News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Massive XRP Liquidity Cluster Emerges Above $3.2 as Price Holds Key $2.38 Support

CryptoNewsNet·2025/10/23 02:39

Crypto ETF Boom: 155 Filings Across 35 Assets, Analyst Backs Index Funds

CryptoNewsNet·2025/10/23 02:39

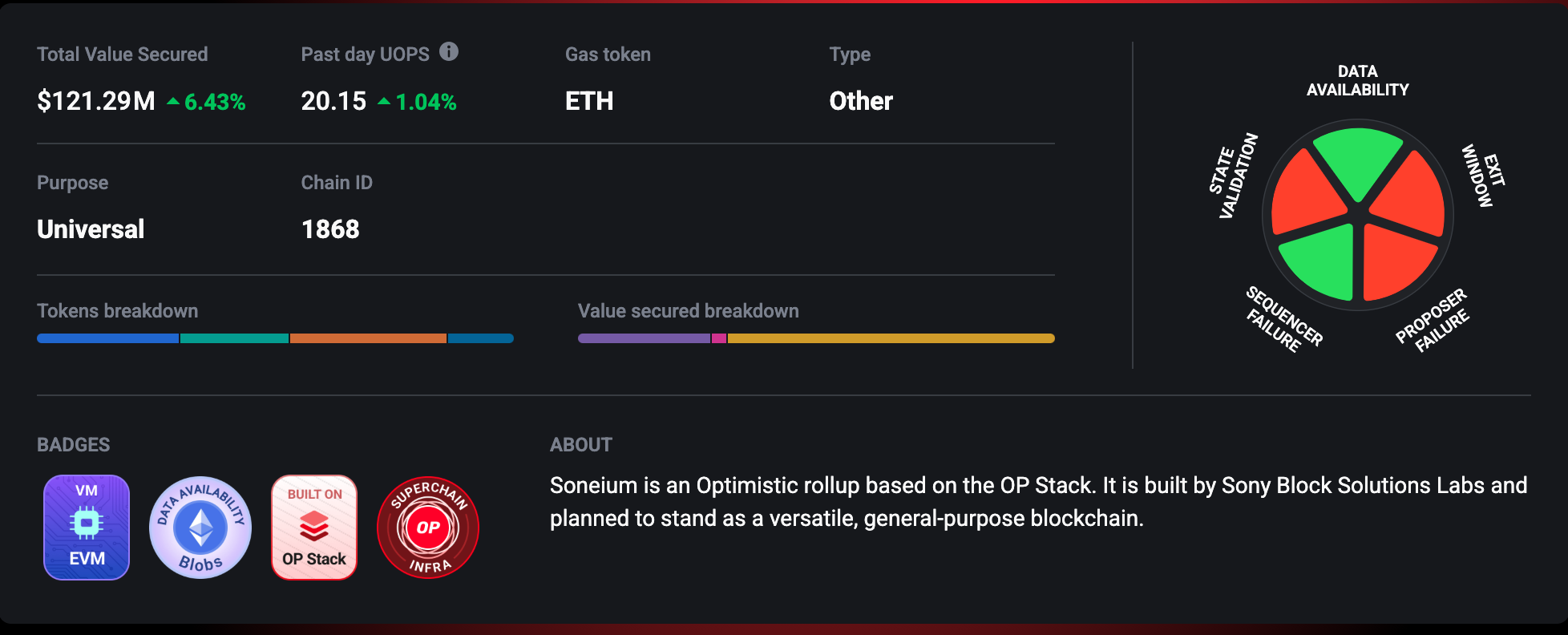

Japan’s Soneium Bets Big: Sony, SBI, and Startale’s Bid to Build a Global Layer-2 Powerhouse

CryptoNewsNet·2025/10/23 02:39

Citi Gives “Buy” Rating to Strategy Amid Bitcoin Upside—Warns of High Volatility Risk

Cointribune·2025/10/23 02:33

Crypto Wallets Join Forces to Launch Global Phishing Defence Network

DeFi Planet·2025/10/23 02:30

Chainlink Labs Proposes On-chain Compliance Framework to U.S. Treasury

DeFi Planet·2025/10/23 02:30

Kadena Shuts Down Operations Amid Market Pressures, Blockchain to Remain Decentralized

DeFi Planet·2025/10/23 02:30

Asian Exchanges Crack Down on Crypto Treasury Listings as Market Momentum Fades

DeFi Planet·2025/10/23 02:30

What signals emerged from the latest Fintech conference held by the Federal Reserve?

The era of confrontation has ended, and the era of dialogue has begun.

深潮·2025/10/23 01:42

Flash

- 02:45Data: The crypto market shows mixed performance, AI sector rises nearly 5%, while BTC and ETH remain in weak consolidation.ChainCatcher news, according to SoSoValue data, the cryptocurrency market sectors showed mixed performance. Among them, the AI sector rose by 4.82% in the past 24 hours, with ChainOpera AI (COAI) surging by 61.04% and Recall (RECALL) rising by 22.61%. The CeFi sector increased by 1.42%, with Exchange Coin (BNB) and Hyperliquid (HYPE) up by 1.50% and 7.73% respectively. In addition, Bitcoin (BTC) fell by 0.12%, fluctuating narrowly around $108,000. Ethereum (ETH) dropped by 1.08%, remaining above the 3,800 yuan mark. In other sectors, the Layer1 sector fell by 0.52% in 24 hours, with Zcash (ZEC), which had previously seen significant gains, dropping by 8.02%. The Layer2 sector declined by 1.18%, but Mantle (MNT) and SOON rose by 1.82% and 3.27% respectively. The PayFi sector dropped by 1.85%, with Monero (XMR) remaining relatively strong, up by 1.94%. The DeFi sector fell by 1.93%, with Uniswap (UNI) down by 3.19%. The Meme sector dropped by 2.00%, but MemeCore (M) bucked the trend and rose by 2.51%. Indices reflecting the historical performance of sectors show that the ssiAI, ssiLayer2, and ssiSocialFi indices fell by 5.72%, 5.42%, and 3.87% respectively.

- 02:44Real estate tokenization company Propy to invest $100 million to expand in the U.S. marketAccording to Jinse Finance, as disclosed by Cointelegraph, real estate tokenization company Propy will invest 100 million dollars to expand into the US market, leveraging blockchain and artificial intelligence to streamline industry processes.

- 02:44Goldman Sachs: Bank of Japan May Keep Policy Rate Unchanged Next WeekJinse Finance reported that Goldman Sachs economists stated in a report that, from a risk management perspective, the Bank of Japan may keep its policy rate unchanged next week amid high uncertainty. They said: "After assessing the high level of uncertainty in its baseline outlook, the Bank of Japan may judge that, although there are significant downside risks to the economic outlook, there are also considerable upside risks to the price outlook." They pointed out that the Bank of Japan may maintain a gradual rate hike stance. (Golden Ten Data)