News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

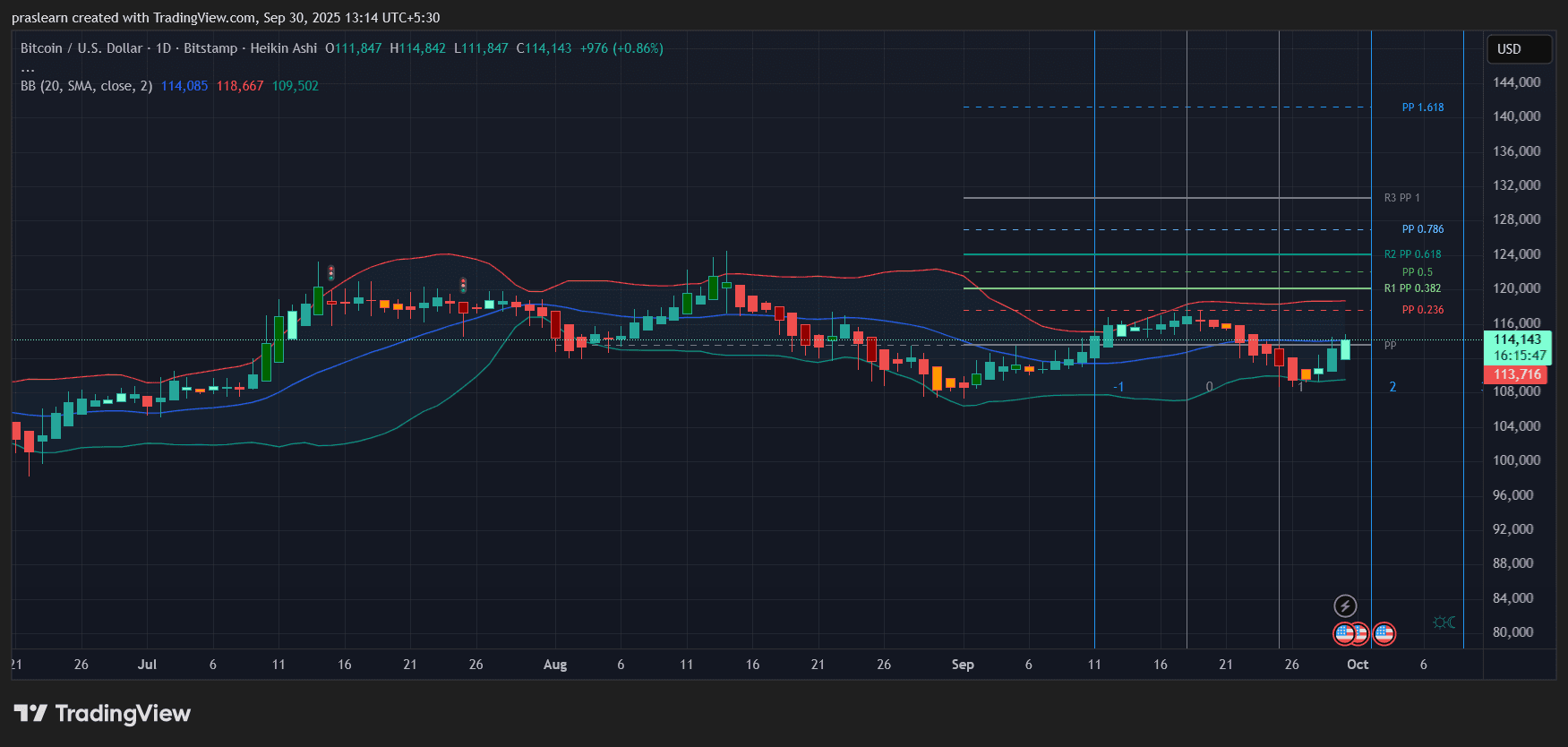

1Bitget Daily Digest(September 30)|The TOKEN2049 Singapore 2025 conference is about to kick off, with several key token unlocks scheduled in the coming days.2Research Report|In-Depth Analysis and Market Cap of Falcon Finance(FF)3Will Bitcoin drop to $95,000 or surge toward $140,000? Cycle signals reveal the real direction

Quant Unveils QuantNet as QNT Eyes a Breakout Toward $130

CryptoNewsNet·2025/09/30 11:45

SEC, CFTC Pledge Closer Cooperation, ‘Harmonization’ on Crypto and Market Oversight

CryptoNewsNet·2025/09/30 11:45

Indonesian University Rolls Out On-chain Records At No Cost to Students

CryptoNewsNet·2025/09/30 11:45

Bitcoin Options Tied to BlackRock’s IBIT Are Now Wall Street’s Favorite

CryptoNewsNet·2025/09/30 11:45

Sonic (S) Defends Key Support – Will This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/09/30 11:36

Hedera (HBAR) Defends Key Support – Could This Pattern Trigger An Upside Breakout?

