News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

Bitcoinworld·2025/12/18 03:06

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

BlockBeats·2025/12/18 03:02

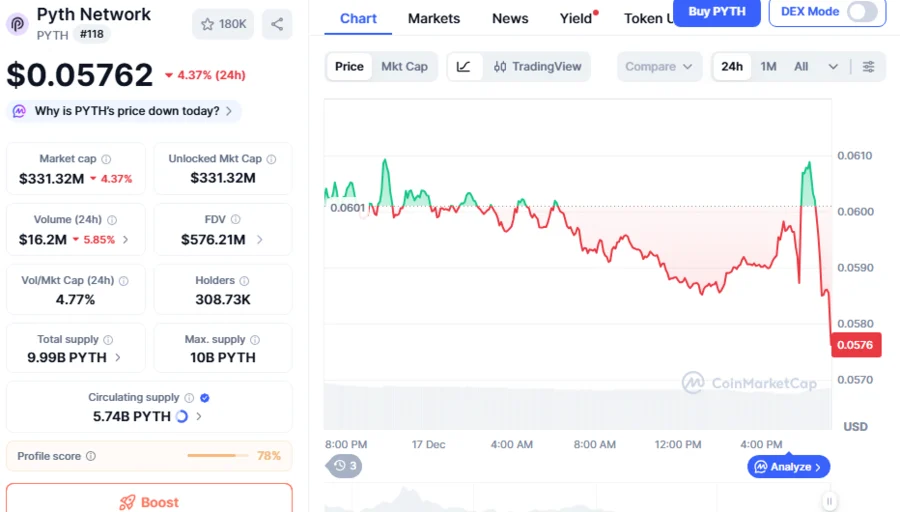

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

BlockchainReporter·2025/12/18 03:00

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day

Bitcoinworld·2025/12/18 02:57

Pieverse Opens a New Chapter: Agentic Neobank

Chaincatcher·2025/12/18 02:22

Cronos Labs launches Cronos One, a comprehensive solution for web3 beginners

币界网·2025/12/18 02:11

Unleash X402 with Yooldo: Revolutionizing the Web3 Gaming Experience

TechFlow深潮·2025/12/18 02:05

Revolutionary Move: Danal Becomes First Korean Firm in Circle’s Alliance Program

Bitcoinworld·2025/12/18 01:57

Ondo and LayerZero jointly launch cross-chain bridge for tokenized stocks and ETFs

TechFlow深潮·2025/12/18 01:53

Flash

03:19

QCP: Fed Policy Flattens, AI Investments and Cryptocurrencies Face Structural ChallengesAccording to TechFlow, on December 18, QCP released a briefing stating that the latest FOMC meeting of the Federal Reserve sent cautious signals, with the policy path clearly flattening and the market expecting about 2.3 rate cuts next year. The policy remains "data-dependent," aiming to stabilize the labor market while controlling inflation. The Federal Reserve's $40 billion Treasury purchase plan has already lowered repo rates by 25 basis points to 4%, easing some funding pressures. At the same time, the mismatch between investment and returns in the AI sector is becoming increasingly prominent. Although capital continues to flow into AI infrastructure, revenue growth lags behind. If returns cannot be realized, it may trigger a broader stock market valuation adjustment. The cryptocurrency market is facing new structural risks. MSCI is evaluating the exclusion of companies with more than 50% cryptocurrency exposure from its indices, which could lead to passive outflows of up to $2.8 billion. Although regulatory environments in regions such as Japan are gradually improving, the balance between market resilience and fragility remains delicate.

03:15

Suspected Astra Nova team has once again transferred RVV tokens worth $430,000 to an exchangePANews, December 18—According to monitoring by onchainschool.pro, from last night to early this morning, a wallet suspected to belong to the Astra Nova team transferred RVV tokens worth $430,000 to an exchange. Similar fund transfers from this wallet have been ongoing for over a month. During this period, a total of approximately $1.5 million worth of RVV has been sent to an exchange. The wallet currently still holds about $22.8 million worth of RVV tokens.

03:14

Circle launches Arc Builders FundForesight News reported that Circle has launched the Arc L1 Blockchain Builders Fund. The fund aims to accelerate innovation, with a focus on supporting project teams that can fully leverage the design advantages of Arc. This includes on-chain markets with low-latency architecture; RWA and private credit markets built on private composable rails; on-chain foreign exchange flows combining Circle StableFX and the Circle payment network; intelligent commerce for autonomous systems and the machine economy; and energy and computing protocols based on deterministic settlement.

News