News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Briefing (Oct 21) | Four Crypto ETPs Listed on London Stock Exchange; All Three Major US Stock Indexes Close Higher2Who is the real "controller" behind the evaporation of $1.9 billion?3Crypto Market Prediction: Ethereum (ETH) Is Back, Bitcoin (BTC) Breaks Bears at $110,000, Shiba Inu (SHIB) Ramp Deletes Zero

Ethereum core dev criticizes Vitalik Buterin's influence, cites centralization

Cryptobriefing·2025/10/21 10:57

We Asked 3 AIs if Altseason Will Arrive in 2025

CryptoNewsNet·2025/10/21 10:48

‘Corpo chains’ doomed unless they embrace crypto’s ethos: StarkWare CEO

CryptoNewsNet·2025/10/21 10:48

U.S. Crypto Coalition Warns Bank Data Fees Could Cut Off Stablecoins and Wallets

CryptoNewsNet·2025/10/21 10:48

DPRK Hackers Use 'EtherHiding' to Host Malware on Ethereum, BNB Blockchains: Google

CryptoNewsNet·2025/10/21 10:48

Debt-Fueled AI Pivot Puts Bitcoin Miners to the Test

CryptoNewsNet·2025/10/21 10:48

Jack Dorsey Reignites Debate Over Bitcoin’s Identity: “Bitcoin Is Not Crypto”

Cointribune·2025/10/21 10:45

Is Sui (SUI) in an Accumulation Zone Before a Bullish Rally? This Emerging Fractal Says Yes!

CoinsProbe·2025/10/21 10:45

Is Pump.fun (PUMP) Gearing Up for a Bullish Breakout? This Key Pattern Says Yes!

CoinsProbe·2025/10/21 10:45

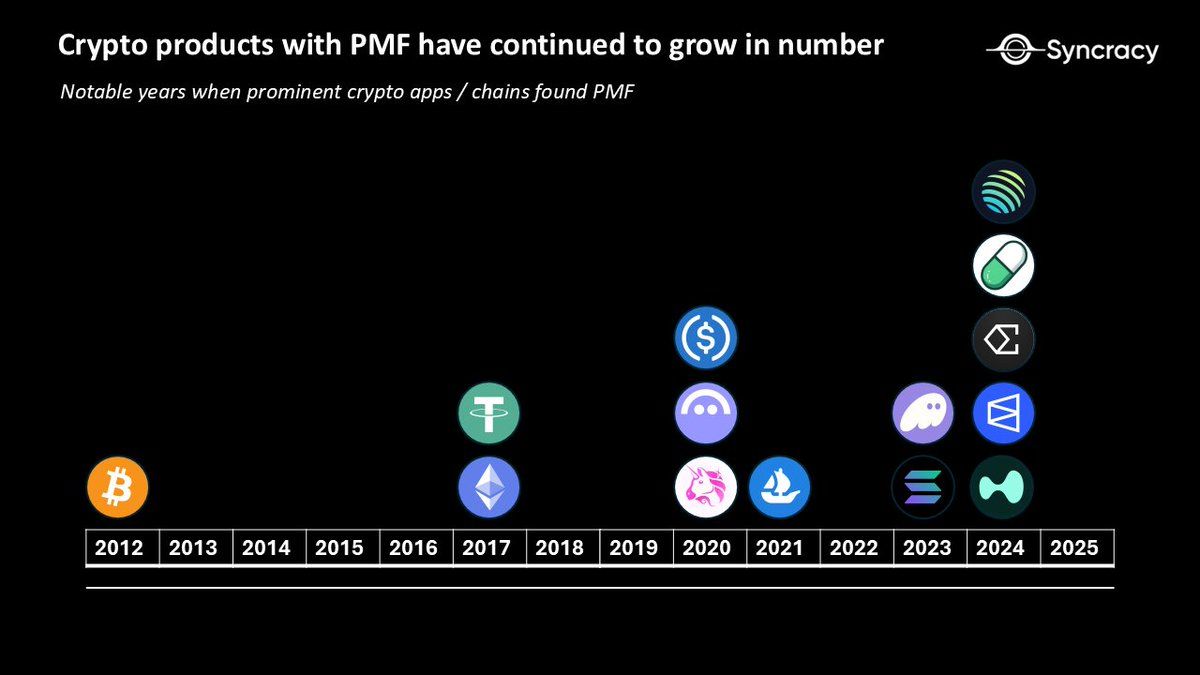

When the traditional world shows respect, let go of your crypto pessimism

The real reason for the recent surge of pessimism in the crypto industry is that it has become increasingly difficult for market participants to achieve excess returns.

