News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The coming months may present a good opportunity for wallet projects to launch their tokens.

$MASK could potentially reach a 12 billion USD FDV and bring about the largest airdrop in history.

Tether is building a crypto empire.

L2 "publicization" is already imminent.

Tether has launched a compliant stablecoin, USAT, which meets the requirements of the U.S. GENIUS Act while maintaining the original USDT's global market strategy, forming a dual-track operational model. Summary generated by Mars AI. The content generated by the Mars AI model is still in the iterative update stage in terms of accuracy and completeness.

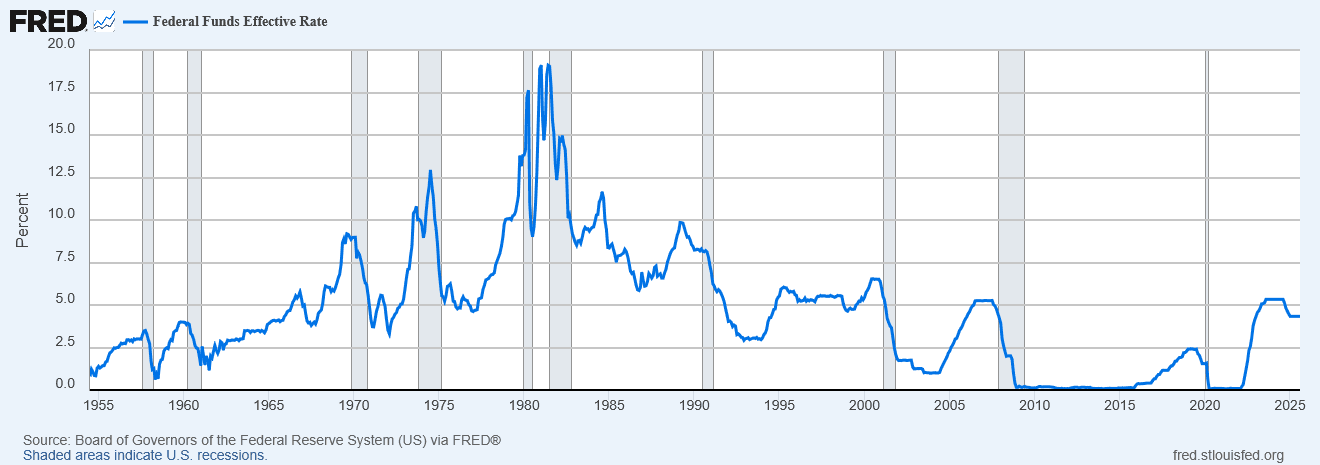

Powell speaks again one week after the interest rate cut. What will happen to the market next?

The attacker carried out a series of operations, including calling the execTransaction function of the Gnosis Safe Proxy contract and the MultiSend contract, gradually removing other owners, ultimately taking over the contract and maliciously minting UXLINK tokens.

Powell acknowledged that the current interest rates remain somewhat restrictive, but this allows us to better respond to potential economic developments.

- 13:34The White House is considering nominating Josh Sterling as CFTC ChairmanJinse Finance reported that the White House is considering nominating Josh Sterling as Chairman of the CFTC. Josh Sterling previously served as the Director of the Market Participants Division at the Commodity Futures Trading Commission (CFTC). His responsibilities at the CFTC included overseeing registered participants in the U.S. derivatives market, such as banks, intermediaries, and asset management firms; supervising whether these institutions comply with reporting rules, registration requirements, and the compliance of trading activities. He also participated in the CFTC's rulemaking under the Dodd-Frank Act and promoted several landmark enforcement cases. Sterling is currently a partner at Milbank LLP, focusing on regulatory and enforcement matters in derivatives, financial market infrastructure, and cryptocurrencies.

- 13:34US court rejects Justin Sun's request to prevent Bloomberg from disclosing his crypto asset portfolio worth over $3 billionsChainCatcher news, according to Cryptonews, Judge Colm Connolly of the United States District Court for the District of Delaware has ruled in favor of Bloomberg in the lawsuit filed by Justin Sun. Previously, Justin Sun had filed a second motion seeking a temporary restraining order and other measures to prohibit Bloomberg from disclosing his specific cryptocurrency holdings. The judge ruled that Justin Sun failed to prove that Bloomberg had agreed not to disclose details of his assets, and that he must provide clear and convincing evidence that Bloomberg had made such a commitment. Court documents show that Justin Sun holds 60 billion TRX, 17,000 BTC, 224,000 ETH, and 700 million USDT. In February this year, Bloomberg contacted Justin Sun's team to compile the Billionaires Index. After the article was published, he first filed a lawsuit and then withdrew it. After failed negotiations, on September 11, Justin Sun filed another motion requesting Bloomberg to delete the relevant content. He claimed that the reporter had promised confidentiality, but Bloomberg denied this. The judge also found that Justin Sun failed to prove that the disclosure of information would make him more vulnerable, and that the Bitcoin information he himself disclosed was even more specific.

- 13:34Data: Total value of tokenized RWA on Solana chain rises to $671 million, reaching a new all-time highAccording to ChainCatcher, citing SolanaFloor data, the total value of tokenized real-world assets (RWA) on the Solana chain has risen to $671 million, setting a new all-time high. Previously, more than $150 million in funds flowed into BlackRock's BUIDL fund on the Solana chain.