News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

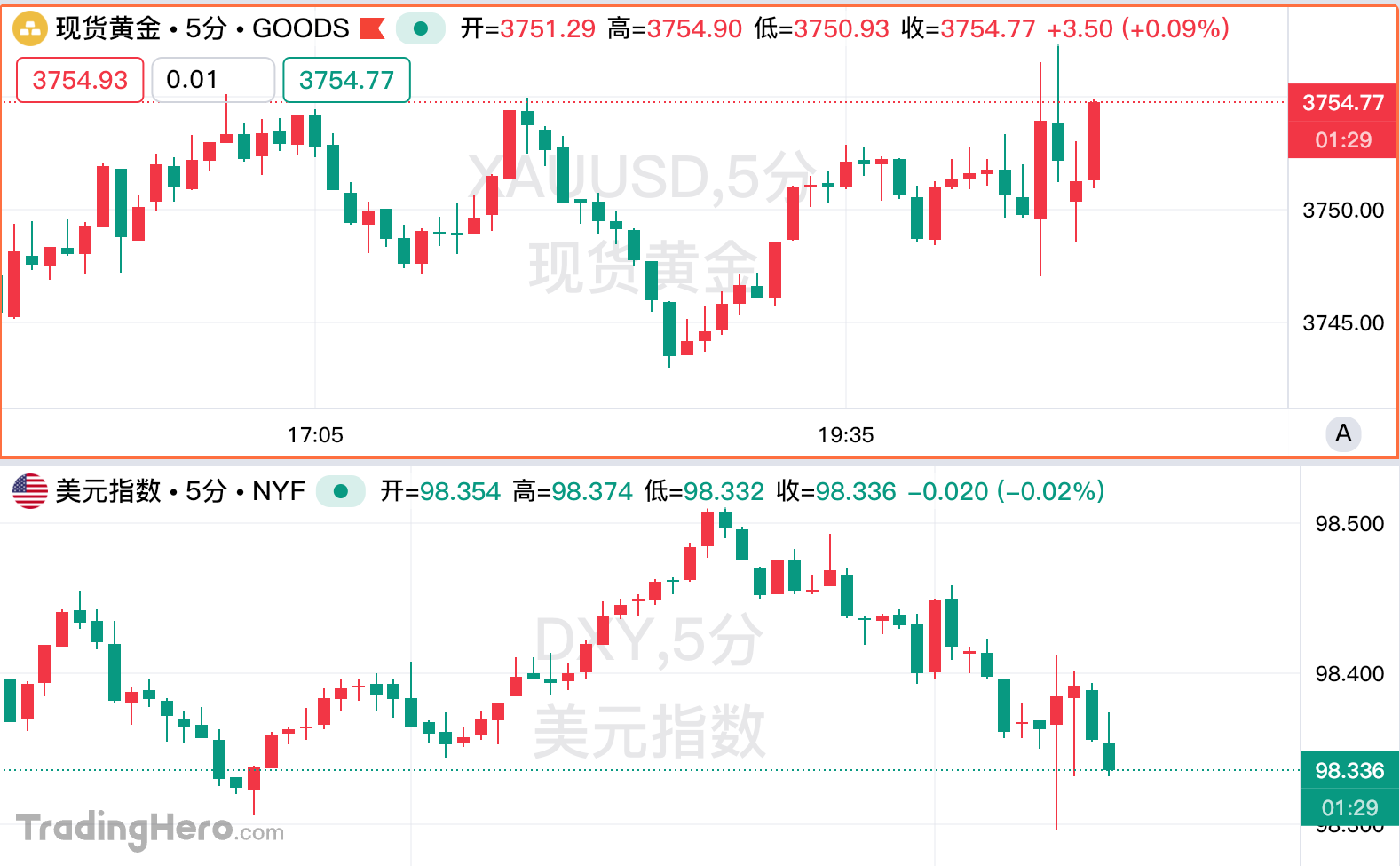

U.S. PCE data met expectations, with personal spending growth reaching its highest level since March this year. The Federal Reserve is likely to maintain its previously established pace of rate cuts.

Can DeFi and social applications ignite the second half of the Solana bull market?

Quick Take Summary is AI generated, newsroom reviewed. A major whale is sitting on a $16M unrealized loss after buying 60,333 ETH at an average cost of $4,230, as the price slipped below $4,000. The massive $238.7 million position was primarily acquired through OTC deals from custodians like Coinbase and Wintermute. The whale is using a portion of the ETH for yield generation by depositing it into Aave's Wrapped Token Gateway, not selling yet. The mistimed large-scale accumulation highlights the volatility

Quick Take Summary is AI generated, newsroom reviewed. Nimbus v25.9.1 released on September 26, 2025. Low urgency on mainnet, high urgency on Hoodi, Sepolia, Holesky. Fusaka fork dates: Holesky (Oct 2), Sepolia (Oct 16), Hoodi (Oct 30). Nimbus uses 0.5–1 CPU core, 300–500 MB RAM, lighter than rivals.References X Post Rference

- 16:29Plasma absorbs over $4 billion worth of cryptocurrencies within 24 hours of launch, ranking eighth in blockchain DeFi total value locked.According to ChainCatcher, the stablecoin L1 blockchain Plasma absorbed over $4 billion worth of cryptocurrencies within 24 hours of its launch, ranking eighth in blockchain DeFi deposit value. This is mainly attributed to users locking assets in Plasma lending vaults and partner DeFi protocols, who can earn the network's native token XPL. Plasma's initial success has driven up the price of the XPL token, which has risen 30% from its opening price and is currently around $1.2, corresponding to a fully diluted valuation of nearly $12 billion—24 times higher than the $50 million valuation during its public sale in June. For investors who participated in Plasma's seed round on the early investment platform Echo last November, this represents an astonishing 324-fold return.

- 16:16Anthropic: International staff to double, AI team to expand fivefoldJinse Finance reported that the number of business clients for the US AI startup Anthropic has surged from less than 1,000 to over 300,000 in just two years, with demand for its Claude AI model growing across industries and regions. The company announced that it will triple its international workforce by 2025 and expand its applied AI team fivefold.

- 16:11The Baby Shark token on Story Protocol plummeted 90% after the creator denied authorization.ChainCatcher news, according to CoinDesk, the Baby Shark token, which claimed to officially represent the most viewed video on YouTube, plummeted by 90% after the issuing platform revealed that the company minting this meme coin realized after the fact that it did not have the rights to issue it. The price of the token on Story Protocol crashed from a high of $0.35 on Tuesday to less than $0.00064. Previously, Seoul-based brand owner Pinkfong Co. issued an official statement on the X platform on Friday, stating that the token "has absolutely no association with the company." "Baby Shark" is a two-minute animated music short aimed at young children, which has garnered over 16 billion views since its release in 2016. The token was issued through IP.World, and its market cap once reached $200 million. IP.World stated that there were flaws in the rights provided by Pinkfong's licensing agent on which it relied, and its verification process hindered the distribution of creator fees. In its statement, Pinkfong Co. said that only the Baby Shark meme coin on Solana and the Baby Shark Universe token on BNB Chain are officially recognized assets. However, this statement failed to calm traders, who had previously mistaken the token as an official collaboration project of Pinkfong Co., a misunderstanding further exacerbated by influencer endorsements and Story Protocol's own promotional efforts.