoin Daily Report (November 3)

AICoin·2025/11/03 04:26

CZ openly builds a $2 million position and calls for ASTER, reigniting the battle in the decentralized derivatives arena

CZ has publicly disclosed his personal investment activities for the first time, purchasing 2.09 million Aster (ASTER) tokens, which drove the price up by 30%. As a decentralized perpetual contract exchange, Aster has quickly risen thanks to its technological advantages and CZ’s support, leading to fierce competition with Hyperliquid. Summary generated by Mars AI. This summary is produced by the Mars AI model; the accuracy and completeness of its generated content are still being iteratively improved.

MarsBit·2025/11/03 04:18

Flash

- 05:28Hong Kong SFC: Licensed virtual asset trading platforms will be allowed to connect to overseas liquidity through affiliated overseas platformsJinse Finance reported that on November 3, Leung Fung-yee, CEO of the Hong Kong Securities and Futures Commission (SFC), stated at Hong Kong Tech Week 2025 that the SFC's new policy will allow licensed virtual asset trading platforms to connect with overseas liquidity through affiliated overseas platforms, while implementing multiple safeguards to reduce settlement and integrity risks. For example, overseas virtual asset trading platforms are required to implement delivery-versus-payment and prepayment arrangements, establish a reserve fund in Hong Kong for compensation purposes, and launch a joint supervision program, aiming to strike an appropriate balance between convenience and protection. She emphasized that Hong Kong's regulatory regime is renowned for its visibility and transparency, providing clarity, certainty, and consistency for the market, thereby enhancing the confidence of market participants and supporting sustainable market development. The SFC has taken the lead in adopting the principle of "same business, same risk, same rules," actively participating in the International Organization of Securities Commissions' development of regulatory principles for central digital asset platforms, and promoting the adoption of similar standards in regulatory frameworks, including the Markets in Crypto-Assets Regulation. These coordinated efforts help strengthen connections and interoperability between markets.

- 05:13Hyperliquid's largest short seller "Abraxas Capital" has unrealized profits exceeding $50 million across two addresses, with total positions reaching $760 million.ChainCatcher News, according to HyperInsight monitoring, the total balance of two addresses labeled as Abraxas Capital (0x5b5, 0xb83) has risen from $165 million last Monday to $256 million. In the past 24 hours, these addresses ranked first in contract positions on Hyperliquid, with the total notional value of their positions increasing from $480 million to $760 million. In the past 24 hours, Abraxas Capital has continued to significantly increase its short positions in BTC and ETH. The main short positions of the two addresses have changed as follows compared to last week: ETH increased from $226 million to $267 million, BTC increased from $124 million to $280 million, and HYPE increased from $97.4 million to $103 million. According to monitoring, the total unrealized profit of the two addresses has reached $50.2 million. Among a total of 22 short positions currently held, only the main address (0x5b5) still has an unrealized loss on the ETH short position, with an average holding price of $3,531 and an unrealized loss of $12.57 million (about 54%).

- 05:12A whale who started accumulating at the beginning of a certain year deposited 3,000 ETH into a certain exchange.According to ChainCatcher, Onchain Lens monitoring shows that a certain whale has deposited 3,000 ETH worth $11,170,000 into an exchange. This address withdrew 8,009 ETH 249 days ago, which was worth $18,250,000 at that time, and it still holds 2,002 ETH. It is estimated that the total profit from its holdings is approximately $14,760,000.