News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Bitcoinworld·2025/12/17 05:27

Pi Network stock price remains under pressure, momentum weakens

币界网·2025/12/17 05:15

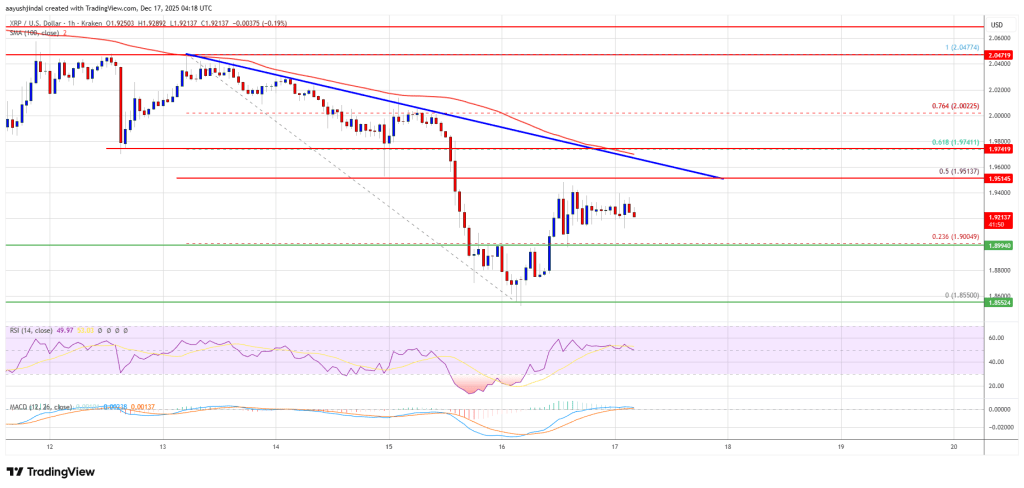

XRP price recovery appears fragile—can bulls break through the price ceiling?

币界网·2025/12/17 05:15

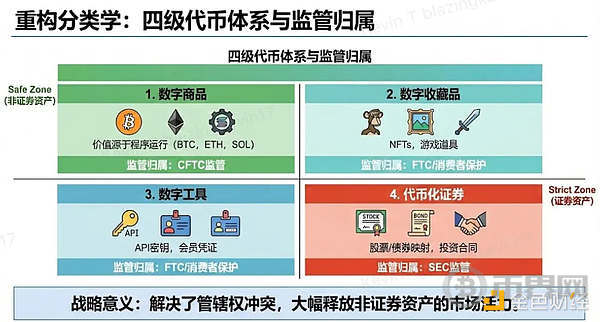

Pantera: 2025 will be a year of structural progress for the crypto market

币界网·2025/12/17 05:15

Urgent Crypto Fraud Crackdown: US Senators Launch Bipartisan SAFE Act to Protect Investors

Bitcoinworld·2025/12/17 05:12

Trump to interview pro-crypto Christopher Waller for next Fed Chair: WSJ

The Block·2025/12/17 04:45

Ethereum Spot ETFs Face Alarming $223.7M Exodus: 4th Day of Major Outflows

Bitcoinworld·2025/12/17 04:45

Bitcoin ETF Shock: $277.4 Million Flees US Funds as BlackRock Leads Outflow

Bitcoinworld·2025/12/17 04:42

Flash

- 05:26Former Theta Labs executive sues CEO for alleged fraud and market manipulationAccording to TechFlow, on December 17, Decrypt reported that two former Theta Labs executives, Jerry Kowal and Andrea Berry, filed a whistleblower lawsuit in California, accusing company CEO Mitch Liu and Theta Labs of fraud, token market manipulation, and retaliation against whistleblowing employees. The lawsuit alleges that Liu used Theta Labs as a personal trading tool, inflating the price of THETA tokens through misleading partnerships (including exaggerating ties with Google), undisclosed internal token sales, and NFT market manipulation. The plaintiffs described a long-term pattern of self-dealing, claiming that Liu carried out a "deliberate pump-and-dump scheme," harming the interests of investors and employees. As of press time, Liu and Theta Labs have not commented on the matter.

- 05:19Former Theta executive accuses the company’s CEO of fraud and retaliationPANews, December 17 — According to Decrypt, two former executives of blockchain company Theta Labs have filed whistleblower lawsuits in California, accusing the company and its CEO Mitch Liu of years of fraud, market manipulation, and retaliatory behavior. Former executives Jerry Kowal and Andrea Berry filed lawsuits in Los Angeles Superior Court, alleging that Liu used Theta Labs and its parent company Sliver VR Technologies to inflate token prices through misleading partnerships and undisclosed insider token sales, while retaliating against employees who raised concerns. The attorney representing Jerry Kowal pointed out that Mitch Liu used Theta Labs as a personal trading tool, engaging in fraud, self-dealing, and market manipulation. Liu's carefully orchestrated pump-and-dump schemes repeatedly wiped out the value for investors and employees. The alleged schemes also include "generating fake bids for NFTs," some of which were related to high-profile collaborations with celebrities such as Katy Perry. Berry's complaint also targets Theta's previous statements about Google, accusing the company of publicly misrepresenting a routine cloud services agreement as a strategic partnership. The complaint also highlights two other instances of self-dealing, alleging that "Theta's so-called 'partners' were actually other companies created and wholly owned by Liu."

- 05:14Federal Reserve Chair Candidate Waller, Crypto-Friendly, Seen as 15% Chance to Be Next Fed ChairBlockBeats News, December 17th, according to WSJ report, Trump is scheduled to interview current Federal Reserve Board Governor Waller on Wednesday to evaluate the potential candidate for the next Federal Reserve Chair to succeed Powell. On the prediction market Polymarket, Waller's probability of being nominated by Trump as Federal Reserve Chair has risen to 15%. Furthermore, the probability of Warsh being nominated by Trump has decreased to 27%, while Hassett's nomination probability has risen to 53%. Waller was nominated by Trump to join the Federal Reserve Board in 2020 and is a supporter of cryptocurrency, particularly focusing on the stablecoin and decentralized finance (DeFi) sectors. Waller stated at the Fed's Payment Innovation Conference in October, "I want to convey a message: the Fed has entered a new era in the payment space— the DeFi industry is no longer underestimated or dismissed." He also mentioned that stablecoins are "just a new form of private money" and will coexist with other payment tools. Earlier reports indicated that Waller has become a key advocate for interest rate cuts within the Federal Reserve this year. During the Fed's meeting in July to keep rates unchanged, Waller cast a dissenting vote in favor of cutting rates. Waller is the most favored candidate for Federal Reserve Chair by economists, highly regarded on Wall Street for his logical and consistent argument in favor of rate cuts this year, considered capable of bridging the increasing internal divisions within the Federal Reserve. Several of his arguments for rate cuts have been adopted by the current Chair Powell. Waller will speak on the economic outlook on Wednesday night East 8th District Time.

News