News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

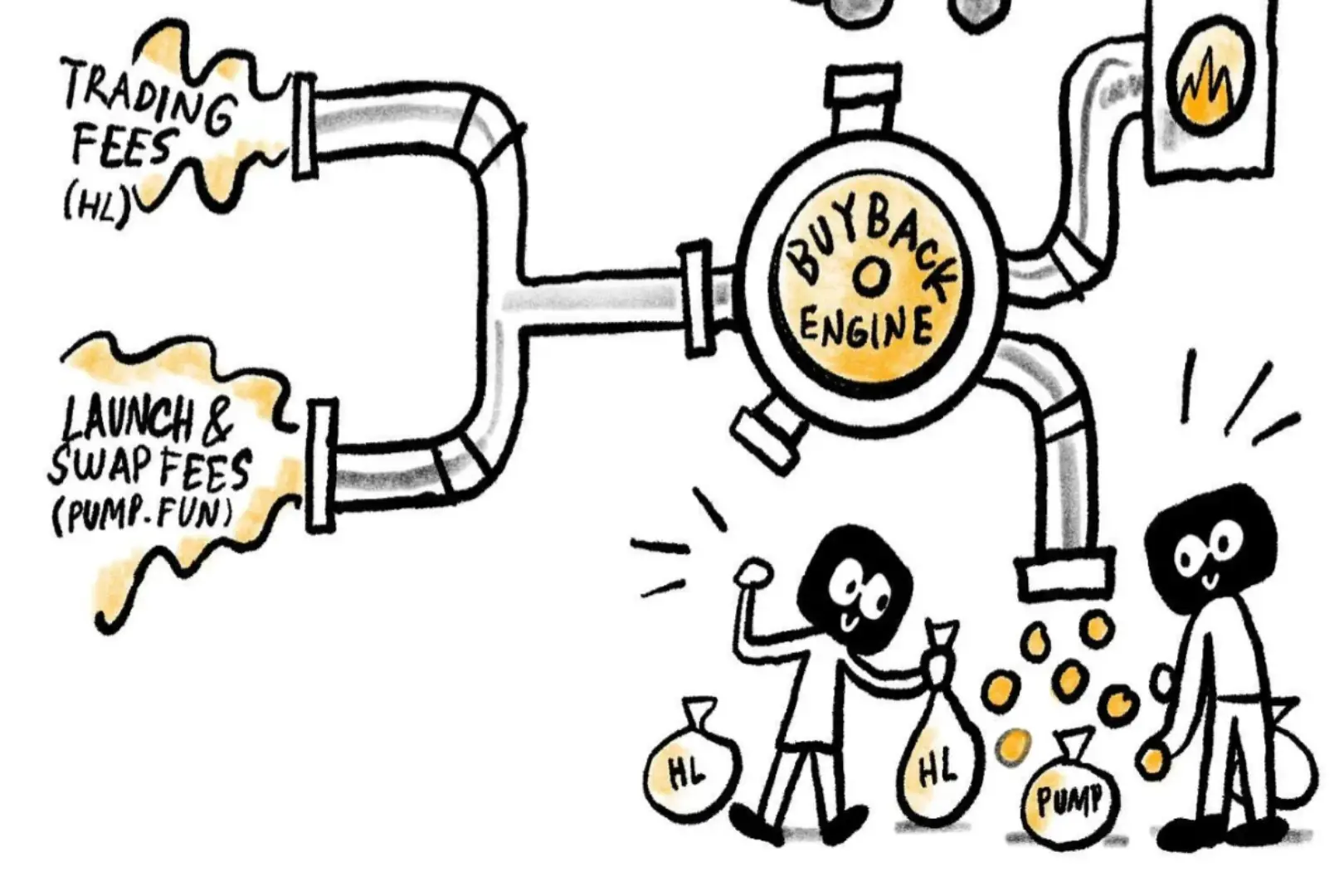

The author, Prathik Desai, points out that two major "revenue engines" in the crypto industry—perpetual contract exchange Hyperliquid and meme coin issuance platform Pump.fun—are adopting a large-scale token buyback strategy similar to Apple's massive stock repurchase approach. They are using almost all of their revenues at an astonishing pace to buy back their own tokens, aiming to transform crypto tokens into financial products with "shareholder equity proxy" attributes.

The five major projects of the TRON ecosystem made a collective appearance at the Token2049 summit, systematically showcasing their collaborative "infrastructure-application ecosystem" architecture.

Hyperliquid's tech stack has significantly lowered the barrier to entry for mobile frontend development, with retail users increasingly expecting a mobile-native transaction experience in traditional finance, a trend that is now extending to the cryptocurrency space.

There are two directions for Ethereum, and both are very important.

In Brief Zade foresees no widespread altcoin rally due to lack of technological breakthroughs. Market focus is shifting toward discrete, narrative-led growth in specific areas. Crypto investors’ focus on short-term gains challenges long-term project sustainability.

- 10:42A trader bought 1.68 million READY with 202.7 SOL two days ago.According to Jinse Finance, monitored by Lookonchain, trader "LeBron" spent 202.7 SOL (approximately $44,700) two days ago to purchase 1.68 million READY. Previously, LeBron earned $8.9 millions on MELANIA, $4.56 millions on LIBRA, $3.2 millions on TRUMP, and $1 million on HARRYBOLZ.

- 10:26Cango: Bitcoin production reached 616.6 in September, with Bitcoin treasury increasing to over 5,800Jinse Finance reported that Cango released its September 2025 Bitcoin production and mining operations update. Bitcoin production reached 616.6 BTC, with an average daily output of 20.55 BTC. This month, operational hash rate increased to 89.7%, and the Bitcoin treasury grew to over 5,800 BTC.

- 10:11The S&P 500 Index has not experienced a 5% pullback for over 100 trading days.Jinse Finance reported that the US stock market is leading investors into a one-way upward trend, with the S&P 500 Index having gone 114 consecutive trading days without a 5% pullback. As of press time, S&P 500 index futures and Nasdaq 100 index futures are both up 0.3%. If this trend continues, the two major indices are expected to set the longest winning streak since July. Bank of America strategist Michael Hartnett stated that one investment strategy to respond to the artificial intelligence boom is the "barbell strategy"—balancing the extreme valuation differences by combining low-valued cyclical assets with high-valued technology assets. Positive factors driving market enthusiasm this week include: Global Infrastructure Partners is in-depth negotiations to acquire Aligned Data Centers, and OpenAI continues to announce new partnership projects. According to PitchBook data, since the beginning of this year, venture capital institutions have invested $192.7 billions in artificial intelligence startups, setting a global record. (Golden Ten Data)