News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 4) | Solana Mobile to Launch the SKR Token; Ethereum Mainnet Successfully Activates the Fusaka Upgrade; U.S. Initial Jobless Claims to Be Released Today at 13:302Ethereum treasury demand collapses: Will it delay ETH’s recovery to $4K?3Bitcoin’s strongest trading day since May cues possible rally to $107K

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

BTC_Chopsticks·2025/12/04 02:41

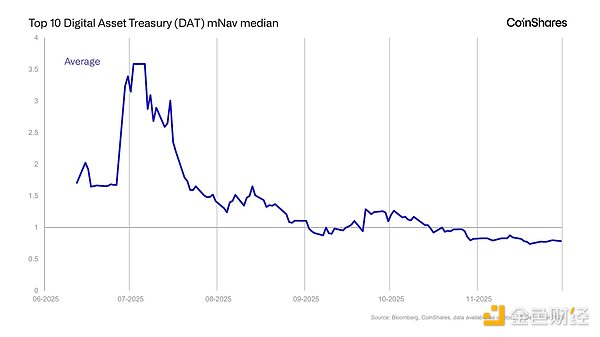

DAT: A Concept in Transition

金色财经·2025/12/04 02:20

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.

深潮·2025/12/04 02:12

Vitalik praised the Ethereum Fusaka upgrade.

Cointime·2025/12/04 02:12

Bitwise: Don't worry, the Strategy will never sell its bitcoin holdings

金色财经·2025/12/04 01:45

Massive Leverage Triggers Crypto Flash Crash

Cointribune·2025/12/04 01:39

Fusaka is activated: Ethereum enters a new era

Cointribune·2025/12/04 01:39

2026: The Year of Federal Reserve Regime Change

The Federal Reserve will shift away from the technocratic caution characteristic of the Powell era and move toward a new mission that explicitly prioritizes lowering borrowing costs to advance the president’s economic agenda.

Block unicorn·2025/12/04 00:52

Flash

- 03:02Columbus Circle Capital Corp I shareholders approve merger with ProCap BTC businessJinse Finance reported that shareholders of Columbus Circle Capital Corp I (NASDAQ: BRR) approved the business combination with bitcoin financial services company ProCap BTC on December 3, 2025. The transaction is expected to be completed on December 5, and the merged company will be renamed ProCap Financial, Inc., continuing to trade on the Nasdaq Global Market under the ticker "BRR". ProCap BTC has raised over $750 million from traditional finance and bitcoin industry investors.

- 02:59The former product director of a certain exchange will join Y Combinator as a visiting partner.ChainCatcher reported that former Product Director of a certain exchange, Nemil Dalal, will join Y Combinator as a Visiting Partner, focusing on the crypto sector. "Personally, YC had a transformative impact on me in 2012. It allowed me to gain invaluable lessons that enabled me to build early-stage startups. This greatly benefited me later in incubating products such as USDC, the exchange's Developer Platform, and x402. I am glad to give back to the YC community, which has given me so much." Nemil Dalal worked at the exchange for 7 years, driving the development of USDC, DeFi, and developer tools.

- 02:45Analysis: Bitcoin selling pressure is gradually weakening but demand remains lacking; the reasonable expectation for December is stabilization rather than an immediate rebound.According to ChainCatcher, trader Murphy posted that the main sources of selling pressure currently come from the profitable chips of long-term holders (LTH) and the underwater chips of short-term holders (STH) of bitcoin. For STH, after panic sentiment is released in a concentrated manner, if the price stabilizes or shifts from a sharp drop to a slow decline, the selling pressure will gradually decrease; for LTH, if their realized profit and loss ratio declines, their motivation to sell will also decrease. Currently, the number of new BTC addresses has temporarily stabilized after a round of decline, but the amount of BTC held by these addresses is still decreasing. This indicates that the overall risk appetite of BTC investors has not significantly improved, resulting in a lack of new demand. He believes that before seeing a clear recovery on the demand side, a reasonable expectation for BTC in December should not be an immediate reversal, but rather no further sharp or deep declines, and a corresponding rebound after an oversold situation.

News

![[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems](https://img.bgstatic.com/multiLang/image/social/44682a8c7537c9a9b467e17ed74a704d1764777241317.jpg)