News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 28)|CoinFerenceX 2025 Web3 Conference is about to commence,JUP unlocks 53.47 million tokens; Kraken raises $500 million;2Grayscale’s XRP ETF Decision Set for October 183Solana price prediction 2025-2031: Trends and insights for investors

JPMorgan downgrades CleanSpark stock rating to neutral due to valuation concerns

PANews·2025/09/28 09:50

Smart "Gatekeepers": How "Conditional Liquidity" is Redefining Solana's Trading Rules

Conditional liquidity is not just a technological innovation; it is a profound restructuring of fairness and efficiency in the DeFi market.

Bitget Wallet·2025/09/28 06:24

Exploring Network School: A Web3 Utopia Built in an Unfinished Country Garden Building in Malaysia

Is it worth spending $1,500 to join Network School?

深潮·2025/09/28 05:11

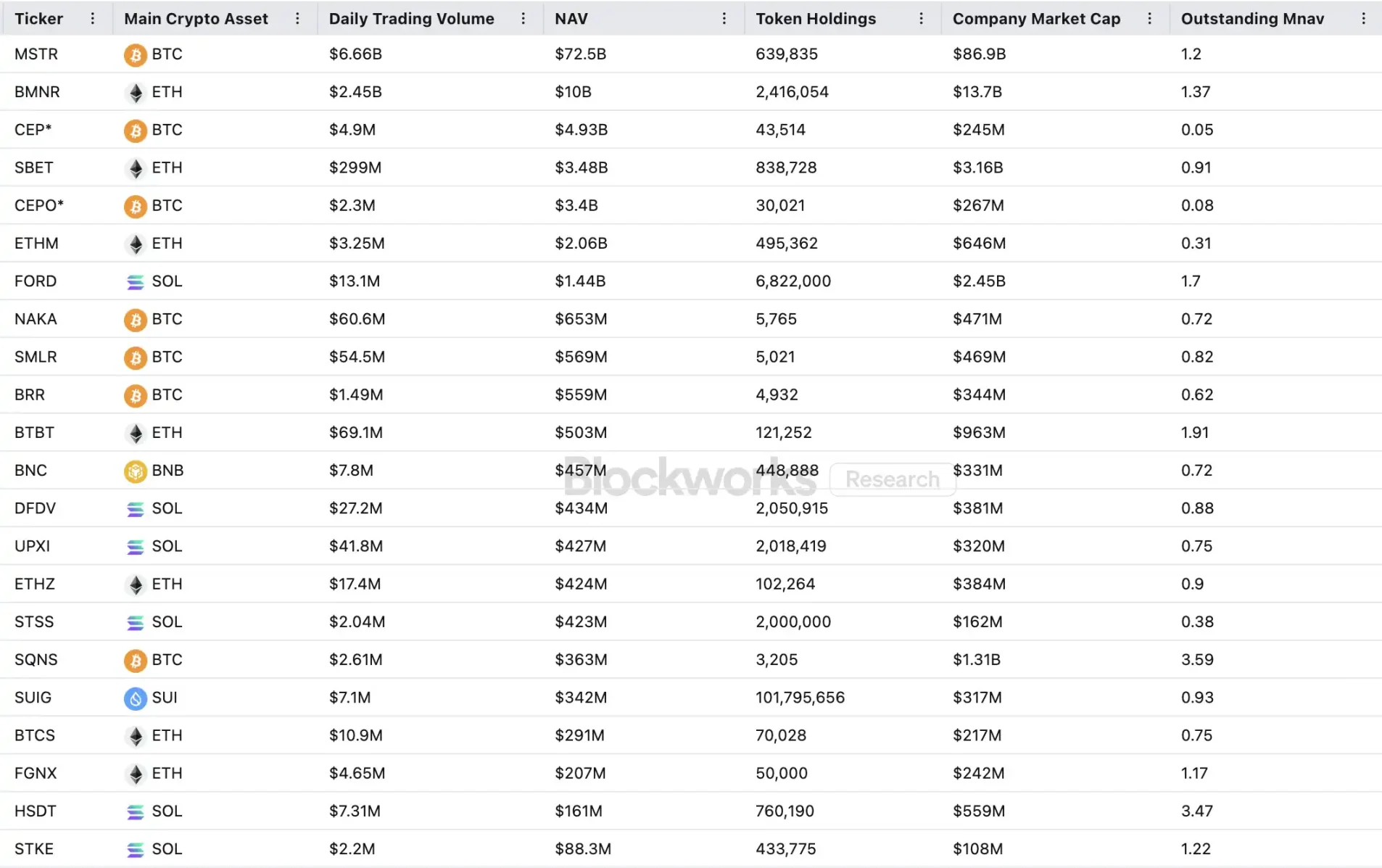

The US SEC starts targeting crypto treasury companies. Will the DAT narrative continue?

DAT hits the brakes—what should investors pay attention to?

深潮·2025/09/28 05:11

Cryptocurrency enters its "adolescent stage": What is the future development of Ethereum?

Cryptocurrencies have entered their "adolescent" stage, but progress in usability remains slow. This is largely due to previously high transaction fees and clumsy user interfaces.

Ebunker·2025/09/28 04:32

UAE Joins Crypto-Asset Tax Information Exchange

Coinspaidmedia·2025/09/28 04:03

Morgan Stanley to Open Crypto Trading to Retail Clients in 2026

Coinspaidmedia·2025/09/28 04:03

Cloudflare Launches NET Dollar Stablecoin for AI-Driven Internet Economy

Coinspaidmedia·2025/09/28 04:03

Options Data Reveals Growing Skepticism in Bitcoin Price Outlook

Cointime·2025/09/28 03:27

Flash

- 09:55Moody's: The Crypto Wave Driven by Stablecoins Poses Serious Challenges to Monetary Sovereignty and Financial Stability in Emerging MarketsChainCatcher news, according to Gelonghui, international credit rating agency Moody's recently warned that the crypto wave driven by stablecoins is posing an increasingly severe challenge to the monetary sovereignty and financial stability of emerging markets. The report points out that as stablecoins and other