News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 26)|BlackRock Registers Bitcoin Premium ETF; Nine European Banks Jointly Launch Euro Stablecoin; Crypto Market Sees Broad Decline as Bitcoin and Ethereum 2Warning Signs for Altcoins as Market Sentiment Flips Bearish3Research Report|In-Depth Analysis and Market Cap of Mira Network (MIRA)

Ethereum flashes ‘rare oversold signal’ for first time since $1.4K ETH

Cointelegraph·2025/09/26 21:36

Bitcoin price ignores PCE inflation as bears eat through $109K support

Cointelegraph·2025/09/26 21:36

Price predictions 9/26: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, LINK, AVAX

Cointelegraph·2025/09/26 21:36

Bullish Bitcoin bets unraveled below $110K: Will October revive risk-on sentiment?

Cointelegraph·2025/09/26 21:36

AiCoin Daily Report (September 26)

AICoin·2025/09/26 21:10

Ethereum whales accumulate $1.6 billion in ETH as price falls below $4,000

TheCryptoUpdates·2025/09/26 20:51

BlackRock requires strong investor demand before launching altcoin ETFs

TheCryptoUpdates·2025/09/26 20:51

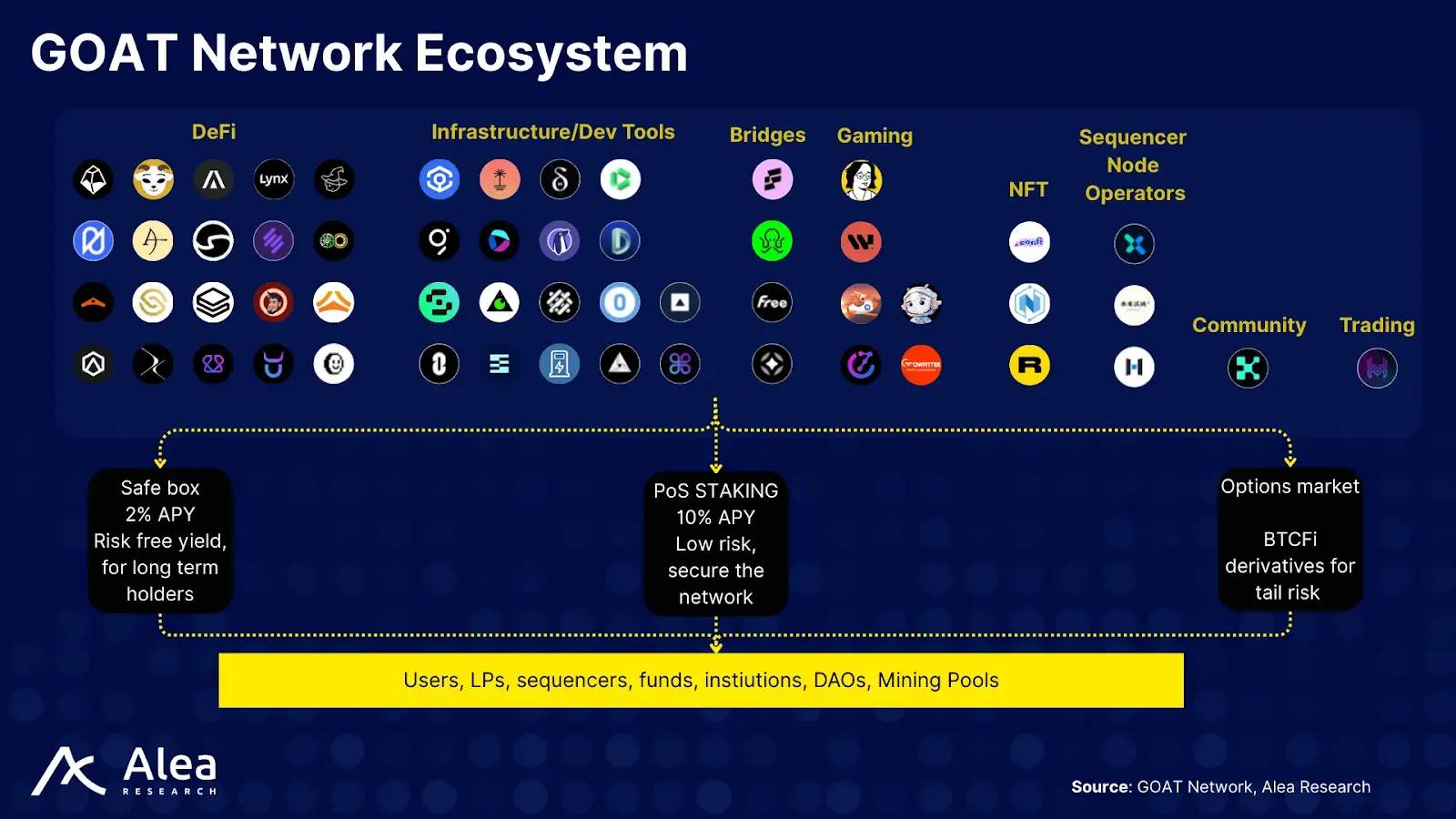

The "Fog" and "Lighthouse" of Bitcoin L2: GOAT Network's Path Choices and Industry Baseline

When everyone can call themselves Layer2, a more fundamental question emerges: What does the Bitcoin ecosystem truly need?

深潮·2025/09/26 20:24

Japan’s Crypto Market Surges 120% as Stablecoins Take Over

Coindoo·2025/09/26 19:18

Flash

- 21:53Data: Bitmine Remains Top ETH Holder, Holdings Increase by 41% in the Past 30 DaysBlockBeats News, September 26, according to strategicethreserve data, the following are the crypto treasury (DAT) companies and institutions with significant changes in Ethereum holdings over the past 30 days: Bitmine Immersion Tech (BMNR) ranks first, currently holding 2.42 million ETH, valued at approximately $9.56 billions, with holdings increasing by 41% in the past 30 days; SharpLink Gaming (SBET) ranks second, currently holding 839,000 ETH, valued at approximately $3.32 billions, with holdings increasing by 5.1% in the past 30 days; The Ether Machine (ETHM) ranks third, currently holding 495,000 ETH, valued at approximately $1.96 billions, with holdings increasing by 43.4% in the past 30 days; Ethereum Foundation ranks fourth, holding 223,900 ETH, valued at approximately $884 millions, with holdings decreasing by 3.4% in the past 30 days.

- 21:53Data: The market continues to accumulate against the trend, with $5.75 billion worth of BTC and $3.08 billion worth of ETH flowing out of CEXs in the past weekBlockBeats News, September 26, according to data released by Sentora, despite the recent poor market price performance, the outflows of ETH and BTC from trading platforms remain strong, indicating that the entire market is still accumulating. In the past week, the net outflow of BTC from trading platforms was valued at $5.75 billions, while the net outflow of ETH was valued at $3.08 billions.

- 21:53Data: U.S. stock market concentration hits record high, top 10% of stocks account for 78% of total market valueBlockBeats News, on September 27, trading information platform Kobeissi Letter released data: Currently, the top 10% of U.S. stocks by market capitalization account for 78% of the total U.S. stock market value, setting a new historical high. This proportion is 3 percentage points higher than the record high in the 1930s, and also exceeds the peak during the internet bubble in 2000, when the ratio was 74%. In contrast, in the 1980s, the total weight of the top 10% of companies by market capitalization was less than 50%. Meanwhile, the percentage of the top 10 stocks in the S&P 500 Index by market capitalization has reached a record 41%, indicating the market has never been so concentrated.