News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 24)|Tether seeks $20 billion private placement; SEC plans to launch mechanism by end of 2025; Global central banks may add Bitcoin to reserves within five years2When 10 billion sell-off pressure meets the 45% burn proposal, the Hyperliquid valuation battle escalates3Will Bitcoin Crash? ETFs Outflows vs Gold Breakout Hype

XRP News: What Jerome Powell’s Fed Dilemma Means for XRP Price?

Cryptoticker·2025/09/24 10:21

Major Pullback After Rate Cut: Is the Crypto Bull Market Over? | Trader's Observation

Powell speaks again one week after the interest rate cut. What will happen to the market next?

BlockBeats·2025/09/24 07:47

Technical Analysis of UXLINK Theft Involving Approximately $11.3 Million

The attacker carried out a series of operations, including calling the execTransaction function of the Gnosis Safe Proxy contract and the MultiSend contract, gradually removing other owners, ultimately taking over the contract and maliciously minting UXLINK tokens.

BlockBeats·2025/09/24 07:46

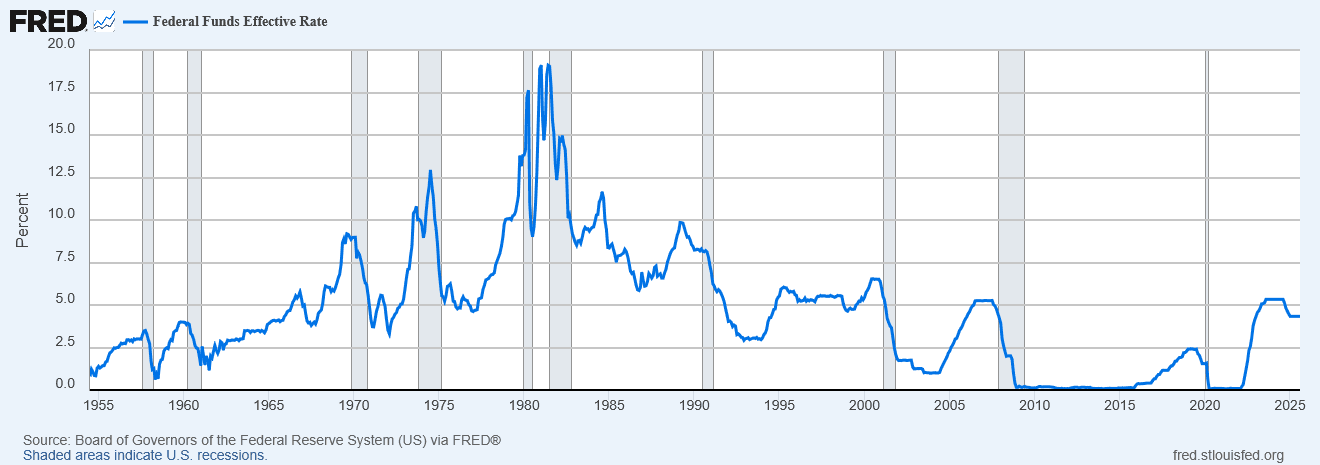

Powell’s Latest Signal: The Federal Reserve Shifts to Neutral Amid Inflation and Employment Pressures

Powell acknowledged that the current interest rates remain somewhat restrictive, but this allows us to better respond to potential economic developments.

BlockBeats·2025/09/24 07:45

PayPal Expands Use Cases for PYUSD Stablecoin

Coinspaidmedia·2025/09/24 04:15

XRP Stabilizes Above $2.70 Support as Bollinger Bands Suggest Possible Breakout Above $3.16

Coinotag·2025/09/24 03:09

Brevis launches the Yapper leaderboard event on Kaito AI, initiating a new privacy-preserving InfoFi paradigm

The privacy-protecting reward mechanism introduces on-chain credential bonuses based on zero-knowledge proofs.

BlockBeats·2025/09/24 03:00

Can stablecoins become the true pillar of US dollar hegemony?

Bitpush·2025/09/23 20:21

Flash

- 12:40Listed company Iveda announces the establishment of a cryptocurrency treasuryChainCatcher news, according to businesswire, Iveda, a Nasdaq-listed provider of cloud-based video AI search and surveillance technology solutions, announced the establishment of a cryptocurrency treasury strategy. Its board of directors has authorized the purchase of cryptocurrencies to achieve diversified asset allocation, but the company has not yet disclosed the specific cryptocurrencies it intends to purchase.

- 11:46Hyperliquid's native stablecoin USDH has been officially launchedAccording to ChainCatcher, citing The Block, the USDH stablecoin issued by Native Markets has been launched on the Hyperliquid platform, and the USDH/USDC trading pair is now open for trading. Initial trading volume indicates a cautious yet active market start, with transaction volume reaching approximately $2.2 million as the market kicks off. USDH is the first US dollar-pegged token issued through a validator node selection process on Hyperliquid. It is a stablecoin natively issued on HyperEVM and can circulate cross-chain throughout the entire Hyperliquid ecosystem. Earlier this month, Native Markets won the bid, defeating proposals from several companies including Paxos, Frax, and Agora. The plan requires a phased rollout, with the first USDH/USDC spot market going live “within days” after the vote passed. The issuer stated that its reserves are fully backed by cash and short-term US Treasury bonds, with the initial portfolio managed both off-chain and partially on-chain, and transparency ensured through data provided by oracles. The proposal materials also outlined an economic cycle mechanism, using part of the reserve earnings for HYPE token buybacks.

- 10:54Analysis: Bitcoin implied volatility drops to lowest level since 2023, market may be poised for decisive moveChainCatcher news, according to analysis by XWIN Research, Bitcoin's implied volatility has dropped to its lowest level since 2023. In 2023, this low point previously appeared before Bitcoin surged 325% from $29,000 to $124,000. Now, whether this "calm before the storm" scenario is repeating has attracted attention. On-chain data from CryptoQuant supports this: First, exchange reserves are declining, with total balances approaching multi-year lows, indicating that the amount of Bitcoin available for immediate sale is decreasing. Historically, this often signals a supply squeeze when demand rises. Second, the MVRV ratio is in a neutral range, meaning investors are neither heavily underwater nor enjoying excessive profits. The market is not under pressure from panic selling or profit-taking, and a strong "wait-and-see" sentiment prevails. Third, funding rates are balanced, with neither excessive long nor short positions, which corresponds to the subdued volatility and shows that the market is accumulating energy. These three signals together paint a consistent picture: the supply of Bitcoin on exchanges is decreasing, investors are holding their coins, and the derivatives market remains calm. Although implied volatility indicates that the current period is one of the calmest in years, historical experience shows that such periods rarely last long.