cryptocurrencies accelerate their global adoption, emerging markets face the risk of weakened monetary sovereignty. The widespread penetration of stablecoins anchored to fiat currencies such as the US dollar may erode central banks' traditional ability to regulate interest rates and exchange rates. Moody's specifically emphasized that if individuals transfer bank deposits to stablecoins or crypto wallets, the banking system may face deposit outflows, which would not only affect liquidity but could also undermine overall financial stability. Data shows that in 2024, the number of global digital asset holders has reached approximately 562 millions, a year-on-year increase of 33%. Among them, emerging markets such as Latin America, Southeast Asia, and Africa have seen the fastest growth, mainly driven by the convenience of cross-border remittances, demand for mobile payments, and the need to hedge against local currency inflation. This stands in sharp contrast to developed economies, where demand is driven by clear regulations and investment channels. Moody's warns that if regulatory gaps are not promptly addressed, the crypto wave may further amplify monetary and financial security risks in emerging markets.

- 08:44BTC surpasses $109,500Jinse Finance reported that according to market data, BTC has surpassed $109,500, currently quoted at $109,515.45, with a 24-hour increase of 0.18%. The market is experiencing significant volatility, so please manage your risks accordingly.

- 08:27Citi: Stablecoin market size expected to reach $4 trillion by 2030Jinse Finance reported that Citi released the "Stablecoins 2030" report, raising its forecast for stablecoin issuance by 2030 to a baseline of $1.9 trillion, with an optimistic scenario reaching up to $4 trillion. The report also stated that, assuming a velocity of circulation of 50 times (similar to the speed of fiat payments), it is predicted that by 2030, stablecoins could support approximately $100 trillion in annual transaction activity, and up to $200 trillion in the best-case scenario. According to DefiLlama data, the current total market capitalization of stablecoins is about $296.8 billion, with USDT accounting for 58.75%.