News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

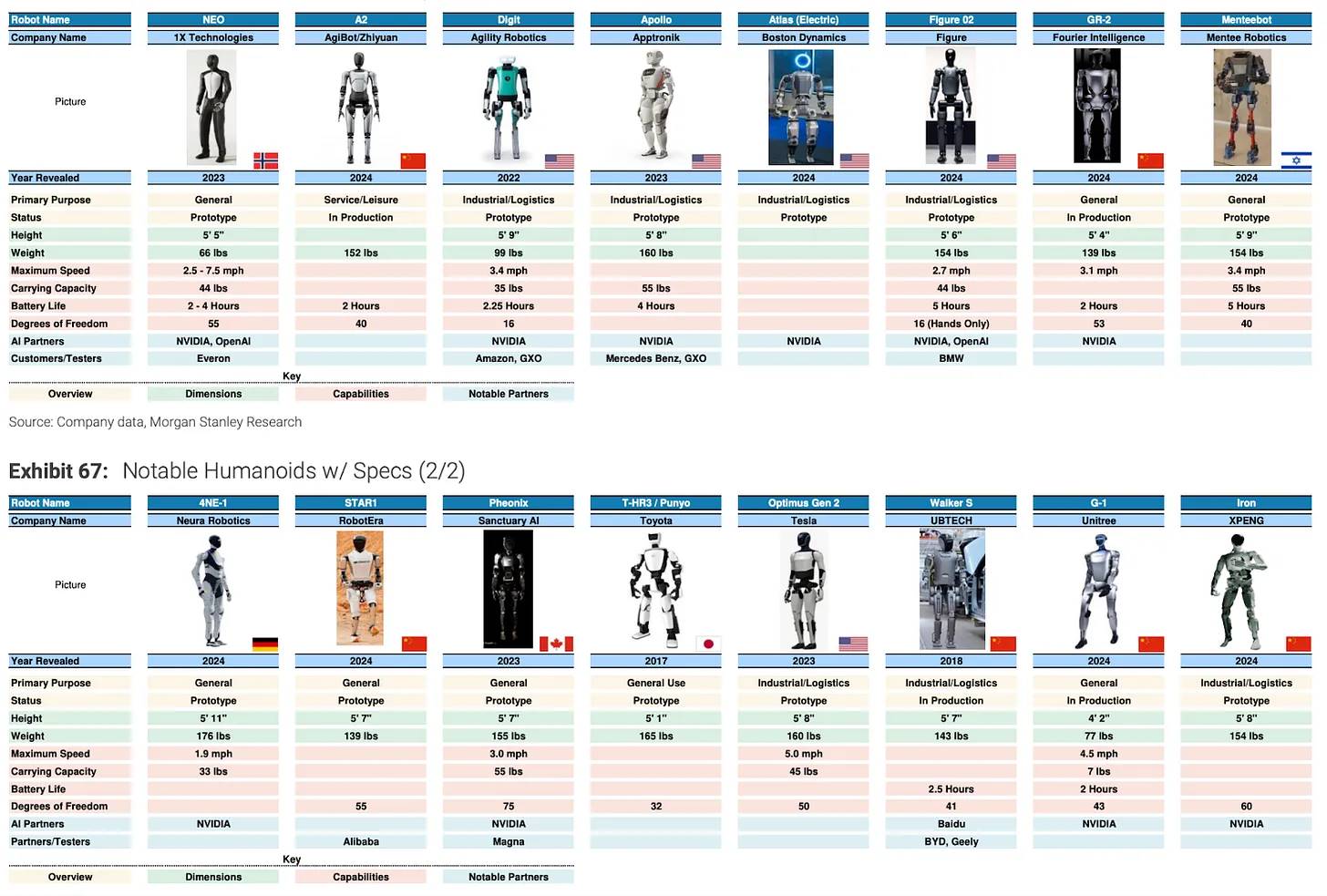

Embodied intelligence x Web3: Structurally driven solutions create investable opportunities.

The goal of transforming traditional finance with Ethereum does not necessarily have to be achieved through DeFi.

Tether and Circle have minted $12 billion in stablecoins over the past month; Figma holds $90.8 million in spot bitcoin ETFs; Russia plans to lower the entry threshold for crypto trading; Ethereum ICO participants have staked 150,000 ETH; REX-Osprey may launch a DOGE spot ETF. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

U.S. non-farm payroll data for August fell far short of expectations, with the unemployment rate hitting a new high. Market expectations for a Federal Reserve rate cut in September have risen significantly, causing sharp volatility in the cryptocurrency market. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Sei once surpassed Solana in active users. By leveraging EVM compatibility and a high-performance architecture, Sei is propelling itself onto a new growth trajectory and becoming a focal point in the industry narrative.

- 03:01After losing $10.67 million chasing ETH last night, a certain whale address switched to shorting BTC, with a position valued at $122 million.BlockBeats News, September 6, according to on-chain data analyst Yujin's monitoring, a certain whale address lost $10.67 million by chasing ETH after last night's non-farm payroll data, and has lost a total of $35.84 million on long ETH positions. Now, this address has switched to shorting BTC. After closing all ETH long positions with a stop loss last night, the address has gradually opened short BTC positions over the past 5 hours. Currently, it has shorted 1,107 BTC, with a position value of $122 million. The opening price was $111,390, the liquidation price is $116,824, and the current unrealized profit is $830,000.

- 03:01Arkham: 45,000 BTC Unaccounted for by the German Government May Still Be Controlled by Movie2K OperatorsBlockBeats News, on September 6, Arkham posted on social media stating that the institution has identified $5 billion worth of bitcoin that the German government failed to seize. Previously, at the beginning of 2024, German police confiscated 49,858 bitcoin from the operators of the movie piracy website Movie2K, and sold them in July 2024 at an average price of $57,900, earning $2.89 billions. However, Arkham's investigation discovered another bitcoin cluster related to early Movie2K activities, totaling approximately 45,000 bitcoin (currently valued at $4.99 billions). These bitcoin have not been moved since 2019 and are distributed across more than 100 bitcoin wallets, most likely still controlled by the Movie2K operators. The scale is almost equivalent to the amount of bitcoin that was seized. The German government's statement did not mention this additional batch of bitcoin, nor was it included in the original "emergency sale" plan.

- 02:53WLFI: Blacklist will only be enabled to protect users and will not interfere with normal activitiesForesight News reported that the Trump family crypto project WLFI posted on Twitter, stating that its team has noticed the community's concerns regarding the recent wallet blacklist. WLFI only intervenes to protect users and will never interfere with normal activities. In the past few days, a total of 272 wallets have been blacklisted, accounting for only a very small portion of the total holders. This action is purely a temporary measure taken to prevent harm during the investigation and to assist affected users. Among these 272 addresses, 215 (about 79%) are related to phishing attacks, 50 (about 18.4%) were reported as stolen by their owners through support channels and were blacklisted for protection at the owners' request, 5 (about 1.8%) were flagged due to high-risk exposure, and 1 (about 0.4%) is suspected of misappropriating funds from other holders and is currently undergoing a comprehensive internal review.