News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

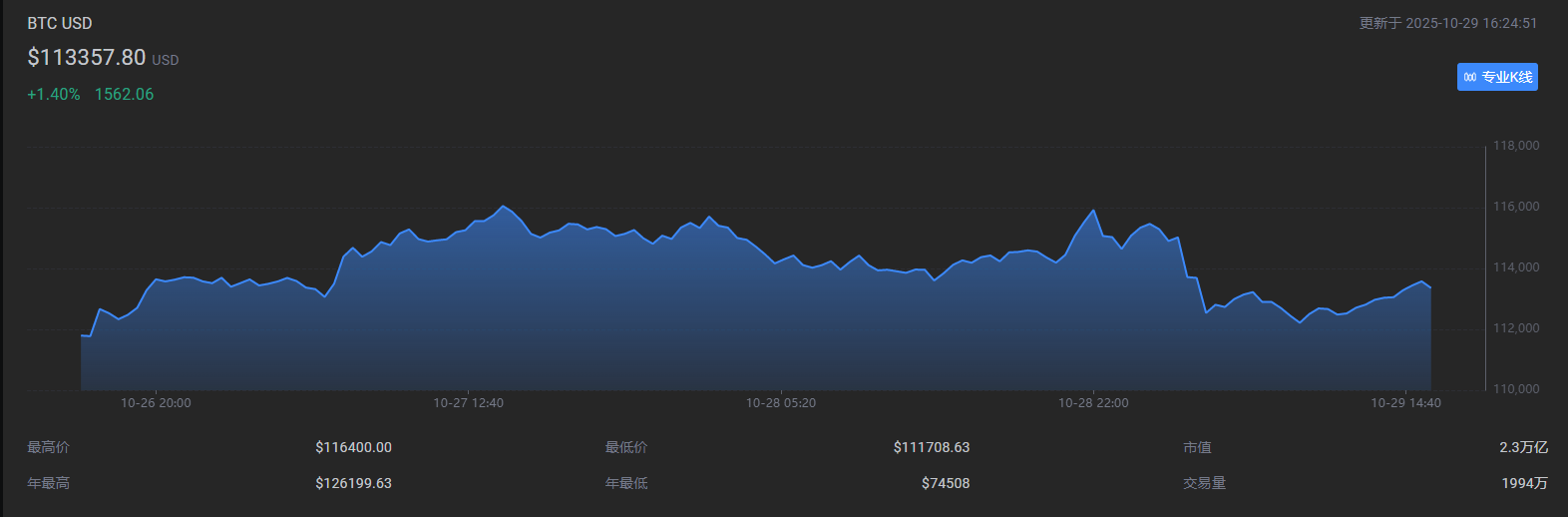

Risk appetite has not yet increased, and liquidity in the crypto market remains extremely tight.

The improvement in the US-China tariff war and BTC has once again fallen to the bull-bear dividing line, with cyclical patterns indicating clear signs of a "peak."

Bittensor is migrating Bitcoin-style mining to AI through "incentivized computation," building an open multi-subnet marketplace powered by TAO, where inference, training, and computing power providers are rewarded based on performance. Jacob visited China for the first time, discussing his experience leaving Google, ecosystem expansion in Asia, TAO halving, protocol revenue, and his five-year vision.

DAT's corporate structure possesses unique advantages that ETFs cannot match, which is precisely why it commands a premium over its book value.

x402 ignites the AI payment revolution as AEON takes the lead in bringing it to global commerce.

![[October 11 Short Whale] Sells Another 200 BTC—What Kind of Market Trend Will Collide with the Federal Reserve Decision?](https://img.bgstatic.com/multiLang/image/social/79491c3fe8d0d3b17d283ebd2a9faa8e1761739967786.png)

The cryptocurrency market showed signs of recovery in October 2025, with investor sentiment shifting from cautious to cautiously optimistic. Net capital inflow turned positive, institutional participation increased, and the regulatory environment improved. Bitcoin spot ETF saw significant capital inflows, while the approval of altcoin ETFs injected new liquidity into the market. On the macro level, expectations of a Federal Reserve rate cut intensified, and the global policy environment became more favorable. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved and updated.

- 12:54Fed Decision Preview: Powell's Press Conference May Deliver a Hawkish SurpriseJinse Finance reported that the press conference of Federal Reserve Chairman Powell is the most closely watched event in the market. The current basic situation is that, in the absence of government data, Federal Reserve Chairman Powell will maintain the status quo and will not reveal much in terms of forward guidance. The only thing that could surprise the market is if he expresses uncertainty about a rate cut in December, which is likely to be seen as a hawkish surprise, since the market is currently very confident about a rate cut in December. In theory, the market's direct reaction to this would be: US stocks falling, US Treasury yields rising, short-term bond yields rising faster than long-term bond yields, the US dollar strengthening significantly, and precious metals such as gold and silver declining. On the other hand, if Powell's stance on a December rate cut remains unchanged, the market will continue to fluctuate based on the development of trade conditions. (Golden Ten Data)

- 12:46BlackRock: Reports of strategic investment in Treasure NFT are falseJinse Finance reported, citing market sources: Recently, a series of false posts have appeared, claiming that BlackRock has made a strategic investment in TreasureNFT. This information is untrue. BlackRock has no association with TreasureNFT.

- 12:45Fed Decision Preview: Market Focus on Powell's Press ConferenceJinse Finance reported that the market generally expects the Federal Reserve to cut interest rates by 25 basis points, adjusting the policy rate to 3.75-4.00%. At the same time, it is expected that the central bank will announce the end of quantitative tightening (QT). This meeting will not release the quarterly economic outlook report, so the main focus will be on Powell's press conference. It is expected that Federal Reserve Chairman Powell will once again characterize the rate cut as a risk management measure and, in the absence of key economic data, will not disclose too much information in order to maintain stable market expectations. The current market expectation is that a rate cut by the Federal Reserve in October is a certainty, and the probability of a rate cut in December is also close to 100%. By 2026, a cumulative rate cut of 117 basis points is expected, higher than the 75 basis points projected by the Federal Reserve. (Golden Ten Data)