News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

After the FOMC meeting, bitcoin entered a correction phase. Long-term holders realized profits on 3.4 million BTC, and the slowdown in ETF inflows has made the market more vulnerable. Both spot and futures markets are under pressure, and the cost basis for short-term holders at $111,000 is a key support level. Summary generated by Mars AI. The accuracy and completeness of this summary are still under iterative improvement.

Goldman Sachs trader Paolo Schiavone warns that the bitcoin flash crash is a signal of a market shift and that the frenzy in risk assets may cool down. He believes that after a short-term correction, the market will move towards a "melt-up" scenario. While technical indicators show warning signals, fundamentals still support buying. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

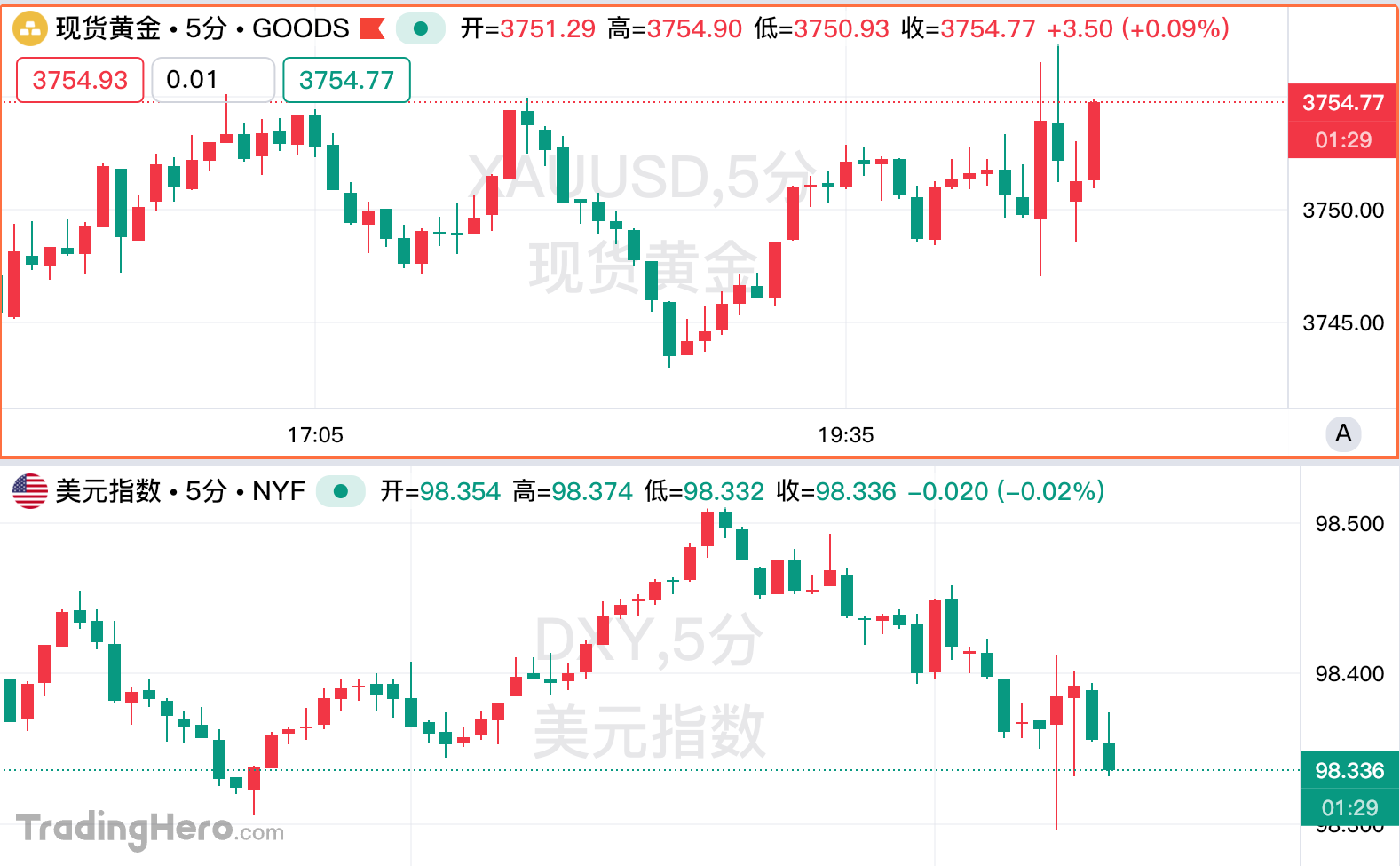

U.S. PCE data met expectations, with personal spending growth reaching its highest level since March this year. The Federal Reserve is likely to maintain its previously established pace of rate cuts.

- 16:53SoftBank and ARK are in talks to participate in Tether’s major funding roundJinse Finance reported that SoftBank and ARK are in talks to participate in Tether's major financing round. Tether, the world's largest stablecoin issuer, is seeking to raise up to $20 billion at a $500 billion valuation. This deal could make Tether one of the most valuable private companies globally, putting it on par with OpenAI and SpaceX. Tether aims to raise $15 billion to $20 billion through a private placement, accounting for about 3% of the company's shares. Negotiations are still in the early stages.

- 16:53If a U.S. government shutdown delays the September jobs report, the FOMC meeting will face a data gap.Jinse Finance reported that according to the contingency plan released earlier this year by the U.S. Department of Labor, if the federal government shuts down, the September employment report originally scheduled for release next Friday will be delayed. The specific scope of the government's shutdown impact is still unclear, as most government agencies—including the Bureau of Labor Statistics, which is responsible for compiling the monthly employment report—have not yet publicly updated their contingency plans. If Congress fails to pass the spending bill by next Tuesday, these agencies will operate according to their contingency plans. According to a plan updated by the Department of Labor in March last year, once a shutdown occurs, all data collection work and planned data releases will be suspended. If the government shutdown continues and the Bureau of Labor Statistics delays data releases, the Federal Reserve will lack several key employment and inflation economic data before its next policy meeting on October 28-29, which will undoubtedly increase the risks of policy-making.

- 16:29Plasma absorbs over $4 billion worth of cryptocurrencies within 24 hours of launch, ranking eighth in blockchain DeFi total value locked.According to ChainCatcher, the stablecoin L1 blockchain Plasma absorbed over $4 billion worth of cryptocurrencies within 24 hours of its launch, ranking eighth in blockchain DeFi deposit value. This is mainly attributed to users locking assets in Plasma lending vaults and partner DeFi protocols, who can earn the network's native token XPL. Plasma's initial success has driven up the price of the XPL token, which has risen 30% from its opening price and is currently around $1.2, corresponding to a fully diluted valuation of nearly $12 billion—24 times higher than the $50 million valuation during its public sale in June. For investors who participated in Plasma's seed round on the early investment platform Echo last November, this represents an astonishing 324-fold return.