CoinsProbe·2025/09/30 11:36

After Plasma and Falcon, how can one participate in USD.AI, the highly anticipated "next-generation miracle mining project"?

This year, Framework has led investments in two stablecoin projects: one is Plasma, which has surpassed 10 billion, and the other is USD.AI.

BlockBeats·2025/09/30 11:34

What will happen to bitcoin if the US government shuts down?

Traders who rely on U.S. employment data to determine whether the Federal Reserve will cut rates again may need to wait for a while.

BlockBeats·2025/09/30 11:33

Bitcoin and Ethereum ETFs see over $1B in inflows as crypto looks set to stage comeback

Coinjournal·2025/09/30 11:33

How A U.S. Government Shutdown Could Affect The Bitcoin Price?

Cryptoticker·2025/09/30 11:24

Flash

- 11:49Jia Yueting enters the crypto sector, leading Faraday Future to co-lead Qualigen's $41 million financing roundOn September 30, according to official news, Qualigen Therapeutics, Inc. (NASDAQ: QLGN) announced today the successful completion of a $41 million PIPE financing. This round was led by Faraday Future Intelligent Electric Inc. (NASDAQ: FFAI), with its founder and Global Co-CEO Jia Yueting, President Jerry Wang, as well as SIGN Foundation, Sequoia Capital (US, India, China), IDG, Circle, and other institutions participating. Faraday Future invested $30 million to acquire Qualigen common and preferred stock, accounting for approximately 55% of the post-financing total equity. Jia Yueting personally invested about $4 million and voluntarily locked up his shares for two years, holding about 7% equity. The company plans to use most of the funds to expand its new crypto business. This financing marks a key milestone for Qualigen's strategic transformation towards Web3 and the crypto sector, with the company planning to rename itself CXC10. In the future, while maintaining its existing business, the company will focus on building its crypto business around three major growth engines and six core products: · C10 Value Anchoring System: Establishing a value benchmark through the C10 digital asset library, C10 index, and a potential C10 ETF · DeAI Intelligent Agent: Launching the AI crypto trading assistant BesTrade, connecting users with value discovery · RWA and Ecosystem Tokens: Issuing the C10 stablecoin and "AI+Crypto" dual-bridge RWA products, linking traditional assets with Web3 The company's goal is to become a top US-listed company connecting Web2 and Web3, AI and crypto, and to pioneer a new paradigm combining AI, crypto, and the traditional economy. With this round of financing, Jerry Wang will serve as Co-CEO, Jia Yueting as Chief Advisor, and Faraday Future CFO Koti Meka will also serve as Qualigen CFO.

- 11:49Bitcoin ATM service provider Bitcoin Well plans to raise 100 million USD to increase its BTC holdingsChainCatcher News: According to market sources, Bitcoin Well, a Bitcoin ATM service provider listed in Canada, has announced plans to raise 100 million USD to support its Bitcoin treasury in increasing its Bitcoin holdings.

- 11:37Republic plans to launch Animoca Brands equity tokenization solution on SolanaJinse Finance reported that investment platform Republic announced today its plan to tokenize the equity of Animoca Brands, a global leader in the Web3 sector. This initiative will provide global investors with a new way to access Animoca Brands. Reportedly, Animoca Brands holds over 600 leading Web3 investments and leverages tokenization technology and blockchain to offer digital property rights services to consumers. Currently, Animoca Brands' shares are not listed on any public exchange, and the traditional way for investors to acquire equity in the company is mainly through the over-the-counter secondary market. Republic's equity tokenization solution will utilize blockchain technology to create a more efficient and transparent investment method, expanding investor participation channels while complying with regulatory requirements. The tokenized equity will be minted on the Solana blockchain and distributed to the wallets of participating investors. Token trading will be facilitated through Republic's global trading marketplace. More details about the tokenization process will be announced later.