深潮·2025/10/21 10:10

Flash

- 10:43Ripple plans to lease a new landmark in the City of London, with annual rent exceeding 10 million pounds.October 21 news, cryptocurrency company Ripple Labs Inc. is in talks to lease high-rise space in Brookfield Group's newly built skyscraper in London. If the deal is completed, Ripple will move into one of the most expensive office areas in the City of London. According to sources familiar with the matter, Ripple plans to lease about 90,000 square feet (8,361.3 square meters) of office space in the Leadenhall Building in the City of London. This 35-story building was developed by Brookfield, and the landlord is reportedly asking for a rent of £140 ($187.33) per square foot, making it one of the most expensive office spaces in the financial district, comparable to the rent levels in the upscale Mayfair area. As the negotiations are not public, the sources requested anonymity. Ripple has more than 900 employees in 15 offices worldwide, providing digital asset payment and custody services for banks and financial institutions. (BBG)

- 10:40Hyperscale Data's Bitcoin asset holdings increase to $60 million, accounting for approximately 66% of the company's market capitalization.ChainCatcher news, according to PRNewswire, US-listed BTC treasury company Hyperscale Data (NYSE American: GPUS) announced that its bitcoin treasury assets are valued at approximately $60 million, accounting for about 66% of the company's market capitalization. In addition, Hyperscale Data has allocated $43.7 million in cash for Sentinum to purchase BTC on the open market. The company's Executive Chairman, Milton “Todd” Ault III, stated that they will continue to mitigate short-term market volatility risks through a dollar-cost averaging strategy and build a long-term reserve position. The company plans to expand its bitcoin treasury to the equivalent of 100% of its market capitalization as part of its $100 million digital asset treasury strategy.

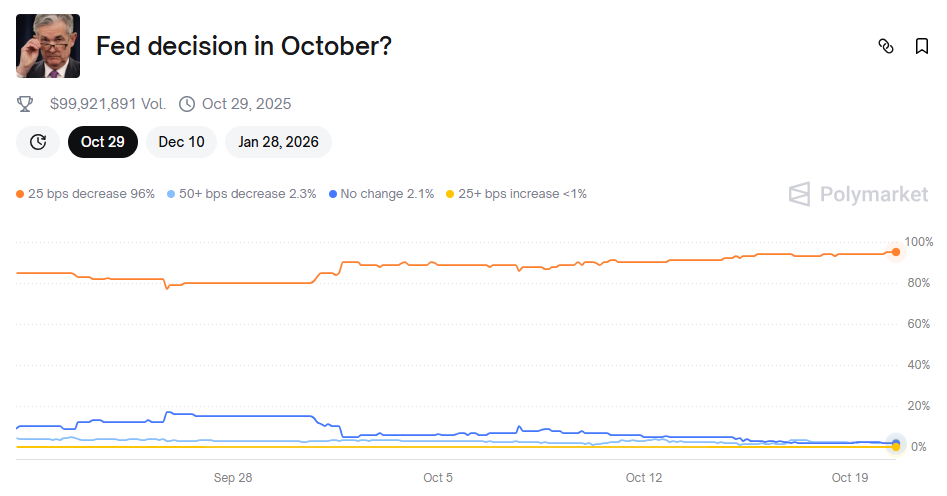

- 10:40The Federal Reserve is expected to cut interest rates two more times this year, with the rate path for 2026 remaining uncertain.According to ChainCatcher, citing Golden Ten Data, a Reuters survey conducted among economists from October 15 to 21 shows that the Federal Reserve is expected to cut interest rates by 25 basis points each in the coming week and in December, bringing rates down to 3.75% - 4%. Out of 117 economists, 115 predict another rate cut on October 29, while two expect a 25 basis point cut in October and a 50 basis point cut in December. The proportion of economists expecting another rate cut in December has dropped to 71%. Financial market traders are even more certain, as interest rate futures contracts have fully priced in two more rate cuts this year.